Published 15 Jul 2025

How to Start Investing with AI (Without Reading Charts or News)

Introduction — Why It Matters

Many people find investing intimidating. Complicated charts, never-ending news updates, and financial language often push beginners away. However modern AI tools are reshaping this experience. You no longer have to figure out confusing graphs or monitor the news to start investing.

AI builds a connection

Machine learning powers automated investing tools that handle massive amounts of data. They provide useful investment insights without needing you to read charts or follow the news. This makes it easier for people new to investing to get started and opens up financial advice to more individuals.

Closing the advice gap

Many people in different parts of the world do not get help from financial advisors as they cannot pay for human expertise. Tools powered by AI such as robo-advisors and smart assistants, offer a cheaper way to provide automated portfolio help and fill this gap.

An alternative option appeared

Using AI to invest creates a balance between managing investments yourself and having them managed. It allows people to benefit from algorithms and data-based insights without needing advanced financial or tech skills.

How AI Operates in the Background

AI investing doesn’t rely on intuition or chance. It depends on data smart algorithms, and machine learning working as one. These systems first collect massive volumes of structured data, like financial reports or past prices, along with alternative data such as satellite photos, job listings, or even social media opinions — which casual investors often overlook. This vast pool of information helps AI identify hidden trends and patterns that people might not notice on their own.

AI models use advanced methods to study collected data, like regression, clustering, and deep neural networks, to detect trends in industries and markets. One innovative method, Hierarchical Risk Parity (HRP), relies on machine learning to create balanced portfolios. It groups related assets into clusters and allocates funds . Unlike older models, which handle unstable covariance matrices by inversion, HRP forms structured groups and adjusts positions according to risk. This leads to allocations that are stronger and more diverse.

AI systems go beyond just analyzing — they take action too. Some platforms called robo-advisors, handle tasks like assigning and rebalancing portfolios using a person’s risk level and financial goals. These robo-advisors now use AI to improve things like managing risks, optimizing taxes, and adjusting portfolios dynamically. A more sophisticated form known as agentic AI, works like a personal assistant. It can hold conversations, take initiative, and even complete trades by using live data and the user’s preferences.

But this power carries a duty too. AI can feel like a “black box”. When users don’t see clear reasoning behind it, they may hesitate to trust its choices. This is where Explainable AI (XAI) steps in. Methods such as SHAP values or feature importance make it easier to describe the thinking behind AI trading decisions. By showing why the system did something, XAI builds trust and openness.

Experts remind us that AI isn't without its boundaries. A hedge-fund quant points out that AI misses real-world instincts and lacks deep knowledge of specific industries. It is great at breaking down reports or identifying patterns, but it falls short in making high-conviction investment decisions. The most effective systems combine AI's ability to analyze data fast with human decision-making. They pull out insights while keeping human judgment in charge.

To sum up, AI-based investing involves a few main steps:

- Collecting a mix of structured and unstructured data.

- Using machine learning to detect signals and hidden patterns.

- Automating portfolio creation and ongoing adjustments, ranging from robo-advisors to systems that use multiple agents.

- Employing explainable AI to ensure both clarity and trust.

- Recognized that AI complements human understanding but cannot take its place.

These combined tools give investors the ability to use data-backed insights without analyzing charts or scanning through news. It brings simplicity, ease, and new potential to the world of modern investing.

Why Beginners Find AI Investing Attractive — Those Who Avoid Charts

New investors often feel lost trying to make sense of shifting charts, complicated financial terms, and endless news updates. Tools that use AI tackle these issues head-on making investing feel simpler, more logical, and easier to approach.

1. Let Go of Emotional Decisions

Emotions can trip up beginners. Many panic-sell or impulse-buy leading to poor choices. AI systems stick to data, probabilities, and models to make decisions. Whether it's a trading bot or a robo-advisor, AI relies on patterns and facts, not fear or overconfidence.

2. Quicker and Smarter Choices

AI works fast as well as . It examines huge amounts of data to find trends in sentiment financial reports, or irregularities in markets in no time. For anyone who doesn’t want to spend hours watching tickers or reading news updates, this can make a huge difference.

3. Nonstop Stock Tracking

Stock markets run all the time, and AI tools do not take breaks either. They keep an eye on stocks day and night identifying chances and taking action even while investors are offline or sleeping. This reliability opens up opportunities for beginners in a way traditional methods don’t.

