Published: 11 Nov 2025

Multi-Chain Expansion: The New Competitive Frontier

The stablecoin market in 2025 has outgrown single-network dominance.

It’s no longer just about which issuer mints the most tokens — it’s about which blockchain holds the liquidity.

Ethereum and Tron still account for the majority of circulating supply, but their grip is slipping.

New players like Solana, Base, and Arbitrum are taking over transaction volume, wallet activity, and DeFi integration.

These chains combine low-cost transfers with native support for USDC and USDT, drawing users and liquidity from older networks.

The result is a multi-chain stablecoin economy, where digital dollars move seamlessly across ecosystems.

In this environment, liquidity migrates not by chance but by efficiency, compliance, and composability.

This report examines how stablecoin supply is now distributed across chains, where liquidity is flowing, and why cross-chain infrastructure has become the next competitive frontier.

Key Takeaways — Stablecoins Go Multi-Chain

By 2025, stablecoins have become natively multi-chain assets.

Issuers, users, and protocols now treat blockchain choice as a business decision rather than a technical constraint.

-

Five networks — Ethereum, Tron, Solana, Base, and Arbitrum — now host over 95% of total stablecoin supply.

-

Tron’s share continues to decline, as capital migrates to more transparent, regulated, and DeFi-friendly ecosystems.

-

Layer-2 chains like Base and Arbitrum have grown into full liquidity hubs, backed by native USDC issuance.

-

Solana’s speed and micro-fee structure make it a prime network for payments and retail transactions.

-

Cross-chain infrastructure — Wormhole, LayerZero, and Axelar — enables stablecoins to move seamlessly between ecosystems.

The competitive advantage has shifted.

Where once dominance came from issuance size, now it depends on execution speed, composability, and user access.

Stablecoins no longer belong to one chain — they belong to the networks that make them move fastest and cost least.

Supply by Chain — The New Distribution Map

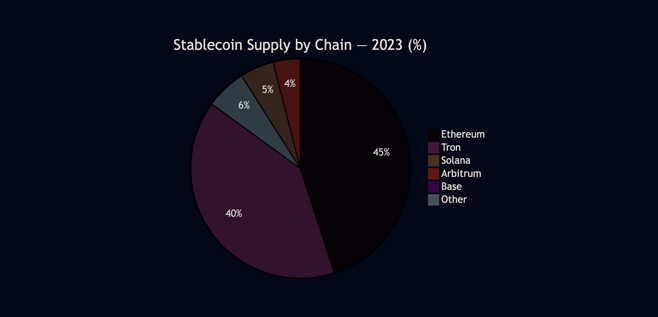

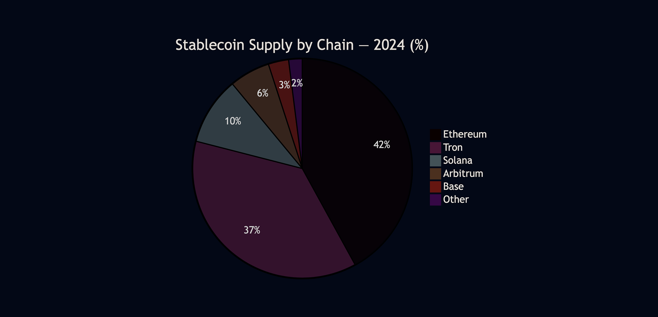

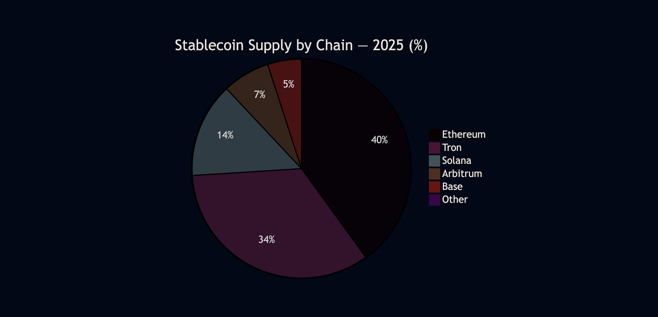

Two years ago, Ethereum and Tron together held more than 80% of all circulating stablecoins.

Today that number has fallen below 75%, as liquidity spreads to Solana, Base, and Arbitrum.

This marks the most significant geographic shift in the stablecoin market since 2020.

Ethereum remains the anchor of institutional liquidity — home to DeFi protocols, treasuries, and long-term holders.

Tron, while still strong in emerging-market payments, is losing share as users seek better on-chain integrations.

Meanwhile, Solana has become the fastest-growing chain for stablecoin transactions, and Base has quickly gained ground thanks to Coinbase’s direct USDC support and ultra-low fees.

Arbitrum continues to dominate Layer-2 DeFi activity, becoming a preferred network for high-volume trading and yield markets.

The chart below visualizes how stablecoin distribution has evolved between 2023 and 2025.

Stablecoin Supply by Blockchain (2023-2025, %)

Insight

Stablecoin supply has turned into a multi-chain barometer for network competitiveness.

Each chain’s share now reflects not only liquidity depth but also ecosystem maturity and regulatory readiness.

As users move where transactions are faster and cheaper, stablecoins are becoming the ultimate measure of blockchain utility.

