Published 25 Jul 2025

A Full GTM Strategy for a Web3 Intelligence Project

Overview of RateXAI and Its Offerings

RateXAI is an AI‑driven Web3 analytics platform that applies autonomous agents, big‑data processing and natural‑language interfaces to turn billions of on‑chain and off‑chain signals into actionable insights.

A press release from March 19 2025 announced that RateXAI’s Meta Scoring Engine processes more than 3 billion on‑chain transactions, 200 million wallet activities and billions of social posts across major blockchains (Ethereum, BNB Chain, TON, Solana and Base). The engine integrates 70+ metrics so users can assess token performance, spot whale movements and anticipate liquidity fluctuations.

RateXAI offers a conversational interface that allows non‑technical users to query complex data sets and receive data‑driven answers. The platform’s RateXMetaScore (AAA-BBB) rates tokens using 65+ signals from on‑chain data, DEX liquidity, SmartMoney flows and social sentiment. RateXAI emphasises transparency, speed and user‑friendly design to democratize institutional‑grade analytics.

Product Modules

-

Web3 Explorer: interactive dashboards with real‑time token metrics, transaction flows and liquidity data.

-

Meta Scoring Engine: institutional‑grade scoring (AAA–BBB) using 65+ signals from on‑chain and social sources.

-

SmartMoney Sniper & Whale Tracking: monitor whale transactions and wallet behaviours across multiple chains.

-

MetaDEX & JupyteX: real‑time DEX order books, liquidity pools and Python‑ready datasets for quantitative researchers.

-

On/Off‑Chain Audit & White‑label Integrations: enterprise APIs and SDKs for exchanges, funds and developers.

These modules will be packaged into tiered plans (see §6) to target different customer segments.

Market Opportunity

Rapid Growth of Web3 and AI

The Web 3.0 market is growing rapidly; Grand View Research estimates the global Web 3.0 market was USD 2.25 billion in 2023 and forecasts growth to USD 33.53 billion by 2030 (CAGR 49.3%). The growth is driven by increased demand for decentralized applications and data privacy. AI adoption within Web3 is accelerating; DappRadar’s June 2025 report found that AI‑related on‑chain activity surged 86% in 2025 and AI DApp users climbed to 4.5 million daily unique wallets. AI DApps now command 19% market share, up from 9% at the start of the year, and AI agent projects attracted $1.39 billion in funding in 2025, exceeding 2024 totals. Europe accounts for about 26% of AI DApp users, while Asia, North America and other regions contribute substantial shares.

Need for Intelligent Crypto Analytics

Crypto participants — from retail traders (“degens”) to institutional investors — are inundated with massive data streams. RateXAI’s blog explains that Web3 data includes billions of transactions, millions of wallets and continuous social chatter; information is scattered across chains and platforms, leading many participants to react to hype instead of facts. By consolidating these signals and providing real‑time analytics, RateXAI addresses a clear pain point. The rising complexity of decentralized finance (DeFi), non‑fungible tokens (NFTs) and cross‑chain protocols means investors, exchanges and developers need richer analytics than what traditional tools offer.

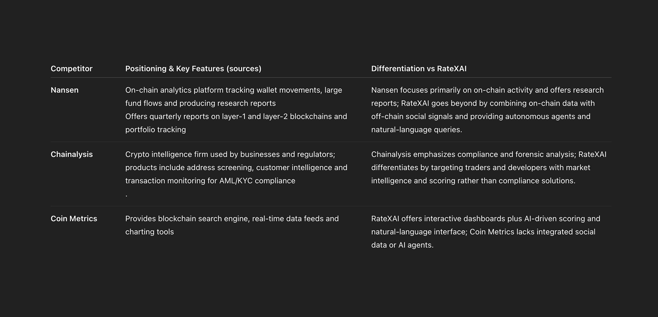

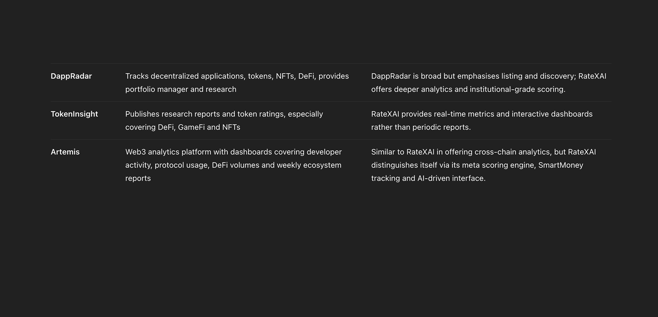

Competitive Landscape

Summary:

The blockchain analytics market is fragmented — tools specialize in on‑chain data, compliance or DApp discovery. None of the major competitors integrate comprehensive on‑chain and off‑chain signals with autonomous AI agents and a conversational interface. RateXAI can position itself as the “Bloomberg Terminal for Web3” — providing an all‑in‑one intelligence layer that is accessible to retail traders yet extensible for enterprises.