4. Built-In Systems to Handle Risks

AI tools often come with built-in controls to reduce risk. Features like stop-loss rules or portfolio rebalancing are common. They run countless tests, like checking past market crashes or sudden price jumps, to handle risks before they happen. This kind of advanced management is hard to find among beginner investors.

5. Bringing Pro Tools to Everyone

Not long ago advanced analytics powered by AI were within the reach of hedge funds or very rich individuals. Today, tools like robo-advisors, AI filters, and smart ETFs allow everyday people to have access to these features at a much lower price.

6. Designed to Educate

AI-first platforms include built-in explanations. They simplify things by breaking down why they picked a stock, highlighted a risk, or made changes to a portfolio. This kind of feedback lets users pick up knowledge over time without needing to dig into complex reports.

AI investing offers a strong choice to avoid deciphering charts or keeping up with market updates. It's fast, neutral, automated, and secure. It also provides tools that used to be exclusive to professionals in a way that's easy to understand and doesn't need expert financial knowledge.

Why AI Isn’t Enough and the Role of Trust

AI offers incredible capabilities, but it still doesn’t match the instincts and intuition human investors rely on. Gappy Paleologo, a seasoned quant at Balyasny Asset Management, explained on Bloomberg’s “Money Stuff” podcast that tools like ChatGPT lack the practical real-world insights necessary to make bold investment choices. They fail to grasp the subtle details you pick up through direct talks visiting factories, or engaging with company leaders.

Developing intuitive insight matters most when making risky or unusual investment decisions. Paleologo explained, “an investor has a different experience of a company than an LLM”, highlighting that while AI can summarize reports , it cannot replicate the expertise and gut feeling of a skilled investor.

A big concern with many AI models is their “black box” design, which lacks clear logic. This can make users uneasy about trusting their recommendations. Explainable AI, or XAI, has come up to address this by providing tools like SHAP values, feature importance, and partial dependency plots to show how decisions are made. In the finance world, explainability is not optional. EU regulators under GDPR demand it, and companies use it to establish trust and tackle bias.

XAI has its flaws. It leaves AI systems open to risks. Sharing the logic can allow others to reverse-engineer or exploit it. Making sense of complex models remains a challenge. Experts may see the explanations as too basic. At the same time, beginners struggle with unfamiliar terms.

AI systems also bring larger risks. Finance Watch highlighted how opaque models without strict oversight might harm financial stability. Depending too much on these models can lead to overconfidence. This is true when AI users or providers overlook operational or legal loopholes.

Some companies are finding a balance between people and algorithms. AQR, a quant hedge fund managing $136 billion, has shifted more decision-making to algorithms. Co-founder Cliff Asness mentioned it is tricky to justify gains to investors when markets are down. This shows a clear compromise: machines bring efficiency, but understanding their reasoning gets harder.

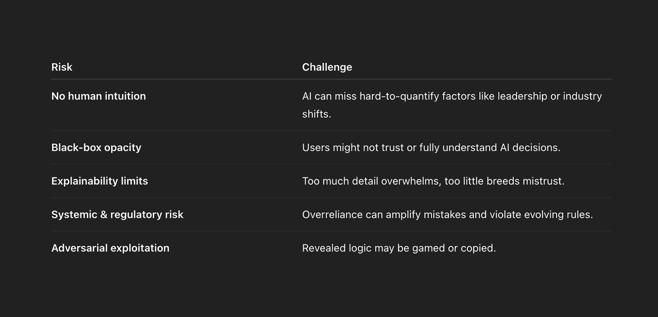

Important Risks to Watch Out For

AI provides efficiency, size, and organization, but it misses intuition and context that human investors contribute. Clear explanations can help address trust issues, but regulations and strict monitoring are critical. The best systems combine AI's data processing with human judgment instead of replacing one with the other.

Exploring Big Ideas and Future Possibilities

Using AI in investing isn't just about clicking "buy" or "rebalance". It marks a major change in how people connect with financial markets today.

AI Brings New Ways To Shape Investment Plans

AI is creating big changes in basic investment strategies. It has moved past the old-fashioned 60/40 stock and bond breakdown. Algorithms now use extra kinds of data like sentiment analysis, resource usage, and business spending patterns to build portfolios.

This change means investors no longer stick to strict traditional rules. Instead, portfolios adjust in real-time based on the latest data in areas where AI investment is growing fast.