Liquidity Flows — From Tron to Layer-2

From 2023 to 2025, one of the most dramatic shifts in the stablecoin landscape happened quietly — liquidity left Tron and moved to Layer-2 networks.

What began as small experimental transfers became a structural migration of billions of dollars in circulating supply.

Tron, once the low-cost settlement hub for USDT transfers across Asian exchanges, started losing appeal as regulatory scrutiny increased and Layer-2 networks on Ethereum offered faster, cheaper, and more composable alternatives.

Meanwhile, Base and Arbitrum attracted institutional flows and DeFi liquidity, while Solana captured retail payment activity with near-zero transaction fees.

By late 2025, over $25 billion in stablecoin liquidity had moved off Tron into Layer-2 and Solana ecosystems.

This redistribution has not only changed transaction geography but also reshaped where yield and liquidity mining opportunities emerge.

Stablecoin Liquidity Migration (2023-2025, $B)

| From Chain | To Chain | Estimated Flow ($B) | Main Drivers |

|---|---|---|---|

| Tron | Base | 10.5 | Low fees, direct Coinbase USDC issuance |

| Tron | Arbitrum | 7.8 | Deep DeFi liquidity pools |

| Tron | Solana | 6.9 | Payment integrations and speed |

| Ethereum | Base | 5.3 | Scalability and institutional access |

| Polygon | Arbitrum | 2.1 | Yield-focused capital rotation |

Insight

This liquidity migration reveals a new hierarchy among blockchain ecosystems.

Where Tron once dominated through simplicity and cost, Layer-2 scalability and composability have become stronger incentives for stablecoin holders.

Liquidity is now fluid — it goes where regulation, fees, and ecosystem maturity align best.

Interoperability — The Cross-Chain Race

As stablecoins spread across ecosystems, seamless movement between networks has become essential.

In 2025, interoperability isn’t an experimental feature — it’s a core layer of liquidity infrastructure.

Protocols like Wormhole, LayerZero, and Axelar are now the backbone of stablecoin mobility.

They allow USDC, USDT, and other tokens to move instantly between chains without relying on centralized custodians or risky wrapped versions.

This innovation turned what used to be fragmented liquidity into a unified, composable system that links Ethereum, Solana, and the major Layer-2s.

By late 2025, over 30% of all stablecoin transfers across ecosystems occur via interoperability protocols instead of native bridges.

The result — reduced friction, fewer security risks, and more capital efficiency.

Liquidity can now enter one network, earn yield or settle payments, and exit on another — all within seconds.

Cross-Chain Activity Heatmap (2025)

| Network | Inflows (USDC) | Outflows (USDT) | Bridge Protocols Used | Dominant Use Case |

|---|---|---|---|---|

| Ethereum | +12.3 B | -10.1 B | Wormhole, LayerZero | DeFi collateral |

| Tron | -18.7 B | +1.2 B | Native bridge | Exchange liquidity |

| Solana | +8.5 B | +2.7 B | Wormhole, Axelar | Payments & settlement |

| Arbitrum | +6.2 B | -2.1 B | LayerZero | Yield & trading pools |

| Base | +9.8 B | +3.0 B | Native USDC, LayerZero | Retail & commerce |

Insight

Cross-chain messaging has become a strategic advantage in the stablecoin market.

The networks that enable smooth, secure movement of capital are winning the competition for liquidity.

Interoperability is no longer a technical experiment — it’s the foundation of the multi-chain economy.

Methodology & Sources

This research combines on-chain data from Artemis, DefiLlama, and Nansen with official transparency reports from Circle, Tether, and Paxos.

Liquidity flow estimates are derived from bridge contract analytics and LayerZero / Wormhole dashboards, adjusted for duplicate transfers and cross-chain mint events.

Stablecoin supply data was aggregated across Ethereum, Tron, Solana, Arbitrum, and Base using weighted averages of total circulating supply between Q1 2023 and Q4 2025.

Network activity and inflow/outflow metrics were verified via block explorer datasets, CoinMetrics node feeds, and DefiLlama TVL distributions.

All cross-chain heatmap figures represent gross token movements, not net positions, to better reflect network throughput.

Data accurate as of early November 2025, based on verified public disclosures and on-chain metrics.

Conclusion — Networks Compete for Stablecoin Liquidity

The stablecoin market has entered its most competitive phase yet.

Instead of fighting for issuance dominance, blockchains are now competing for liquidity retention and transaction relevance.

Ethereum continues to serve as the primary settlement layer for institutions and DeFi, but the frontier has clearly shifted.

Tron’s transactional monopoly is eroding, while Layer-2 ecosystems and Solana are capturing users through speed, affordability, and native integrations.

This migration signals a deeper transformation — one where stablecoins act as the currency layer that binds otherwise fragmented ecosystems together.

Interoperability protocols have made these movements seamless, allowing value to flow to the most efficient environment in real time.

Liquidity no longer belongs to a single chain; it belongs to the networks that interconnect best.

As stablecoins evolve into programmable, borderless capital, the contest between chains is no longer about ideology or branding — it’s about performance, composability, and trust.

The multi-chain future is not a prediction; it’s already here, powered by the movement of digital dollars.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024