Published 13 Oct 2025

Conspiracy or Strategy? What Really Triggered the $19B Crypto Collapse

The October 12 liquidation wave erased $19 billion in value across the crypto market — the largest single-day collapse in the industry’s history.

Official explanations quickly pointed fingers at Ethena’s $USDe depeg and a supposed oracle malfunction.

But the timeline, trading data, and profit flows suggest this was not an accident.

A Hole Inside Binance

Evidence points to a deeper issue within Binance itself.

Collateral appears to have been valued using internal pricing mechanisms, not independent oracles — a setup ripe for exploitation.

In a matter of minutes, roughly $90 million in USDe was dumped, driving the token down to $0.65 and triggering massive forced liquidations worth between $500 million and $1 billion.

That domino effect didn’t stop there — it expanded into a full-scale market collapse totaling $19 billion in liquidations across all major assets.

For something supposedly “unexpected,” the timing was almost surgical.

The Perfect Setup

While the market bled, one entity was already positioned to win.

Roughly $1.1 billion in BTC and ETH shorts were in place — positions that netted around $192 million in profit during the crash.

And just as this unfolded, Donald Trump’s new tariffs on China hit the news cycle.

Curiously, U.S. equity markets barely moved, while crypto — and specifically Asian trading hours — took the full impact.

The alignment of these events feels too clean, too deliberate, to dismiss as coincidence.

Smoke and Mirrors

The “Ethena caused it” narrative now looks more like a distraction than an explanation — a scapegoat story to hide what really happened.

The data hints at something far more orchestrated: major Asian trading desks, possibly tied to leading exchanges, unloading positions, triggering stop-losses, draining liquidity, then buying everything back at the floor.

If altcoins fell 70% and you were the one buying, that’s a 5×–20× payoff while everyone else was still stunned.

Binance later cited “technical issues” and promised compensation — a familiar move that often follows controlled events rather than accidents.

Echoes of the Past

The precision of this sequence — from internal mispricing to global liquidation timing — doesn’t look random.

It looks like a coordinated extraction, executed with the efficiency of a test run.

To many observers, the pattern feels eerily similar to Terra LUNA’s first wave — the one everyone thought was over before the real crash began.

If this was a “stress test,” it was perfectly timed, perfectly executed, and perfectly profitable.

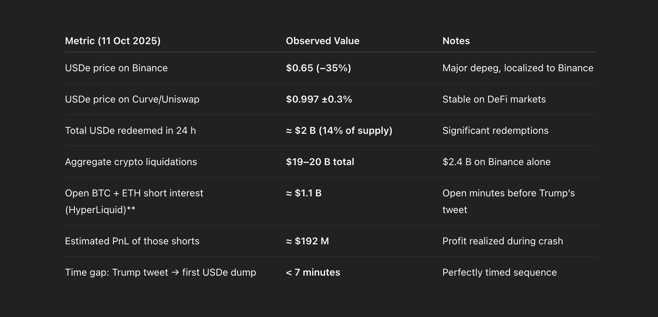

What the Numbers Show

To support this analysis, RateXAI Labs compiled on-chain and exchange data from October 11-12, reconstructing the sequence of events with a forensic approach.

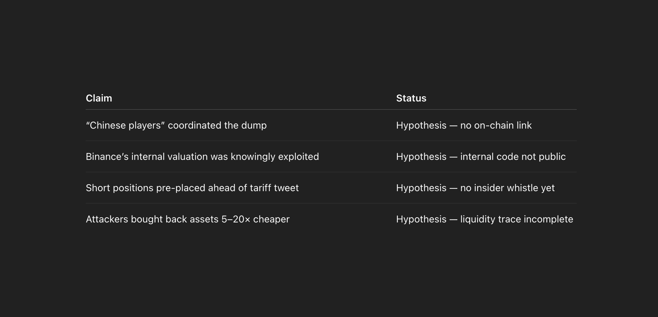

Everything below distinguishes between verified data and hypothesis to show where the trail of evidence ends and speculation begins.

Proven by On-Chain and Exchange Data

Still Under Investigation (Hypothesis)

Timeline of the Critical Hour (UTC)

- 13:07 — Trump announces 100% China tariffs.

- 13:10 — USDe dumping starts on Binance.

- 13:15–14:45 — Massive forced liquidations wipe ≈ $19B.

- 14:50+ — Binance suspends withdrawals, cites “technical issues”.

- Later — Exchange promises 72h compensation period.

Synthetic Reconstruction — How It Could Have Worked

- Pre-setup: attackers identify Binance’s internal pricing loop (no external oracle).

- Borrow ≈ $90 M USDe, open ≈ $1.1B BTC/ETH shorts on HyperLiquid.

- Trigger: Trump’s tweet provides the perfect distraction.

- Dump: USDe collapses to $0.65 → cross-margin breaches → auto-liquidations.

- Profit: shorts close at bottom, attackers re-accumulate cheap assets.

Early Warning Dashboard — Watch for the Next Wave

- On-chain signals: unusual USDe inflows > 50M to Binance while oracle lag > 5s.

- Derivatives: sudden BTC/ETH short interest spike before macro news.

- Order-book latency: Binance API > 200ms + withdrawal freeze.

- Social chatter: Mandarin keywords “统一抵押”, “循环贷款” in Telegram/WeChat.

Bottom Line

The “Ethena depeg” story doesn’t hold under data scrutiny.

Trump’s tariffs were a spark, not the cause.

The true acceleration point was Binance’s internal pricing flaw, amplified by leveraged short positioning.

As of now, coordination remains plausible but unproven — yet the precision of the event suggests this was no ordinary crash.

RateXAI DEXplorer loading…

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024