Published 07 Jul 2025

AI Chart Analysis: The Future of Trading for Non-Professionals

AI is changing the way trading works in the world of crypto. Traders no longer need to spend hours on charts, news, and signals. AI can process that information within moments and provide helpful tips. This shift allows ordinary people to dive into market analysis without feeling unsure. In this article, we will look into actual tools, platforms, and real-life examples that show how AI makes analyzing charts quicker, simpler, and within reach for regular crypto traders.

AI Tools to Analyze Crypto Charts

TradingView (with AI features)

TradingView stands out as a leading charting platform and now includes AI-backed tools. These tools offer features like automatic detection of patterns such as head and shoulders or triangles. It also provides Elliot Wave identification and smart screeners to review technical indicators along with market mood. AI points out details that a person might overlook, and there is no need to deal with coding or complex setups.

CryptoGPT Projects

"CryptoGPT" includes different AI projects. One example is an assistant that works like a chatbot and answers your questions by providing market analysis. Another is a blockchain-based platform where AI bots review news, on-chain trends, and charts . Some bots such as agent 42N connect with TradingView to give real-time updates. Many of these tools are still being tested, but they highlight how AI can support traders as a helpful co-pilot.

AutoGPT Bots

AutoGPT bots set trade goals and make decisions. Developers link them to exchanges with API keys. These bots track prices and act on rules like “Buy if ETH falls by 5%”. The tech is still in early development and needs some setup skills, but it hints at a future where AI controls crypto trading.

Bitsgap AI Assistant

Bitsgap specializes in trading bots, and its 2024 AI update brings smart portfolio advice. The AI analyzes thousands of trading pairs, tests strategies, and recommends the best portfolio setup. You don’t need coding skills — just work through their web interface. It works well for people who manage multiple bots and want better performance using data-driven tips.

FX273 and Emerging Platforms

FX273 introduced in late 2024, provides an AI-focused trading experience. It offers automated trades, portfolio safeguards, sentiment analysis, and real-time forecasting. Although its success rates remain uncertain, platforms such as FX273 highlight how AI-powered trading tools are becoming used.

True Stories from Crypto Traders

A trader on Reddit shared how they used ChatGPT-4 to study ETH price charts and ended up making $7,000 in just one session. They asked it to find trends, levels of support and resistance as well as the best entry and exit points. Whenever they sent updated charts, ChatGPT tweaked its advice. Some traders now rely on ChatGPT to double-check their moves before they jump into trades.

Other people have gone even further by building their own tools. One person linked OpenAI's models to TradingView’s API and created a site that provides full AI-generated analysis after typing in a ticker and a timeframe. Some have also used AI to craft scalping strategies or to break down market signals in simple and clear language.

Crypto news outlets have tried out different ideas too. Cointelegraph set up a $100 portfolio challenge with ChatGPT. The AI picked BTC ETH, ATOM, and a few NFT tokens by looking at recent market trends. The performance turned out to be average, but the AI explained each pick by referring to market conditions.

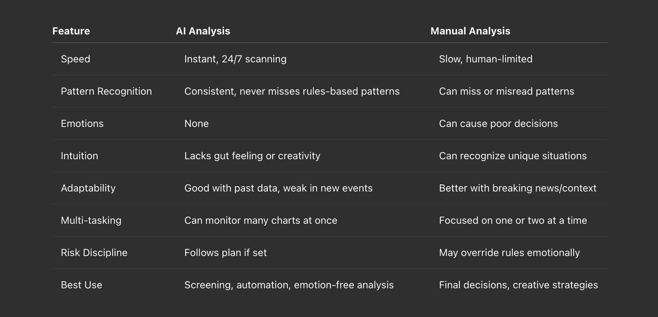

AI vs. Manual Analysis

Overall, AI performs better than humans at tasks that repeat or rely on data. However, humans bring value when decisions require context or creative thinking. The best approach might involve using both together.

Easy To Use for Everyone

- Do you need coding knowledge?

Most AI tools now work without coding. You can use features like TradingView’s pattern finder or explore Bitsgap’s AI by clicking instead of writing code. Some advanced bots such as AutoGPT might need API setups, but most basic features are simple enough for beginners.

- Can I use these tools for free?

Some tools won’t cost you anything, or they provide free versions to try. ChatGPT has a free option, but accessing GPT-4 and live plugins will cost you around $20 each month. Platforms like TradingView and Bitsgap have free plans with certain restrictions. On the other hand, projects like CryptoGPT may ask you to hold their tokens if you want to unlock their AI tools.

- Are they simple to use?

Most modern platforms aim to make things easy. TradingView includes toggle switches. Bitsgap comes with visual dashboards. AI-powered bots on Telegram now let you get fast answers without leaving the app. However, having some basic knowledge of trading terms is important to ask clear questions and make sense of the replies.

- Are there risks?

Yes. AI might lack current data unless connected to an active feed. It can seem sure of itself but still be incorrect. Use it as a tool instead of relying on it completely. Make sure your region or platform permits bots before using them.

How RateX.AI Makes AI Trading Smarter

Web3 can feel overwhelming with endless data mixed signals, and no straight answers. RateX.AI changes that. The platform serves traders, developers, and analysts by delivering quick actionable insights. It monitors markets live, observes SmartMoney behavior, and assigns scores to tokens to avoid chasing trends that don't matter. RateX.AI combines on-chain and social information into a single view so you can make better trading decisions. There’s nothing to set up and no messy data to sift through — it gives the details you need to trade smarter.

Conclusion

AI chart analysis has stepped beyond just being a tool for experts. Platforms like TradingView, CryptoGPT bots, and Bitsgap's AI now make it easier to understand markets and for regular crypto traders. They take care of the technical work, but people still rely on their own judgment, instincts, and strategic thinking. What's the smartest move? Let AI do the hard work while you focus on decisions based on its insights. This mix of technology and human thinking creates a strong way to handle crypto markets in 2025 and later.

For deeper insights and real-time clarity, platforms like RateX.AI bring everything together — so you can focus on what matters, not just the noise.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024