Blending Human Judgment With Smarter AI Systems

The top platforms in the future won’t rely on automation. Hybrid systems that mix automated investment tools with human input to offer tailored advice will likely lead the way. Over 60 percent of revenue in the robo-advisory space already comes from these hybrid options. Even retail investors are expected to adopt them more as time goes on.

Leading financial players like Morgan Stanley and Deloitte estimate that by 2027 80 percent of retail investors will depend on AI-based tools. This shift is merging the gap between do-it-yourself strategies and the services of traditional advisors.

Agentic AI: Your Chatty and Forward-Thinking Advisor

AI is shifting from basic robo-advisors to more advanced tools called agentic assistants. These systems hold conversations, understand what users want, adjust their plans , and might even suggest trades. People can chat with them to get advice about managing their taxes better, spot risks, or balance their investments.

Bias, Clarity, and Trust

As AI takes on bigger roles keeping it clear and understandable matters more. Tools like explainable AI (XAI) use things like feature-importance reports to clarify why algorithms make their choices. In areas like finance, regulators are starting to demand this kind of transparency.

But there’s a fine line to watch. Showing too much transparency might open the door to misuse, while showing too little can erode trust. Good platforms should find a middle ground—open enough but with careful protections in place.

Exploring Opportunities: Private Markets, ETFs, and Thematic Strategies

AI goes beyond stocks. It lets funds and firms analyze private investments like equity, credit, and ETFs that focus on robotics or AI themes. These tools give investors a chance to participate in emerging markets and industry shifts with greater assurance.

AI’s Role in Investment Trends and the Risk of Overhype

Big investors believe AI is bringing in a major tech wave similar to what PCs and cloud computing did before. Coatue Management, which handles $55 billion, expects AI's market share in the US to rise — moving from less than 50 percent to around 75 percent of market value over time.

However financial experts caution against making impulsive decisions out of fear of missing out. They highlight the risk of overhyped markets and advise a mix of strategies. While investing in fast-growing areas like AI and robotics, they suggest adding steady, dividend-earning investments to balance portfolios.

Key Thoughts

AI-focused investments will depend on five main strategies:

- Adaptive portfolios — using AI technology and company spending data to make decisions in real time.

- Hybrid models combine automated processes with the option to include guidance from humans when needed.

- Agentic advisors use conversational interfaces to step in and act on your behalf.

- Trust frameworks emphasize creating systems that explain decisions while ensuring AI design prioritizes security.

- Diverse asset exposure involves using AI to explore areas like private markets, specialized ETFs, and alternative data strategies.

Beginners can use these tools to gain access to professional-quality resources without needing to master charts or keep up with news. It is important to pick platforms that are open, well-balanced, and use human‒AI teamwork.

Tips for Beginners: Picking and Using AI Investing Tools

If you are new to using AI to invest, picking the right tool and knowing how to use it well can make a huge difference. Here is what you should do to get started the right way:

1. Pick Tools That Offer Clarity and Transparency

Start by exploring platforms with a focus on Explainable AI (XAI). These should give you clear reasons behind the decisions they make through simple visuals, quick explanations, or basic feature highlights. Clear insights into how decisions happen prevent “black-box” systems and help you trust the tool.

2. Go For Systems That Combine AI with Human Input

Platforms mixing algorithm analysis with guidance from a human expert, like a financial advisor or reviewer lower algorithm tolerance. Studies reveal people feel more confident in hybrid advice than in recommendations made by AI. This approach combines AI-driven insights with the understanding and judgment of humans.

3. Try Easy and Popular Apps First

Start by using well-known apps such as ones providing smart tips, beginner-friendly robo-advisors, or AI-driven chat tools. These options are structured to become a good choice for new users and carry less risk. You can find platforms that simplify market information and suggest steps like "rebalance", "buy", or "hold."

4. Check Security, Regulation, and Compliance

Ensure your platform meets financial rules and safeguards user data. Transparency and compliance now play a major role in AI-powered fintech firms as new laws like the EU AI Act and US data rules keep evolving.

5. Start Small, Monitor, Adapt, and Improve

Put a little money in to test how the AI operates. Watch how it reacts to market changes and see if its reasoning checks out. This approach lets you gain trust in its logic and operations before going bigger.

6. Spread Out Across Tools or Methods

Don't depend on just one AI platform. Various tools pull from different models and data. Some emphasize sentiment trends while others track risks. Using multiple tools can reduce biases or gaps from any single system.

