14 Apr 2025

14 Apr 2025Mastering Stop Orders: How Pro Traders Manage Risk Like a System

Managing risk is what separates lucky trades from real strategy. And when it comes to risk management, stop orders are every smart trader’s first line of defense.

This guide breaks down how stop orders work, why they matter, and how professionals use them to protect profits and trade with confidence — no matter what the market throws their way.

Why Smart Traders Use Stop Orders

Stop orders are one of the most important tools for protecting your capital and managing risk in crypto trading. They help remove emotions from the process and keep you focused on your strategy — not market noise.

When placed correctly, stop orders automatically close or open a trade at a specific price level, helping you avoid big losses or catch important breakouts.

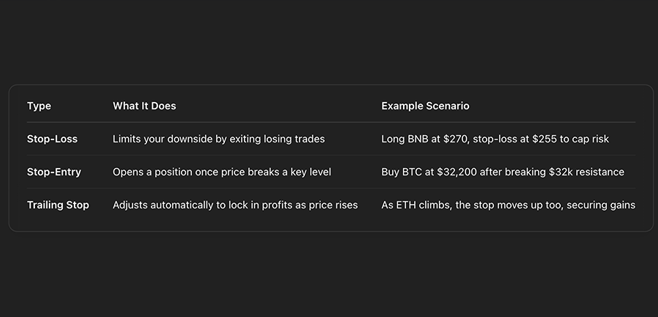

- Stop-Loss Order: Closes your position to limit losses if the price moves against you.

- Stop-Entry Order: Opens a new trade when price breaks a key support or resistance level.

- Trailing Stop: Follow the market as the price moves in your favor — locking in profits while still giving room for growth.

Tips for Placing Smarter Stop Orders

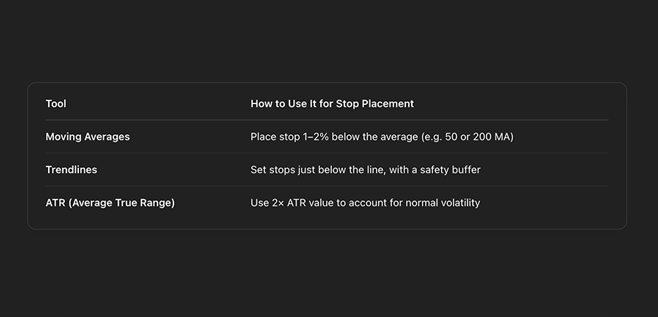

- Always use technical analysis: look at support and resistance zones, moving averages, or volatility indicators like ATR.

- Don’t place stops too close — minor price moves could knock you out early.

- Avoid “obvious” stop levels where most traders place their orders — market makers love to hunt those zones.

Stop Orders = Discipline + Control

Stop orders aren’t just about limiting losses — they’re a core part of building consistent, sustainable trading habits. In a fast, unpredictable market like crypto, having a clear risk management plan is what separates professionals from amateurs.

Stop Order Fundamentals: What Every Trader Should Know

Stop orders are automated trading tools that help you stick to your plan — even when the market gets wild. When price reaches a predefined level, a stop order turns into a market order and executes immediately at the best available price. That means no need to sit and stare at charts all day.

The best part about stop orders? They trade for you — so you don’t have to watch every tick.

Let’s break down the core types of stop orders and how they work in real-world trading.

Main Types of Stop Orders and Their Purpose

Why Market Conditions Matter

Stop orders aren’t magic — their effectiveness depends on market context.

- Volatility: During fast price moves, the final execution may differ from your stop level. That’s called slippage, and it’s common in crypto.

- Liquidity: Thin markets can cause poor fills or delayed execution. Trade assets with high volume and tight spreads.

- Exchange Behavior: In rare cases, some platforms may disable stop orders during extreme volatility. Know your exchange’s policies.

Bottom line? Plan for the worst — and use tools that give you better control.

How to Place Smarter Stop-Losses

A stop-loss shouldn’t be a guess. It should be placed with technical logic, balancing protection with breathing room.

Tools for Strategic Stop Placement

Mistakes to Avoid When Using Stop-Losses

- Too Tight: Don’t crowd your stop near the entry. Give the trade room to play out.

- Static Thinking: Fixed stop levels don’t adapt. Use trailing stops in trending markets.

- Emotional Tweaks: Never move a stop just to “hope” it works. That’s not strategy — that’s gambling.

- Obvious Zones: Placing stops exactly at support or resistance invites stop-hunting. Add a small buffer.

Example:

In 2020, smart gold traders placed their stop-loss just below the $1,900 resistance — not right on it. That small buffer protected them from short squeezes while still riding the breakout.

Stop-losses are your seatbelt — not your parachute. Use them wisely, based on structure, volatility, and your own risk tolerance.

Trailing Stops: The Smart Way to Let Profits Run

Trailing stops are like having a dynamic safety net under your trade. Instead of using a fixed stop-loss, trailing stops move along with the price when the market works in your favor — locking in profits while still giving the trade room to grow.

