Published 28 Jul 2025

From Research to Revenue: Building the Brain of InfoFi

The Problem No One Solved — Until Now

The crypto market has exploded — almost a billion users expected by 2028, trillions in tokenized value, and millions of on-chain actions every hour. But the deeper the market grows, the harder it becomes to read.

Data is everywhere — and nowhere. Analysts drown in dashboards. Traders chase noise. Investors spend days connecting fragments just to answer simple questions: Where is the liquidity moving? What’s the next breakout token? Who’s buying what — and why?

Web3 is overloaded with raw signals, but starved for real intelligence.

RateXAI changes that.

The RateXAI Solution: Make the Market Readable

RateXAI is a high-performance AI & Big Data platform designed to scan, score, and decode the entire Web3 ecosystem in real time. From SmartMoney flows and token fundamentals to social sentiment and DEX liquidity, RateXAI transforms chaos into clarity.

This isn't another data tool. It's a decision engine built for traders, funds, analysts, and developers who need speed, scale, and structured insight — not more tabs, feeds, or guesswork.

With 300+ TB of indexed data, a multi-layer AI architecture, and a full suite of live products — RateXAI is already powering real-time intelligence across Ethereum, BNB, Solana, TON, Base, and more.

The Rise of DataFi, InfoFi, and Agentic Intelligence

The market is shifting fast. Raw data is no longer enough. Traders, analysts, and funds demand interpreted intelligence, token scores, and actionable signals — delivered in real time, across multiple chains and layers.

This new demand is fueling the rise of DataFi and InfoFi platforms — where information is structured, scored, and monetized like financial assets.

DataFi: Turning Information into Tradable Assets

DataFi treats data not as a byproduct — but as a core asset.

Projects like Ocean Protocol have shown that tokenized datasets can be bought, sold, and staked. Market participants now value structured intelligence the same way they value liquidity or token supply curves.

RateXAI fits directly into this trend — by transforming billions of chaotic signals into quantified alpha: token scores, liquidity maps, wallet P&L models, and SmartMoney breakdowns. These outputs are not dashboards. They are data products — ready to be consumed, embedded, or sold.

InfoFi: Real-Time Intelligence Flows

InfoFi refers to the infrastructure that powers real-time financial information flows — from blockchains, social networks, and developer ecosystems.

Kaito, a Web3 search engine, proved the demand: it aggregated unstructured content using LLMs and raised at an $87.5M valuation within months of launch.

RateXAI takes this further — by integrating on-chain data, Telegram/X sentiment, wallet behavior, and DEX signals into one intelligence layer, searchable, scorable, and agent-ready.

Agentic AI: Autonomous Market Readers

The final trend is the rise of agentic intelligence — autonomous agents that scan, interpret, and act on market events. In 2024 alone, the market cap of AI+crypto agents surged from $4.8B to $15.5B in one quarter.

RateXAI operates on a modular AI stack built for this shift — combining GPT-4o, DeepSeek R70B, and Llama 3.3 with real-time market data and user-defined logic.

From passive scanning to active alerting and strategy triggers, the agent layer transforms RateXAI into an autonomous intelligence infrastructure, not just a data source.

RateXAI vs the Competition: The Missing Layer

The crypto data market is full of tools — dashboards, explorers, SQL-based platforms, and research feeds. Each solves a part of the puzzle. None solve the whole problem.

-

Nansen tracks SmartMoney flows and wallet labels — but focuses mostly on DeFi and NFT monitoring behind a high paywall.

-

Dune empowers technical users to write SQL queries — but has no AI layer or real-time monitoring.

-

Arkham introduced an intelligence marketplace — but leans heavily on deanonymization and has limited analytics tooling.

-

Token Terminal standardizes protocol metrics — but covers only a narrow slice of fundamentals.

-

Kaito enables AI-based search — but doesn’t offer scoring, agents, or actionable infrastructure.

RateXAI is different.

It doesn’t replicate these tools. It replaces the fragmented workflow.

The Missing Layer: Structured Intelligence

RateXAI combines what others separate — wallet behavior, token metrics, social sentiment, DEX flow, and SmartMoney tracking — into one composable, AI-ready intelligence layer.

No code. No SQL. No tab-hopping.

From MetaScore ratings (AAA–BBB) to whale alerts and Python-ready liquidity models — RateXAI delivers a system of interpretable, modular signals that feed into research, strategy, or automation.

