Published: 18 Nov 2025

DEXplorer – Unified Research, Signals, and Execution for On-Chain Traders

Why DEX Trading Still Feels Fragmented

DEX trading has become faster and more accessible, but the workflow is still scattered across dozens of tools. Traders jump between exchanges, blockchain scanners, X and Telegram channels, liquidity dashboards, bots, news feeds, and analytics panels. The information exists — it’s just never in one place.

This creates three constant problems.

First — missed signals.

While a trader is checking charts or chasing updates in social channels, the market is already moving. Smart wallets rotate positions, liquidity shifts, and narrative momentum builds long before everything becomes visible in standard dashboards.

Second — no unified picture.

On-chain metrics, off-chain activity, price action, and social sentiment rarely connect into a single, verifiable context. Even experienced analysts spend hours piecing these parts together to understand what’s actually happening inside an asset.

Third — operational noise.

Pro traders and funds burn 15-20 hours a week filtering noise, validating sources, and re-checking signals. Delays and incomplete data lead to poor entries, late exits, and unnecessary exposure — especially in fast-moving DEX environments.

Fragmentation forces traders to operate with partial visibility. And decisions made on partial data often worsen timing, increase false positions, and reduce overall PnL.

What DEXplorer Unifies Into One Terminal

DEXplorer brings the full trading workflow into a single, consistent environment. Instead of switching between scanners, feeds, and execution tools, every stage of the cycle happens inside one terminal. The goal is simple: remove friction, reduce noise, and give traders a complete view of the market before they act.

The interface combines five layers of information that are usually scattered across separate platforms:

-

Market Data — real-time price action, depth, liquidity, and volatility signals.

-

On-Chain Intelligence — token flows, smart wallet activity, holder behavior, and emission dynamics.

-

Social and News Signals — KOL momentum, narrative shifts, breaking headlines, and sentiment trends.

-

MetaScore and Sub-Scores — a unified scoring system that ranks assets across 65+ quantitative and qualitative metrics.

-

Execution and Post-Trade Tools — order placement, monitoring, and PnL tracking in the same non-custodial flow.

With these layers merged, the trader sees context, signal, and execution options without leaving the page. This reduces switching costs, shortens reaction time, and turns fragmented data into a structured decision-making process.

SAE: Turning Noise into Ranked, Verifiable Signals

DEXplorer’s scoring system is powered by the SAE — Scoring Algorithms Engine, a framework that evaluates every asset across 65+ metrics. Instead of treating market data, social flow, and on-chain activity as unrelated pieces, SAE merges them into a single ranking model built for real trading decisions.

MetaScore radar chart

MetaScore radar chart

MetaScore (rMS) — the unified rating

The MetaScore ranges from 0 to 100, with letter grades from AAA to CCC, and reflects the combined strength of three core sub-scores:

- rPS — Predictive Score

Price structure, volatility regimes, order flow, and momentum patterns that historically precede strong moves.

- rKS — KOL / Mindshare Score

Narrative traction, KOL accuracy, community engagement, social velocity, and source-level reliability.

- rLS — Liquidity Score

Depth, liquidity distribution, slippage conditions, volatility absorption, and market-making patterns.

Each of these layers is weighted and updated in real time. When aggregated, they form a ranked, verifiable signal — not a one-dimensional indicator.

Wallet Intelligence: understanding who is actually trading

Wallet Intelligence

Wallet Intelligence

SAE doesn’t stop at metrics. It profiles the wallets behind the activity:

- long-term holders vs. short-term actors

- PnL-positive traders

- cluster behaviors

- smart-money inflow and outflow

- concentration shifts among top wallets

This exposes not just what is happening, but who is driving the move and whether the flow is sustainable.

Scoring Gainers: assets gaining strength right now

Scoring Gainers list

Scoring Gainers list

The Scoring Gainers view surfaces tokens that show the strongest improvement across their metrics during a given timeframe. This is where narrative shifts, early momentum, or structural liquidity changes appear before they reach price action or social channels.

SAE converts fragmented signals into structured rankings. Instead of checking ten sources, traders receive a consistent, data-backed evaluation of every active asset.

Data Infrastructure and Real-Time Indexers

DEXplorer is built on a data backbone designed for speed and depth. The system continuously processes on-chain activity across major ecosystems and synchronizes it with market, social, and narrative signals. This removes delays that typically occur when traders rely on slow or fragmented data sources.