They’re one of the most flexible risk management tools in any trader’s toolkit — perfect for catching big trends without watching your screen 24/7.

How Trailing Stops Work

- As the price rises, your stop-loss rises with it.

- If the price drops by a set amount or percentage — the stop triggers and closes your position.

- If the price keeps climbing — the stop keeps following, locking in more profit.

Simple. Effective. And very smart.

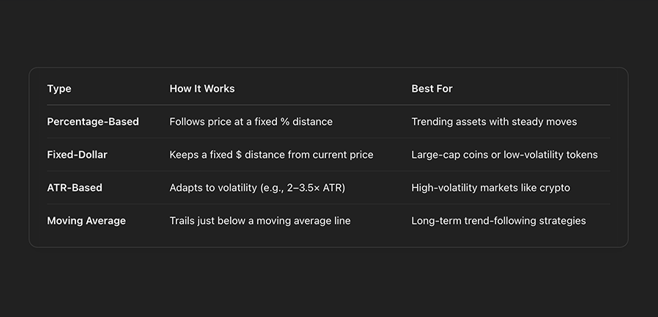

Popular Trailing Stop Methods

Choosing The Right Trailing Stop Distance

Setting your trailing stop too close? You risk getting kicked out early.

Too far? You might leave money on the table.

Here’s what to consider:

- Market Volatility: Higher volatility = wider trailing stops. Use ATR (Average True Range) to measure it.

- Time Frame: Short-term trades = tighter stops. Swing or position trades = more breathing room.

- Trend Strength: Strong trends tolerate wider stops for bigger moves.

- Risk Tolerance: Balance between protecting gains and letting the trade develop.

Quick Example: Crypto in Action

Let’s say you bought ETH at $3,000.

- ATR shows average daily volatility of $100.

- Using a 3× ATR trailing stop = $300.

Your trailing stop stays $300 below ETH’s highest price as long as the trend continues. If ETH climbs to $3,500 — your stop is now at $3,200. If ETH falls back — you’re out with a solid profit.

Pro Tip from RateX Network

-

Trailing stops work best when combined with trend confirmation tools like moving averages, RSI, or volume filters.

-

Never move your stop against the logic of your system because of emotions.

-

Review your trailing stop approach regularly — the market changes, so should your strategy.

Pro Stop Order Techniques: Advanced Risk Management Strategies

When your trading approach moves beyond the basics, stop-loss management becomes more flexible and strategic. Here are powerful techniques professional traders use to control risk while maximizing profit potential.

Partial Stop Orders: Manage Different Parts of Your Position

Dividing a trade into multiple parts — each with its own stop-loss level — is a smart way to stay both aggressive and protected.

- You can secure partial profits early by tightening the stop on part of your position.

- The rest of the trade can stay open longer — giving it space to catch larger market moves.

Example:

A trader who enters a short position on BTC at $27,450 might set a tight 2% stop-loss at $28,000 for part of the trade — while leaving the remaining portion to follow a wider trailing stop.

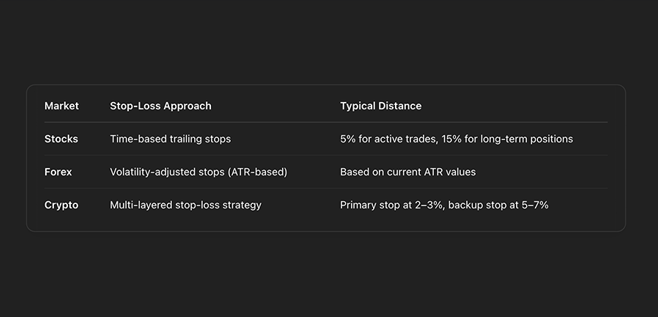

Market-Specific Stop-Loss Tactics

Your stop-loss strategy should always fit the market you’re trading. Different assets behave differently — and your risk management should reflect that.

"Avoiding losses is more important than chasing extra gains."

— Benjamin Graham

Conclusion

Stop orders are one of the simplest — yet most powerful — tools for managing risk in crypto trading. They give traders structure, discipline, and protection in a world where markets move fast and unpredictably.

Research shows that nearly 80% of beginner short-term traders leave the market within two years. And the main reason isn’t bad entries — it’s bad risk management.

Automating your stop orders removes emotions from trading decisions and helps protect your capital from unexpected losses.

Key Takeaways for Smart Stop Order Placement

- Use technical analysis to guide your stop-loss levels.

- Avoid placing stops at obvious round numbers where everyone else does.

- A good rule of thumb: place stops at 1.5× the average price range of recent candles to avoid being stopped out too early.

- Combine stop orders with technical analysis and volatility awareness to stay ahead of the market.

“Every battle is won before it is fought.”

— Sun Tzu

Success in trading doesn’t start with finding the perfect entry — it starts with building a solid exit strategy.

That’s what stop orders are for.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024