It’s not a dashboard. It’s an intelligence OS.

Live Today. Built to Scale.

RateXAI is already operating at scale:

-

300+ TB of indexed data

-

200M+ wallets tracked

-

10B+ transactions analyzed

-

4 live products across GameFi, DEX, SmartMoney, and research

-

Infrastructure powered by Ethereum, BNB, Solana, TON, and Base full nodes

-

Modular AI stack (GPT-4o, Llama 3.3, DeepSeek R70B)

-

Telegram-native apps used by 1.4M+ users

This isn’t a prototype. This is the missing layer — now deployed.

Inside RateXAI: What’s Already Live and How It Works

RateXAI isn’t a concept. It’s an operational intelligence layer, already delivering value to traders, analysts, and builders.

Here’s what’s running today:

RateXMetaScore — Token Ratings Built on 65+ Signals

RateXMetaScore is a multi-factor scoring engine that rates tokens from AAA to BBB using a structured mix of:

-

On-chain metrics: liquidity shifts, volume patterns, protocol usage

-

Off-chain signals: Telegram buzz, activity spikes on X, global news triggers

-

Wallet-level analytics: SmartMoney activity, P&L behavior, concentration

-

Technical indicators and tokenomics: emissions, lockups, supply dynamics

Instead of digging through metrics, users get a single, transparent score — refreshed in real time and ready for filtering, backtesting, or alerting.

SmartMoney Dashboard and Whale Watch

RateXAI tracks over 200 million wallets, including SmartMoney actors, whales, insiders, and ecosystem funds.

The SmartMoney layer reveals:

-

Who’s buying or exiting

-

Where capital clusters

-

What wallets show consistent positive P&L

-

Which projects are gaining traction early

This layer powers both real-time alerts and strategy design — across DEX trades, bridges, airdrops, and staking flows.

DEX Terminal — Real-Time Market Surface

A live DEX intelligence terminal shows:

-

Buy/sell pressure across pools

-

Liquidity concentration and movements

-

Token pair activity and price anomalies

-

Custom filters based on MetaScore, wallet tags, or social sentiment

It’s not just data — it’s market radar, updated second by second.

JupyteX — Research Hub for Analysts and Quants

JupyteX gives analysts direct access to Python-ready datasets from RateXAI's indexed backend.

Over 170 structured datasets are available — including token scores, wallet behavior vectors, cross-chain DEX flows, Telegram keyword spikes, and more.

JupyteX supports custom modeling, visualization, and integration into quant workflows — with zero setup.

Telegram GameFi App — INSIDERAA

Deployed in Telegram with 1.4M+ users, INSIDERAA acts as a lightweight interface for token scores, whale alerts, and real-time narratives.

It connects GameFi users with on-chain signals through gamified missions, token-based rewards, and embedded AI summaries.

It proves that RateXAI’s infrastructure can power mass-market surfaces — from research terminals to mobile-native apps.

The Platform as an Ecosystem: Agents, APIs, and Data Monetization

RateXAI is designed to scale — not just in data, but in how intelligence is created, shared, and monetized. The platform functions as a modular ecosystem with three key layers:

1. Agentic Infrastructure — Autonomous Intelligence That Acts

RateXAI supports agent deployment — intelligent processes that scan, interpret, and act on market signals.

Agents can be customized to:

-

Track SmartMoney behavior for a token list

-

Monitor liquidity spikes across specific DEXs

-

Alert when a MetaScore crosses a threshold

-

Detect sentiment bursts on Telegram and X

-

Trigger reports, summaries, or even downstream actions

Built on a secure stack using GPT-4o, DeepSeek R70B, and Llama 3.3, agents operate in real time — functioning as autonomous research assistants, signal filters, or strategy bots.

2. APIs and Composability — Build on Top of RateXAI

All platform data and outputs — MetaScores, wallet analytics, token events, sentiment scores — are accessible via APIs.

Developers, analysts, and institutions can:

-

Integrate RateXAI into internal dashboards

-

Use datasets in Jupyter, quant tools, or custom models

-

Build Telegram bots, browser extensions, or mobile apps

-

Connect RateXAI modules to existing trading systems

The ecosystem is composable by design — allowing any ML model, analytics layer, or frontend surface to plug into the RateXAI intelligence stack.