Transactions Table

Transactions Table

Smart Wallet Insights

Smart Wallet Insights

The transaction stream inside the terminal updates in real time. Each entry is enriched with metadata:

- wallet type and risk profile

- position size and behavior pattern

- whether the action aligns with smart-money clusters

- how the movement correlates with liquidity shifts and sentiment spikes

Instead of showing raw transfers, DEXplorer highlights context — why these trades matter and how they affect the short-term structure of the asset.

The system uses proprietary indexers for SOL, ETH, and BNB, with new ecosystems added as activity grows. Combined with 300+ TB of internal historical data, this allows SAE to detect patterns early and treat each transaction as part of a larger narrative, not an isolated event.

This infrastructure makes scoring more accurate, reduces false positives, and ensures that every market signal has verifiable on-chain grounding.

Multi-Agent Layer: Continuous Monitoring Without the Noise

The Multi-Agent Layer extends DEXplorer beyond analytics. It automates the work that typically consumes a trader’s entire day: monitoring wallets, validating signals, tracking narrative shifts, and filtering unreliable sources. Instead of reacting to noise, the system focuses on events that historically lead to actionable moves.

Smart Wallet Signals and Sentiment Dynamics

Smart Wallet Insights

Smart Wallet Insights

Sentiment Over Time

Sentiment Over Time

Agents analyze wallet clusters around the clock:

- PnL-positive traders and their position changes

- accumulation and distribution patterns

- concentration shifts among top holders

- consistency between flow and sentiment

- early divergences between smart-money activity and price action

The sentiment timeline helps validate whether narrative momentum supports the flow. When wallet behavior and information trends align, agents flag the asset for early review or action.

Filtering Influential Voices and Narrative Drivers

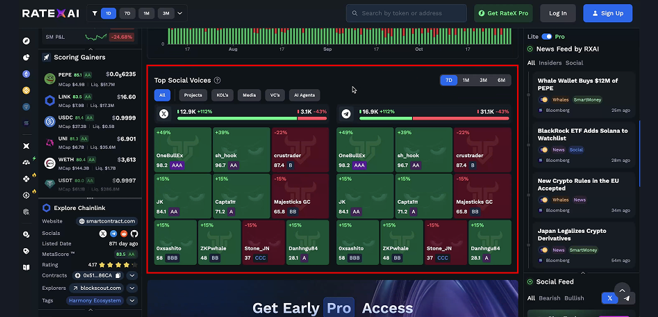

Social Voices heatmap

Social Voices heatmap

Not every social mention matters. The Multi-Agent Layer ranks voices by historical accuracy, influence, and behavioral patterns. The system highlights:

- KOLs who consistently front-run strong moves

- project accounts with reliable updates

- sources that produce false or lagging signals

- clusters that drive short-term volatility

This distills thousands of posts, updates, and rumors into a curated stream of signals that traders can verify and act on.

From Monitoring to Execution Logic

Agents run predefined playbooks — accumulation spikes, free-float shocks, narrative flips, and liquidity dislocations — and generate structured alerts. Each alert includes audit logs showing why the trigger fired and what evidence supports it.

Instead of manually tracking flows across X, Telegram, DEX dashboards, and scanners, traders receive a filtered, contextualized feed designed to reduce false positions and improve timing on both entries and exits.

From Research to Execution: The Full Cycle Inside DEXplorer

DEXplorer is designed to support the entire lifecycle of a trade — from the first hypothesis to the final PnL check — without forcing the trader to switch platforms. Every stage is connected. Context leads to signal, signal leads to execution, and execution feeds back into the scoring engine.

Contextual Research in One View

Explore Chainlink (contracts, integrations, sources)

Explore Chainlink (contracts, integrations, sources)

Every asset page begins with structured context. Contracts, integrations, ecosystem connections, audits, and verified sources are grouped into a single panel. This allows traders to understand where the project sits within its network and how dependent it is on specific partners or infrastructure.

This is especially useful during narrative rotations or ecosystem-driven moves. Instead of searching block explorers or external databases, the trader sees the entire structural map of the asset inside the terminal.