7. Keep an Eye on Oversight

Even with AI managing things, stay involved. Take time to review results, ensure the allocations align with what you aim for, and step in when adjustments are needed. AI should enhance your decisions, not take them away.

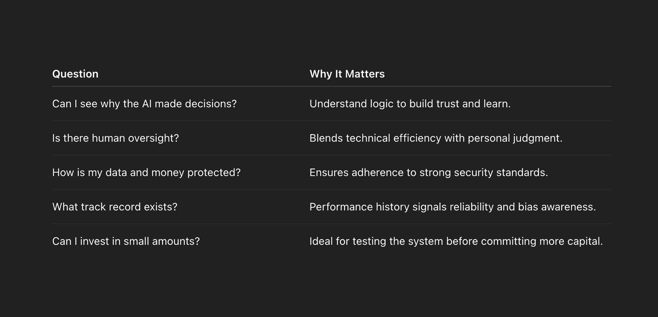

Questions to Ask Before Signing Up

When you pick AI platforms that stay transparent, follow rules that work well for beginners, and mix automation with control, you get access to smart automated strategies without learning charts or keeping up with the news. Begin with small steps, understand how AI operates, watch how it performs, and build your trust. This steady method lets you use AI's abilities while keeping control over your financial path.

What Lies Ahead — The Future of AI and Investing

AI-driven investing is advancing bringing new trends that are changing how people interact with financial markets.

One key development is agentic AI taking the spotlight. These systems do more than follow instructions — they make plans, take action, and adjust on their own. By 2027 about 50 percent of companies aim to try out agentic AI pilots. This change means robo-advisors will shift into independent helpers. They will predict needs, fine-tune investment portfolios, and handle trades by having conversations.

Second, AI is causing a shift in how portfolios are built. Strategies powered by AI now use less typical data such as changes in corporate AI spending, energy-related infrastructure, and private market trends, to create adaptive portfolios. These methods question old-school setups like the 60/40 stock and bond split and force investors to track signals beyond the usual ones.

Third, making AI transparent and easy to understand is turning into a crucial need. The Explainable AI market is expected to grow to almost $10 billion by 2027 and shows an annual growth rate of 20 percent. AI in financial services will focus more on providing clear traceability. These systems will show users the reasons behind their recommendations to address trust issues and meet rules set by regulators.

Governments are making rules stricter. In the EU, US, and UK, they are creating new policies to make sure AI in finance follows fair practices, keeps data safe, and remains accountable. These regulations will have an impact on how companies use AI by focusing on better governance, stronger risk management, and greater clarity.

AI markets have huge room to grow. Experts predict that global markets for AI agents and financial XAI will rise by 20 to 45 percent every year. By the end of the decade, they may be worth tens of billions. Real-world changes also reflect this trend. Morgan Stanley believes platforms powered by AI will lead in retail investing soon. Meanwhile, startups and financial tech companies are working hard to shape the future of investment tools.

What This Means for You

- Prepare to see AI advisors get smarter. They will understand better, adjust to users, and act on decisions.

- Focus on tools that prioritize explainability and compliance rather than looking appealing.

- Get ready to explore portfolios influenced by alternative and real-time inputs moving beyond just price data.

- Know that AI systems and laws will grow together requiring more openness and stronger monitoring.

To sum it up, the future of AI investing revolves around independence, understanding, and reliability. While looking at AI-driven platforms, focus on those offering more than just automated tools. Look for ones that provide transparent thinking, ethical protections, and practical awareness.

Conclusion

AI helps make investing easier and more available to everyone. People no longer have to study stock charts or keep up with financial updates to make smart choices. Now, AI gives a way to explore the market using automation, clear signals, and fact-based insights even without advanced skills.

This change matters because AI makes things less overwhelming for new investors. It turns tricky steps into simpler ones, takes emotions out of decisions, and provides plans shaped around your risk level. Plus when platforms combine AI with human input and explain how they work, they create the trust people need to feel secure using them.

AI investing in the future leans toward greater independence. Agentic AI tools now act faster, adjust smarter, and align better with your goals moment by moment. This level of ease though, brings a need to stay responsible. You still have to grasp the basics of its workings, stay engaged, and know when human decisions are needed.

At the core, AI doesn't take over — it helps you. It creates a way to invest without the fear of missteps. This opens up investing to more people giving them the chance to handle markets with clearer choices and better control. The smartest approach is to begin with small steps, learn as you go, and adapt alongside the tech.а

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024