3. Monetization Layer — Data as Product, Intelligence as Asset

RateXAI introduces the ability to tokenize and monetize insights. Analysts, researchers, and builders will be able to:

-

Package high-value datasets or models

-

Publish scoring formulas or predictive indicators

-

List dashboards, alerts, or agent templates on a marketplace

-

Earn via access subscriptions or one-time data token purchases

This approach turns RateXAI into a DataFi engine, where intelligence becomes a tradable resource.

A curated marketplace is planned — enabling discovery, licensing, and revenue-sharing. The upcoming RXAI token will play a central role in this economy — used for access tiers, staking, and transaction fees across the ecosystem.

Who It’s Built For: Traders, Funds, Builders, Platforms

RateXAI is used by people who make decisions — and need the data to justify them. Each user type faces signal overload in a fragmented market. RateXAI delivers structured answers at speed.

Traders — Real-Time Signals, Scoring, and SmartMoney Insights

Independent and professional traders rely on RateXAI to:

-

Score tokens instantly (AAA-BBB)

-

Track whale movements and SmartMoney flows

-

Monitor DEX liquidity and trading pressure

-

Receive real-time alerts based on wallet behavior or sentiment spikes

-

Identify high-potential tokens before the move happens

Everything is delivered via dashboards, APIs, and Telegram-native apps — no setup, no noise, just actionable signals.

Funds and Analysts — Research Infrastructure at Scale

Funds and investment teams use RateXAI to power due diligence, market monitoring, and internal workflows:

-

Portfolio health checks across liquidity, holder structure, and usage metrics

-

Cross-chain activity tracking for watchlist projects

-

Custom agent setups to monitor new listings, unlock events, or whale moves

-

API integrations into quant models, risk engines, or internal dashboards

-

Access to JupyteX datasets for fundamental research and backtesting

RateXAI becomes a research analyst, portfolio monitor, and alert system — all in one layer.

Builders and Developers — Intelligence as a Backend

Web3 builders use RateXAI as a backend for data-powered apps, features, and products:

-

Use API to display MetaScores inside wallets, aggregators, or dApps

-

Build trading bots or Telegram alerts on top of SmartMoney triggers

-

Plug into the marketplace to create or resell scoring models

-

Combine data streams to create niche analytics tools without building infra

With native Python support, flexible endpoints, and modular architecture, RateXAI removes months of setup work.

Platforms and Exchanges — Embedded Intelligence for Users

Exchanges, DeFi platforms, and aggregators integrate RateXAI to improve user experience:

-

Display token scores, wallet trends, and liquidity data next to listings

-

Surface trending tokens based on SmartMoney or sentiment flows

-

Provide institutional-grade insights to retail users — increasing engagement and trust

-

Offer white-label dashboards, alerts, or agent templates as premium tools

With custom widgets and enterprise access, RateXAI becomes a plug-in layer of intelligence that boosts platform value.

Business Model and Growth Potential

RateXAI is built as a modular platform with multiple revenue streams — combining classic SaaS, token-based utility, and marketplace dynamics.

Freemium Core, Paid Intelligence

The platform follows a freemium model — giving wide access to basic scoring, dashboards, and alerts to drive adoption, while monetizing power users and institutions.

-

Retail traders gain free access to key signals via Telegram and web

-

Premium plans unlock deeper analytics, agent deployment, advanced filters, and custom alerts

-

Institutional clients access APIs, historical data, white-label dashboards, and priority support

Examples of pricing benchmarks in the market:

-

TradingView premium: ~$20–60/month

-

Nansen Pro: ~$1000/year+

-

Arkham Intel: token-based access with variable cost

-

Bloomberg Terminal (TradFi): ~$25–30k/year

RateXAI fits between TradingView and institutional analytics — accessible, but deep.

B2B and Enterprise Licensing

RateXAI offers custom packages for funds, platforms, and infrastructure partners:

-

API access to token scoring, wallet behavior, liquidity heatmaps, and sentiment feeds

-

White-label dashboards for exchanges, research firms, or community DAOs

-

Internal agent deployment for compliance, alerts, or strategy workflows

Modeled at scale, even a small enterprise client base creates a multi-million dollar annual revenue stream.

