Published 02 Nov 2025

Beyond Pegs: The Business Model of Stablecoins

Stablecoins were designed to hold value, not to generate it. In their early years, they existed mainly as utility tokens — a neutral bridge between crypto volatility and fiat stability. But as the market matured, something unexpected happened: stablecoins became one of the most profitable businesses in Web3.

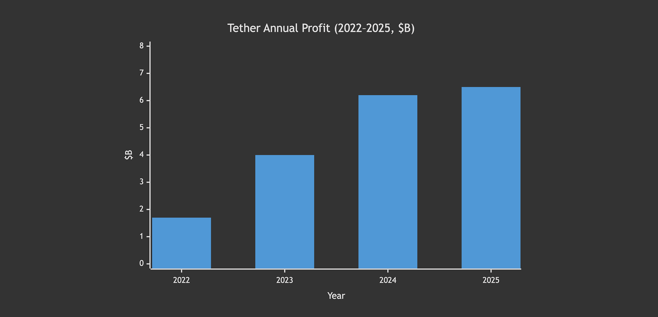

By 2025, issuers like Tether, Circle, and PayPal collectively manage more than $250 billion in collateral. With most of that parked in short-term U.S. Treasuries, the yield from reserves alone now produces billions in annual profit. Tether’s 2024 profit reportedly exceeded $6 billion, placing it alongside mid-tier global banks in net earnings.

This shift transformed the role of stablecoins. They are no longer just “digital cash”. They’ve become a financial engine — a system that quietly earns, compounds, and reinvests yield across the entire crypto economy.

Key Takeaways — How Stablecoins Became Profit Machines

-

Over $250B in collateral now generates continuous yield from short-term Treasuries and cash equivalents.

-

Tether’s annual profit crossed $6B in 2024, outperforming some publicly traded banks.

-

Interest rates created a new revenue layer — stablecoin issuers now earn from traditional financial instruments.

-

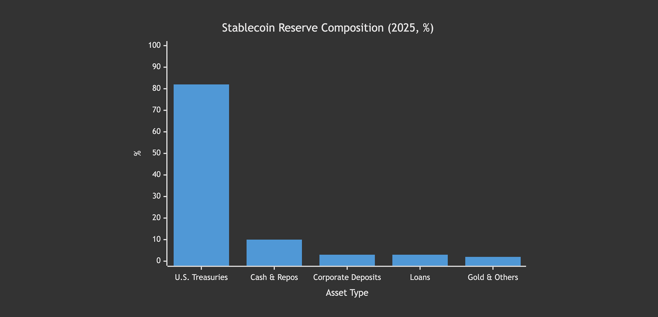

Reserves became yield portfolios: around 80% of backing assets are short-term U.S. government securities.

-

Circle and PayPal’s PYUSD pushed the model toward transparency and regulatory integration.

In less than three years, stablecoins went from technical pegs to profit-generating ecosystems. What was once an operational cost is now a multi-billion-dollar income stream — redefining how liquidity providers, exchanges, and investors view “digital dollars”.

Revenue Model — From Peg to Profit

At the core of every stablecoin sits a simple mechanism: users deposit dollars (or equivalents), and issuers hold those funds in reserve to maintain the peg.

What has changed since 2023 is what those reserves earn. With interest rates near 5%, a $1 billion float in short-term Treasuries now produces about $50 million per year in passive income — before any operational fees are added.

This new yield layer turned stablecoin issuers into cash-flow machines**.

They don’t lend, speculate, or chase risk; they collect yield from government-backed assets while charging partners for minting, redemption, and integration.

The two main revenue channels are clear:

- Interest income from U.S. Treasuries, reverse repos, and money-market instruments.

- Ecosystem fees — including network transactions, custodial spreads, and payment integrations.

The model is elegant in its simplicity. Every token minted increases the total collateral earning yield — creating a scalable, low-risk revenue loop that functions almost like a decentralized money-market fund.

Tether Annual Profit (2022-2025, $B)

Summary Insight

Stablecoin issuers now operate like mini central banks — printing liquidity backed by sovereign debt, but without lending exposure or deposit liabilities.