Target Market Segments

-

Retail Traders & “Smart Degens” – Individuals trading tokens, memecoins and NFTs on DEXs who need timely insights and whale tracking. They are the early adopters of RateXAI’s free/low‑cost plan and help build community. RateXAI’s trending dashboard and token scores speak directly to this group.

-

Institutional Funds & VC Firms – Hedge funds, venture capital firms, family offices and proprietary trading desks require sophisticated analytics to evaluate token fundamentals, spot market manipulation and manage risk. RateXAI’s institutional‑grade scoring, Python‑ready datasets and custom alerts provide actionable intelligence.

-

Centralized Exchanges (CEXs) and Market Makers – Exchanges can integrate RateXAI via white‑label APIs to provide enhanced analytics to their users and internal risk teams. Market makers can utilize liquidity monitoring and sentiment data to optimize inventory and spread management.

-

Web3 Developers & Data Engineers – Builders of DApps, wallets and trading bots require real‑time data to power their products. RateXAI’s API/SDK and JupyteX environment allow them to embed analytics into applications or research pipelines.

-

DeFi Protocols & DAOs – Protocols seeking to improve governance and risk management can use RateXAI’s analytics to monitor liquidity pools, token holders and community sentiment.

Value Proposition and Differentiation

RateXAI’s core value proposition lies in turning the noise of Web3 into readable, actionable intelligence. Key differentiators include:

-

Autonomous AI Agents & Natural‑Language Interface: Users can ask questions like “Which tokens have the highest liquidity growth on Base chain this week?” and receive structured answers, eliminating the need for SQL or blockchain queries.

-

Comprehensive Meta Scoring Engine: RateXAI scores tokens (AAA–BBB) using over 65 metrics from on‑chain data, DEX liquidity, SmartMoney flows, P&L wallet behaviours and social sentiment.

-

Real‑Time and Cross‑Chain: Processes over 300 TB of data, indexing more than 10 billion transactions and monitoring over 500 million wallets across Ethereum, BNB, Base, Solana and TON. This scale provides near‑real‑time views of whale movements and liquidity shifts.

-

Accessible for Non‑Technical Users: RateXAI’s conversational interface and intuitive dashboards democratize institutional‑grade analytics.

-

Developer‑Friendly: Python‑ready datasets and APIs enable quants and developers to build trading strategies, bots or integrate RateXAI analytics into their products.

These differentiators allow RateXAI to capture both retail and enterprise segments and to position itself as the AI layer for Web3 intelligence.

Pricing and Packaging Strategy

-

Free/Community Tier – Provides basic token scores, limited whale tracking and access to social media channels (Telegram, X). Encourages adoption by retail traders and fosters community engagement.

-

RateX Pro Subscription – Paid monthly/annual subscription targeted at serious traders and analysts. Includes advanced dashboards (customizable watchlists, SmartMoney Sniper), unlimited alerts, deeper historical data and early access to new features. Offer discounts for yearly plans and referral bonuses.

-

Enterprise Plan / White‑Label Integration – Custom pricing for CEXs, funds and large Web3 projects. Includes API/SDK access, white‑label dashboards, dedicated support, on/off‑chain audit modules and ability to host data privately. Employ tiered volume‑based pricing for data usage.

-

Developer API & Data Marketplace – Metered API for developers to pull aggregated or raw datasets. JupyteX environment subscriptions for research teams. Data marketplace for selling curated datasets (e.g., memecoin performance, whale network clusters). Pricing based on data volume or requests per minute.

-

Professional Services & Training – Offer custom consulting, analytics audits and educational workshops to enterprises and DAOs. Charge per engagement or via subscription add‑ons.

Marketing Strategy

Brand Positioning

Position RateXAI as “Web3’s Intelligent Signal Hub” — a trustworthy, AI‑driven platform that transforms chaotic blockchain data into actionable insights. Emphasize transparency (open methodology), scalability and empowerment of traders, developers and institutions.