Data Marketplace and Token Economy

RateXAI plans to launch a curated intelligence marketplace where analysts and builders can:

-

Publish data models, dashboards, and agent templates

-

Monetize access through the RXAI token or subscriptions

-

Earn reputation and rewards for performance, adoption, or upvotes

RateXAI will earn a cut on marketplace activity — turning passive users into contributors and scaling the value of the ecosystem.

The RXAI token will unlock advanced features, staking benefits, usage quotas, and potential governance. Token activity will be directly tied to platform usage and data flow.

Scalable by Design

The market opportunity is enormous:

-

Over 560M+ global crypto users in 2024

-

Tens of millions of traders, analysts, and builders looking for intelligence

-

Billions spent annually on tooling, research, and market infrastructure

Even at modest penetration — for example, 100,000 users paying $500/year — RateXAI can reach $50M ARR.

With high-margin SaaS + marketplace mechanics, the platform is designed to scale without linear team or cost growth.

Becoming the Web3 Bloomberg: Long-Term Vision and Valuation

In traditional finance, tools like Bloomberg Terminal and Reuters Eikon became indispensable — not because of charts, but because of trustworthy, structured intelligence delivered instantly.

Web3 is still missing its equivalent.

RateXAI is positioned to fill that gap — combining real-time scoring, autonomous agents, market scanning, and data monetization in one composable layer.

This is not a dashboard play. It's the infrastructure for decision-making.

Key Metrics That Power the Long-Term Thesis

RateXAI is already tracking:

-

300+ TB of on/off-chain indexed data

-

Over 200 million wallets and 10+ billion transactions

-

Real-time liquidity across DEXs and chains

-

1.4M+ GameFi users engaged via Telegram

-

4 public products live, with agent infrastructure rolling out

-

Modular backend with full-node indexing on Ethereum, Solana, TON, BNB, and Base

Each layer is designed to scale — horizontally (via new products), vertically (via power users), and externally (via partners and integrations).

Valuation Benchmarks from Comparable Companies

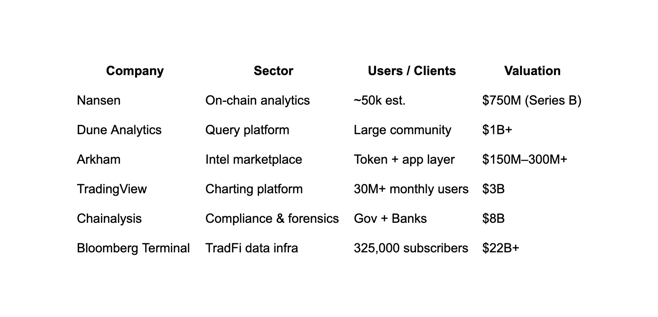

To understand RateXAI’s upside, compare to existing market players:

RateXAI combines elements of several of these models — with a token economy, marketplace mechanics, SaaS logic, and AI-first architecture. That unlocks multiple paths to scale and monetization.

Road to $1B+ Valuation

With continued user growth, institutional onboarding, and a functioning token-based ecosystem, RateXAI is structurally capable of reaching unicorn status. Key milestones include:

-

100k+ paying users (retail + institutional)

-

Multi-million ARR via SaaS and API licensing

-

High-volume data marketplace transactions

-

Ecosystem partners building on the platform

-

Broad RXAI token adoption and usage for access, staking, and rewards

RateXAI is not just building a product. It’s laying the foundation for how intelligence flows through Web3 — from raw signal to strategic action.

As the crypto market moves toward institutional maturity and AI-native workflows, the demand for structured intelligence will only grow. The platforms that own this layer will define the next generation of financial infrastructure.

Conclusion: Why RateXAI Is the Infrastructure Layer Web3 Needs

The crypto market doesn’t need more charts, feeds, or scattered dashboards.

It needs a system that reads the market at scale, scores it in real time, and translates noise into strategy.

RateXAI does exactly that.

With an AI-native architecture, autonomous agents, full-stack data infrastructure, and real-time delivery — RateXAI turns raw blockchain and social chaos into structured intelligence.

For traders, it means earlier entries. For funds, it means cleaner research. For builders, it means composable analytics without overhead. For platforms, it means embedded intelligence that users trust.

Web3 is entering its next phase — where information is capital, and those who read it faster win.

RateXAI is the engine behind that edge.

Not a tool. Not a trend. The intelligence layer powering the next trillion in crypto.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024