07 Apr 2025

07 Apr 2025BNB Token Insight: Strategic Burn Mechanics, Tokenomics, and Market Sentiment

At Ratex Network, we explore how exchange-native tokens evolve from simple utility assets into foundational elements of blockchain ecosystems. Among them, BNB — the native asset of Binance — stands out as a prime example of advanced tokenomics, deflationary design, and ecosystem-wide adoption. This Insight dissects the underlying mechanics that drive BNB’s value and its broader role across both centralized and decentralized finance.

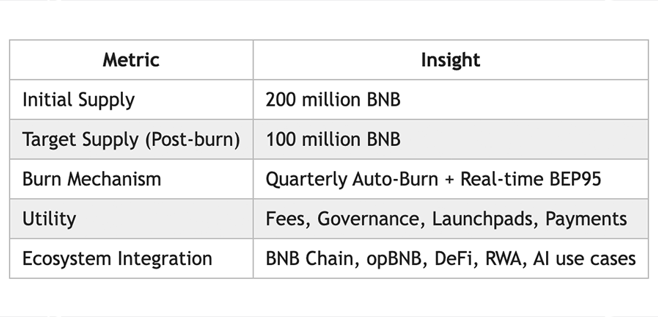

Since its launch, BNB has experienced exponential growth, supported by a combination of strategic supply reduction, expanding utility, and strong market participation. Its performance consistently places it among the most capitalized digital assets globally. One of the key pillars of BNB’s success lies in its automated quarterly burn mechanism, through which millions of tokens are systematically removed from circulation. Originally capped at 200 million tokens, BNB's supply has steadily declined, reinforcing scarcity and fueling long-term investor interest.

This deflationary strategy — coupled with Binance’s expanding suite of services that integrate BNB — creates a compelling dynamic. Rather than relying solely on speculative demand, BNB’s value proposition is tightly interwoven with real network usage and economic incentives. In this Insight, we examine the mechanics behind BNB’s tokenomics, the exchange-driven decisions shaping its trajectory, and what this means for the future of exchange tokens at large.

BNB Tokenomics Summary Table

The Anatomy of BNB’s Price Behavior

Understanding BNB’s market dynamics requires a look beyond price charts. Its price behavior reflects a combination of structured tokenomics, trading psychology, and investor segmentation — each playing a unique role in shaping how the token moves across time.

Technical Momentum and Market Sentiment

BNB often follows a rising trend channel over medium-term cycles, a pattern that signals consistent investor interest and potential for sustained upward momentum. Historical observations show that BNB tends to outperform broader market benchmarks during bullish phases, highlighting its resilience and the network effects tied to its parent ecosystem.

Technical indicators, such as the Relative Strength Index (RSI), have occasionally dipped into oversold zones — suggesting potential bullish reversals. In many cases, such dips precede renewed accumulation, especially when supported by parallel increases in futures market open interest. This metric, which reflects the number of outstanding derivative contracts, often points to growing institutional or professional trader participation.

Market Structure: Support and Resistance Dynamics

BNB frequently trades within identifiable horizontal channels, forming well-defined support and resistance zones. These zones act as psychological thresholds for traders and are often tested repeatedly before giving way to directional movement.

Strong historical support levels have served as reliable reentry points for long-term holders, while layered resistance levels have acted as technical ceilings — requiring either heightened volume or positive sentiment shifts to break through. Understanding these thresholds helps investors assess the likelihood of breakouts or corrections in advance, without relying on short-term forecasts.

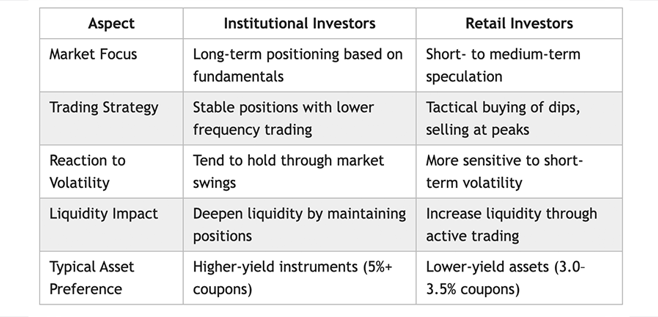

Institutional vs. Retail Participation

An interesting dynamic emerges when analyzing how different investor groups engage with BNB. Institutional participants typically exhibit long-term positioning, anchoring market stability even during periods of volatility. Their attention often aligns with expectations of stronger returns and is driven by macro-level analysis and fundamental conviction.

Retail investors, by contrast, are increasingly demonstrating strategic behavior — buying during dips and locking in profits during peaks. This evolution has reshaped the market’s liquidity profile. Despite differences in approach, both investor groups contribute positively to the token’s market health. Their combined activity deepens liquidity, supports price discovery, and reflects broader trust in BNB as an asset class.