Content & Thought Leadership

-

Educational Blog & Research Reports: Continue publishing high‑quality articles explaining token analysis, DeFi risk management and the benefits of AI in crypto (similar to the “Turning Billions of Signals into Real‑Time Crypto Insight” post). Publish quarterly market outlooks and sector deep‑dives (e.g., memecoin performance, TON ecosystem). Provide both free and gated content to capture leads.

-

Webinars & Live Demos: Host monthly webinars showcasing platform features, case studies and Q&A. Invite influential traders and analysts to discuss market trends and demonstrate how RateXAI’s tools enhance decision‑making.

-

Data Visualizations & Social Media: Share bite‑sized visuals on X (Twitter), Telegram and LinkedIn — such as top‑moving tokens, whale alerts or sentiment spikes — to attract attention and demonstrate value. Use the RateXAI scoring system to highlight trending assets.

-

Community Building: Expand the INSIDERAA Telegram group and create Discord communities where users can discuss strategies, share feedback and request features. Organize trading contests and reward active members with Pro subscriptions or merch. Encourage community‑generated content (charts, analyses) and showcase them on the platform.

-

Influencer & Partner Marketing: Partner with crypto influencers, YouTube channels and newsletter writers to review and recommend RateXAI. Provide affiliate programs with revenue sharing. Collaborate with established projects (Layer‑1 foundations, DeFi protocols) to co‑publish research and highlight RateXAI metrics.

Events & Conferences

-

Web3 & Blockchain Conferences: Sponsor or speak at events such as ETHGlobal, TOKEN2049, Web3 Summit and local meetups. Highlight RateXAI’s AI and big‑data architecture, and demonstrate how it improves investment outcomes.

-

Hackathons & Developer Workshops: Host hackathons to encourage developers to build applications using RateXAI APIs. Provide prizes and potential job offers. Offer developer grants for innovative integrations (e.g., trading bots, on‑chain insurance models).

-

Academic Partnerships: Collaborate with universities and research institutes to use RateXAI data in blockchain research. This enhances credibility and fosters future talent pipelines.

Geographic Focus

Given that Europe accounts for ~26% of AI DApp users and Asia ~22%, start with marketing efforts in these regions. Organize localized webinars in English, Mandarin and Korean; partner with regional exchanges and funds; and hire community managers fluent in relevant languages. Gradually expand into North America and Latin America via targeted campaigns.

Sales & Distribution Strategy

Product‑Led Growth (PLG)

-

Frictionless Onboarding: Allow users to sign up with wallets or social accounts for free. Provide interactive tutorials and guided tours highlighting key use cases (token scoring, whale tracking, sentiment analysis). Offer limited daily queries to encourage upgrade.

-

Freemium → Premium: Use in‑product prompts and email campaigns to convert free users to Pro by highlighting features they miss (e.g., unlimited alerts, deeper historical data). Provide one‑month discounted upgrades for early adopters.

Enterprise & B2B Sales

-

Account‑Based Marketing (ABM): Identify target accounts (CEXs, trading firms, funds) and assign dedicated sales reps. Use personalized outreach via LinkedIn, email and conferences. Provide customized demos and proof‑of‑concept trials.

-

Partnerships with Exchanges & Wallets: Integrate RateXAI scoring and analytics into trading interfaces or mobile apps. White‑label or co‑branded solutions can enhance user experience while generating revenue through licensing fees.

-

API Marketplaces: List RateXAI APIs on popular developer marketplaces (e.g., RapidAPI) and blockchain developer platforms. Provide SDKs for popular programming languages (Python, TypeScript) and sample code.

-

Channel Partners: Collaborate with blockchain consulting firms, risk‑management providers and compliance platforms to cross‑sell RateXAI analytics as an added value.

Customer Success & Support

-

Onboarding & Training: Provide onboarding sessions, documentation and video tutorials. For enterprise clients, assign customer success managers to ensure adoption and integration.

-

Community Support: Maintain active support channels on Telegram, Discord and Intercom. Reward community members who assist others.

-

Feedback Loop: Collect feedback via surveys and user interviews to refine product roadmap and prioritize features that drive conversions.

Launch & Implementation Roadmap

Phase 1: Beta & Community Building (Month 1-2)

-

Finalize core modules (token scoring, whale tracking) and conduct closed beta with existing community members and select trading groups.