As long as rates stay elevated, stablecoins will remain among the most profitable assets in the digital economy.

Reserve Composition — Where the Money Sits

The foundation of every stablecoin is its collateral — and by 2025, that collateral has become remarkably standardized. Nearly all major issuers, including Tether, Circle, and PayPal, now hold over 80% of their reserves in the short-term U.S. Treasuries. The remainder consists of cash, overnight repos, secured loans, and, in Tether’s case, a small share of gold.

This structure didn’t emerge by accident. It’s the result of two pressures — market trust and regulatory scrutiny. Treasuries provide instant liquidity and minimal risk, ensuring every token remains redeemable even during high-volatility events. At the same time, higher yields have made these assets incredibly profitable, creating a rare balance between safety and income.

Circle was the first to fully pivot toward government debt, followed by PayPal’s PYUSD, which publishes monthly attestations. Tether took a more diversified approach but still keeps the majority of its collateral in instruments with maturities under 90 days.

Composition of Stablecoin Reserves (2025, %)

Summary Insight

Reserves have become the real moat of the stablecoin industry.

Transparency reports are now treated like quarterly earnings calls, where shifts in portfolio mix can move market sentiment.

The more transparent and Treasury-heavy an issuer’s balance sheet, the stronger its peg — and the higher its credibility among institutional partners.

Market Impact — Stability, Regulation, and Incentives

The profitability of stablecoins has redefined how both regulators and financial institutions view them. What was once a niche liquidity bridge is now a multi-billion-dollar profit sector holding assets comparable to small national banks. This new scale comes with both advantages and challenges.

On one hand, steady yields have made issuers financially independent — able to fund audits, R&D, and compliance teams without external capital. That autonomy strengthened stability and transparency, leading to faster adoption by exchanges, fintechs, and payment processors.

On the other hand, these profits drew scrutiny. Policymakers now debate whether stablecoin issuers should be regulated like money-market funds or banks. The U.S. and EU introduced early frameworks demanding clearer disclosures, stress testing, and redemption guarantees.

Meanwhile, the incentives inside the ecosystem evolved. Instead of fighting for speculative demand, issuers now compete for institutional trust and integration deals — powering payment APIs, settlement layers, and cross-border finance rails.

This transition marks a critical moment: stablecoins no longer depend on hype cycles. They’ve become self-sustaining financial entities that profit from stability itself — a structural pillar of the on-chain economy.

Methodology & Sources

All figures in this report are based on publicly available issuer disclosures, on-chain data, and independent analytics. Profit estimates combine reported financial statements with yield assumptions on reserve assets, primarily short-term U.S. Treasuries and reverse repo positions.

Tether’s profit calculations are derived from quarterly attestation reports and verified by aggregate reserve growth across 2022-2025. Circle’s and PayPal’s data come from their transparency updates, while DeFiLlama and Artemis provided independent supply tracking and rate benchmarks.

Reserve composition was modeled using asset share disclosures as of Q3 2025, weighted by market supply. When multiple data sources diverged, the conservative (lower-bound) value was used to maintain consistency.

Yield estimates assume an average 4.8% annual return on 3-month Treasuries during 2024-2025, adjusted for rolling maturities and cash buffers.

Data accurate as of early November 2025, based on verified public disclosures and on-chain metrics.

Conclusion — Stablecoins as Financial Engines

Between 2023 and 2025, stablecoins completed their transformation from risk hedges to profit centers. What began as an infrastructure to preserve value has turned into one of the most efficient revenue models in finance.

The key shift wasn’t in technology — it was in how reserves were used. Holding billions in Treasuries allowed issuers to tap into traditional yield streams while staying fully collateralized. The result: a system that earns from safety itself.

Stablecoin issuers now function like digitally native financial institutions, generating predictable returns without credit exposure or complex derivatives. Their balance sheets rival those of regional banks, yet they operate at a fraction of the cost.

As regulation and transparency tighten, the market’s most trusted issuers — those with audited reserves and clear governance — will define the next phase of digital money.

Stablecoins are no longer just a bridge between crypto and fiat. They are becoming the settlement layer of the internet economy.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024