Institutional vs. Retail Investor Behavior

Binance’s Strategic BNB Burn Mechanism

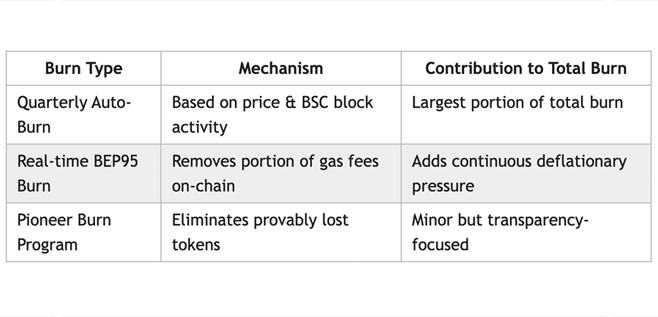

One of the most defining elements of BNB’s tokenomics is its structured deflationary model — a system designed to systematically reduce supply and enhance long-term token value. The BNB Auto-Burn mechanism is among the most aggressive supply-reduction strategies in the crypto industry, setting BNB apart from other exchange-native assets.

Burn Events and Market Behavior

BNB’s periodic token burns aim to introduce scarcity into the system by permanently removing tokens from circulation. However, market reactions to these burns have varied, revealing a nuanced relationship between tokenomics and investor sentiment. While economic theory suggests that reduced supply should drive prices up, real-world outcomes depend heavily on broader market conditions and trader psychology.

At times, price corrections have followed major burn events — highlighting that fundamentals alone cannot dictate price movements. These instances reinforce the importance of understanding market perception and timing, especially when evaluating deflationary mechanisms.

Supply Reduction in Practice

The BNB burn strategy is not a marketing gesture — it’s a mathematical, long-term commitment. Binance set out to remove 50% of BNB’s initial supply, gradually pushing the circulating amount toward a capped threshold. The process involves both automated quarterly burns and real-time burning mechanisms like BEP95, which removes a portion of gas fees during transactions on the BNB Chain.

Over time, this structured burn program has led to a substantial decline in circulating supply, reinforcing scarcity and increasing the perceived value of each remaining token. A portion of burns also compensates for provably lost funds, further refining the system’s integrity and fairness.

Strategic Timing and Predictability

The burn formula is calculated based on a combination of BNB’s market price and blockchain activity, making the process transparent yet adaptive. While the system operates independently from Binance’s core exchange, its alignment with economic cycles gives it a strategic edge.

In addition to regular quarterly burns, real-time burns under BEP95 create a continuous deflationary pressure, adjusting to user activity. This dual-burn model balances long-term predictability with short-term responsiveness, adding depth to BNB’s economic design.

From a macro perspective, a well-executed deflationary mechanism can support price stability and investor confidence, especially when paired with real-world utility and growing ecosystem demand. As the circulating supply trends downward over time, BNB's positioning as a deflationary asset becomes increasingly relevant in a market seeking long-term value and sustainability.

BNB Burn Mechanism Overview

Tokenomics Engineering: How Binance Shapes BNB Value

While price action and token burns tend to grab headlines, the real engine behind BNB’s long-term value lies in its tokenomics design. Binance has strategically engineered a system that combines scarcity, utility, and network incentives — giving BNB enduring relevance, even when broader market conditions are volatile.

Controlled Supply and Intentional Scarcity

BNB’s model enforces a deliberate supply reduction strategy. The total supply was initially capped at 200 million tokens, with a long-term goal of cutting that figure in half through ongoing burn mechanisms. As the circulating supply continues to decline, a classic supply-demand dynamic takes shape — fewer tokens in circulation increases perceived value among investors and users.

This engineered scarcity is not merely symbolic; it is vbuilt into the very structure** of BNB’s economic model. Over time, this creates consistent upward pressure on price, assuming steady or growing demand. It also reinforces the idea of BNB as a long-term asset, not just a transactional token.

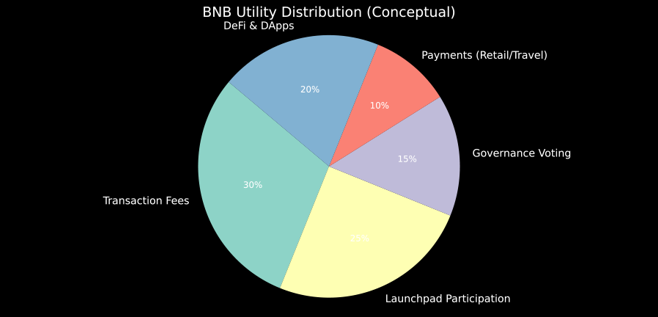

Expanding Utility Within the Binance Ecosystem

BNB’s strength is not limited to its supply-side design. Its value is continually reinforced by a wide range of practical applications across the Binance ecosystem and beyond. What began as a way to reduce trading fees has grown into a multi-dimensional use case, including:

- Transaction fees across multiple chains (BNB Smart Chain, opBNB)

- Participation in token launches (Launchpad, Launchpool)

- Voting rights in decentralized governance

- Real-world payments for travel, retail, and services

- Integration with emerging sectors like DeFi, real-world assets (RWA), and AI-based platforms

This versatility ensures vongoing, organic demand**, regardless of speculative cycles. BNB is not dependent solely on market sentiment — it holds functional value within an expanding digital economy.