-

Launch content series explaining RateXAI’s vision, inviting sign‑ups for beta access.

-

Set up community channels (Telegram, Discord) and begin regular updates.

Phase 2: Public Launch & Marketing Push (Month 3-4)

-

Release RateXAI Pro subscription and free tier to the public.

-

Initiate marketing campaigns: blog posts, influencer partnerships, webinars and targeted ads (Google Ads, X/Twitter Ads). Publish a comprehensive white paper or “State of Web3 Analytics” report showcasing RateXAI methodology.

-

Start enterprise outreach (email, LinkedIn) and schedule demos with target funds and exchanges.

Phase 3: Scale & Partnerships (Month 5-6)

-

Introduce API/SDK and JupyteX environment; host developer hackathon.

-

Secure at least one CEX or major DeFi protocol as a white‑label partner.

-

Attend major conferences (e.g., Token2049) to demonstrate product and network with prospects.

-

Launch referral program to incentivize user growth.

Phase 4: Global Expansion & Product Iteration (Month 7-12)

-

Localize the platform for key markets (languages, region‑specific dashboards).

-

Develop advanced modules (e.g., predictive analytics, portfolio rebalancing recommendations) and integrate L2/side chains as the ecosystem evolves.

-

Continue to publish high‑impact research to reinforce thought leadership.

Key Metrics & Measurement

-

User Acquisition & Growth – track number of registered wallets/users, daily active users (DAUs), growth in free vs. Pro users, geographic distribution.

-

Conversion & Revenue – monitor free‑to‑paid conversion rate, average revenue per user (ARPU), churn rate and enterprise deal pipeline.

-

Engagement & Product Usage – measure queries per user, time spent on dashboards, number of alerts set, API call volume.

-

Community & Brand – Telegram/Discord membership growth, social media followers, content engagement metrics (blog views, webinar attendees).

-

Customer Satisfaction – Net Promoter Score (NPS), support ticket resolution time and survey feedback.

-

Partnerships – number of API integrations, white‑label clients, cross‑sell collaborations and revenue from channel partners.

-

Market Impact – references in media or research reports, citation of RateXAI metrics by analysts.

These metrics should be reviewed monthly, with qualitative feedback used to refine product and marketing strategies.

Risks & Mitigation

-

Regulatory & Compliance Risk: The crypto analytics industry may face increased scrutiny or data privacy regulations. Mitigation: maintain robust compliance with data protection laws (GDPR, CCPA), consult legal experts and avoid offering financial advice (RateXAI’s press release emphasises that information is not investment advice).

-

Data Accuracy & Reliability: Inaccurate or delayed data could erode trust. Mitigation: deploy redundant data sources, regular audits and validation; allow users to report anomalies. Provide transparency about data sources and methodology.

-

Security & Privacy: Large datasets and user accounts present security risks. Mitigation: implement strong encryption, multi‑factor authentication, routine penetration testing and compliance with security standards (ISO 27001). Offer self‑hosted options for enterprises.

-

Competition & Differentiation: Established analytics firms (Nansen, Chainalysis, DappRadar) could replicate features. Mitigation: continue innovation (e.g., AI agent capabilities), build strong community moats and forge strategic partnerships with chains and exchanges.

-

Market Volatility & Adoption: Crypto cycles can impact user spending. Mitigation: diversify revenue streams (subscriptions, enterprise, data marketplace) and position RateXAI as an essential tool regardless of market direction (bear or bull markets both require intelligence).

Conclusion

RateXAI is uniquely positioned to become the AI layer for Web3 intelligence. With a robust meta‑scoring engine processing billions of on‑chain and off‑chain signals and accessible natural‑language interfaces, it can serve both retail traders and sophisticated institutions. The Web3 market is expanding rapidly with a projected CAGR of 49.3%, and AI DApp adoption is accelerating, nearly doubling in 2025. By executing a product‑led growth approach complemented by targeted enterprise sales, thought‑leadership content and community‑centric marketing, RateXAI can capture significant share in the burgeoning crypto analytics space.

The strategy outlined above provides a roadmap for launching, scaling and differentiating RateXAI. It emphasizes understanding the competitive landscape, aligning features with customer needs, pricing effectively and building a strong brand through education and partnerships. By focusing on transparent, real‑time intelligence and fostering a loyal community, RateXAI can become the go‑to platform for navigating the decentralized economy.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024