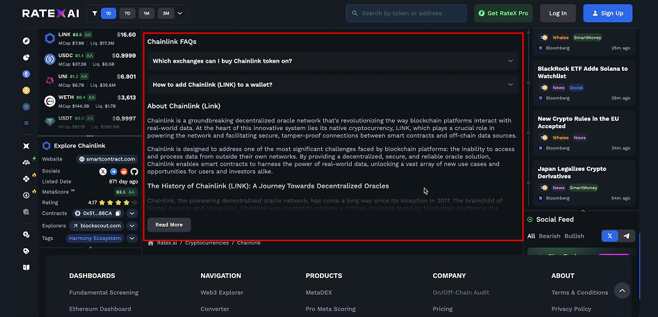

Extended Project Data and Instant Education

About + FAQ

About + FAQ

The extended project module includes background information, core concepts, and FAQ elements that clarify how the token works. This is not marketing material; it’s operational knowledge — enough to understand mechanics, token design, and typical catalysts behind major moves.

By combining research and educational context, DEXplorer reduces preparation time. The user can move from “What does this project do?” to “Is this a valid trade setup?” in minutes.

Connecting Research to Decisions

Once context is clear, the trader can evaluate MetaScore, check wallet flow, compare sentiment trends, and review narrative momentum — all within the same environment.

If the signal is confirmed, execution tools are already available in the terminal.

When the trade is closed, PnL details feed back into the user’s view, completing the loop.

This full-cycle structure removes friction and builds a consistent workflow: one interface, one dataset, one decision path.

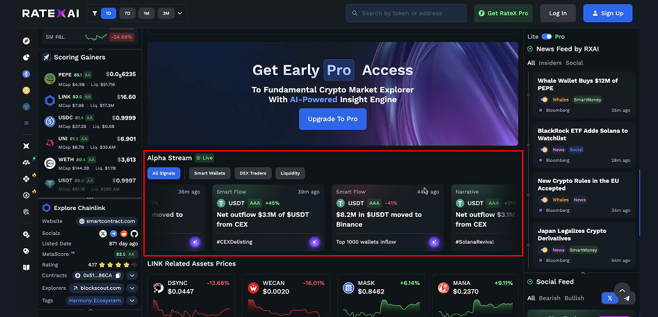

Alpha Stream: Actionable Signals in Real Time

Alpha Stream is the surface layer where all scoring, narrative tracking, and agent analysis converge into clear, time-sensitive signals. Instead of making the trader sort through dozens of indicators, Alpha Stream highlights only the events that fit proven patterns and historically lead to meaningful price movement.

Alpha Stream — Signal Cards Panel

Alpha Stream — Signal Cards Panel

Each card in Alpha Stream represents a structured alert generated by agents monitoring:

- smart-money inflow and outflow

- shifts in liquidity conditions

- volatility breaks and trend inflections

- narrative acceleration or decay

- coordinated activity across wallet clusters

- emerging divergences between sentiment and price action

Every signal contains enough context for immediate decision-making. Traders see why the alert fired, which metrics support it, and how the current conditions map onto previous high-probability setups.

Alpha Stream is not a feed of “maybe interesting” events — it’s a filtered, high-signal-to-noise stream built for fast situational awareness. It helps traders spot early entries, confirm existing setups, and avoid false positions that come from chasing unverified information.

Conclusion — From Fragmentation to an Integrated Trading Workflow

DEXplorer replaces the scattered, high-friction workflow of traditional DEX trading with a unified system built around verifiable data, ranked signals, and continuous agent-driven monitoring.

Instead of juggling scanners, social feeds, and execution tools, traders operate inside a single environment where context, signal quality, and timing are aligned.

SAE provides a consistent scoring framework grounded in on-chain behavior, liquidity structure, market patterns, and narrative flow.

The Multi-Agent Layer turns the constant noise of the ecosystem into structured events that match real trading setups.

Alpha Stream surfaces only the strongest opportunities, backed by clear evidence and audit logs.

This integrated cycle — research → signal → execution → PnL — creates a cleaner, more disciplined way to trade volatile markets.

With faster validation, fewer false positions, and a deeper view of what drives each move, traders can act earlier and with more confidence.

DEXplorer is not just another analytics dashboard.

It is a complete decision-making system designed to help active DEX traders, desks, and funds operate with full visibility and a significantly higher signal-to-noise ratio.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024