Dynamic Fee Structures and Network Incentives

Binance’s continued experimentation with fee structures, such as the introduction of BEP 336, reflects its effort to optimize for both user engagement and ecosystem growth. By significantly lowering transaction costs, the network encourages higher volume activity, which in turn drives greater utility for BNB.

This dynamic pricing strategy aims to keep the ecosystem competitive with emerging Layer 2 solutions and alternative blockchains. And while lower fees may reduce short-term revenue per transaction, they have the potential to generate greater long-term value through increased adoption and network effects.

BNB’s tokenomics strategy is a masterclass in aligning supply control, utility, and incentive design. It’s a living economic system — one that evolves in response to user needs and competitive pressures, while staying grounded in fundamental principles of scarcity and utility.

Market Sentiment Analysis: Beyond the Numbers

When it comes to BNB, market sentiment often moves faster than fundamentals. In the crypto space — where price action can shift dramatically overnight — investor psychology plays a major role in shaping short- and medium-term trends. Understanding how sentiment interacts with tokenomics, utility, and broader market forces is key to anticipating BNB’s next move.

The Predictive Power of Social Signals

Social media has become a rich data source for gauging market behavior. Activity surrounding BNB on major platforms often precedes significant price shifts, making sentiment analysis an increasingly valuable tool for investors and analysts alike.

Rather than relying solely on positive or negative mentions, modern sentiment tools analyze:

- Emotional tone of conversations

- Ratio of opinions to factual content

- Surges and drops in discussion volume

- Behavioral patterns such as exchange inflows and outflows

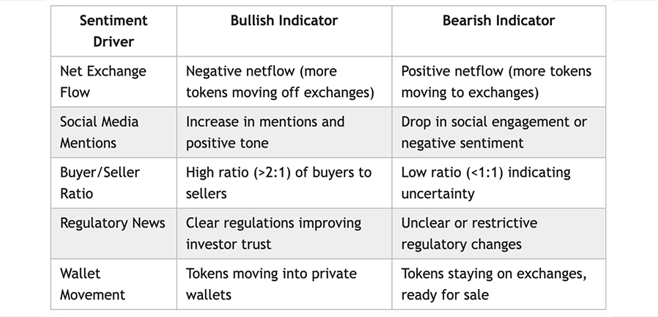

A common bullish indicator is negative net exchange flow — when more users move BNB into personal wallets rather than leaving it on exchanges. This often signals lowered sell pressure and greater long-term holding conviction. Similarly, spikes in online mentions can indicate increased attention and speculative momentum before the actual price reacts.

Even derivative markets reflect sentiment: an outsized buyer-to-seller ratio on major platforms often suggests rising confidence among leveraged traders. These patterns frequently act as leading indicators of broader market moves.

The Role of Regulation in Shaping Sentiment

While token mechanics and user behavior matter, regulatory developments often have the strongest emotional impact on BNB's investor base. As one of the most visible exchange-native assets, BNB tends to react more sharply than most tokens to shifts in legal and compliance narratives.

Announcements around transparency requirements, government oversight, or changes in legal classification can create short-term uncertainty — even when fundamentals remain strong. However, these developments also offer long-term clarity, especially when platforms like Binance adopt more structured reporting or compliance frameworks.

BNB’s nature as both a utility and ecosystem token makes it sensitive to how investors perceive institutional risk and trust. In many cases, proactive regulatory alignment can lead to increased investor confidence — especially among institutional participants looking for maturity and accountability in the crypto space.

Understanding sentiment is not about tracking mood swings — it’s about identifying the underlying emotional context that drives action. At Ratex Network, we view sentiment as a complement to traditional analysis, especially for assets like BNB that sit at the intersection of utility, speculation, and public perception.

BNB Sentiment Indicators Overview

Conclusion

BNB serves as a powerful example of how strategic tokenomics and expanding utility can fuel long-term value in the digital asset economy. Binance’s intentional design — rooted in supply control, ecosystem integration, and incentive alignment — has transformed BNB from a simple exchange discount token into a multi-dimensional financial instrument.

Through mechanisms like automated token burns, real-time deflation via protocol-level fees, and a continuously expanding set of real-world and blockchain-based use cases, BNB has established itself as more than just a speculative asset. Its tokenomics are not only well-engineered, but also responsive to changing market conditions and user needs.

Market sentiment continues to show resilience across both institutional and retail segments, with participants increasingly viewing BNB as a core holding within a diversified crypto portfolio. Its presence across DeFi, real-world applications, and Layer 1 utility positions it uniquely for continued relevance — even as the regulatory landscape evolves.

At Ratex Network, we view BNB as a leading case study in how centralized platforms can leverage token infrastructure to build decentralized influence. Its trajectory offers insights into the future of exchange-native tokens — where functionality, scarcity, and trust converge to create sustainable digital value.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024