Published 17 Feb 2025

RateX Fundamental Screening: A Smarter Way to Monitor Crypto Assets

RateX.AI delivers real-time insights into the ever-evolving crypto market.

Our system continuously retrieves fresh data from multiple exchanges via APIs, ensuring up-to-the-minute accuracy. This raw data undergoes advanced processing, including rigorous cleaning and verification, to maintain its integrity.

With a robust selection of meticulously validated metrics across numerous crypto assets, RateX.AI provides a reliable foundation for data-driven decision-making in the crypto space.

We offer a comprehensive selection of metrics across numerous crypto assets, all subjected to rigorous validation processes.

In this article, we introduce RateX Fundamental Screening — a powerful tool that aggregates data from all tokens across multiple chains. By consolidating vast amounts of on-chain information into a single, easy-to-navigate platform, we simplify crypto monitoring, even for experienced users.

The RateX Fundamental Screening aggregates data of all tokens across multiple chains, providing an all in one place for monitoring cryptocurrencies as On-Chain Information can be overwhelming even for the most experienced crypto users.

We have created a unified dashboard to help our users gain a better understanding of the market liquidity with fundamental information including:

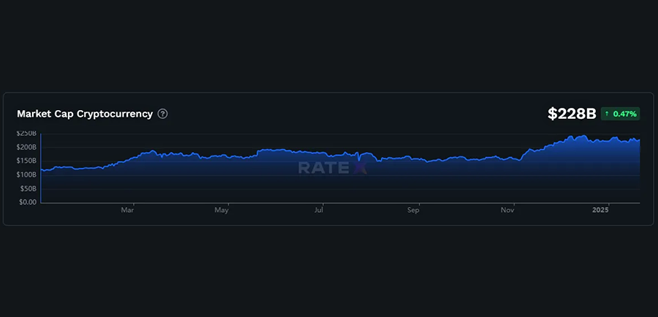

- Market Capitalization: Track the total value of tokens in circulation.

Market capitalization of the network based on circulating supply.

Market capitalization = current price of tokens on the network circulating supply of these tokens on the network.

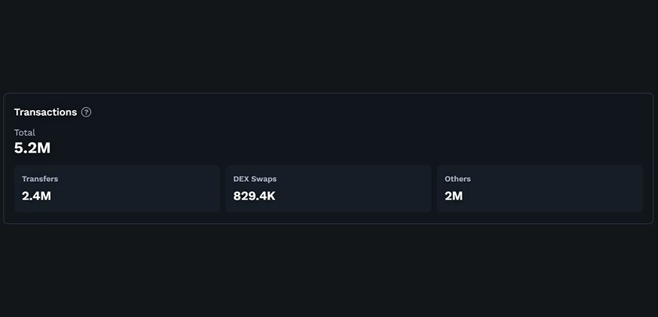

- Transaction: Activity of token transfers, DEX swaps, and other transaction types.

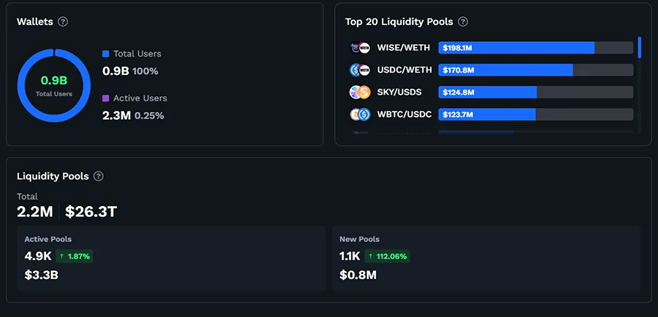

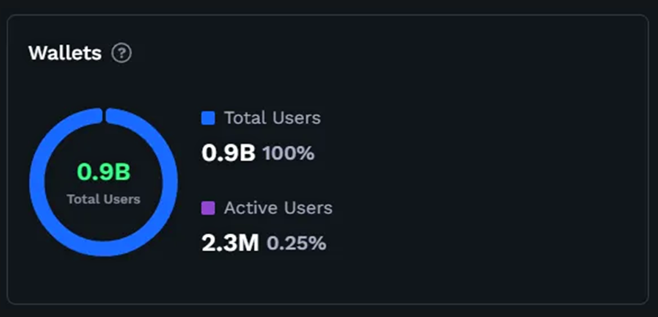

- Wallets: Detail information on wallet activity, including the number of total and active users.

Total users - the total number of wallet addresses. Active users - number of addresses with token transfers

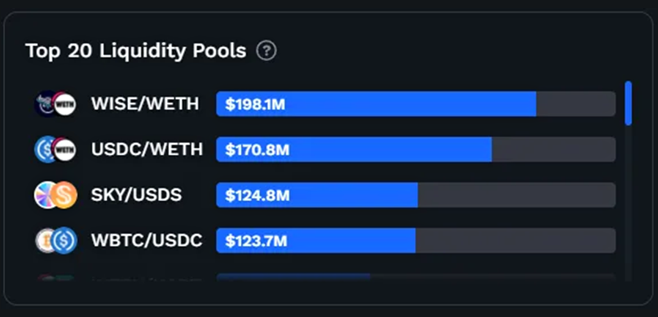

- Top 20 Liquidity Pools: Monitor the most liquid pools, along with broader liquidity pool data.

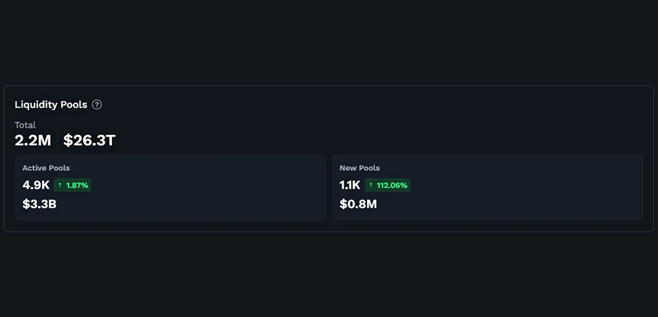

- Liquidity Pools: The Liquidity Pools widget provides key insights into the overall liquidity available in the ecosystem. It displays critical metrics such as the total number of pools and their combined Total Value Locked (TVL), reflecting the depth of liquidity.

The widget also tracks active pools, showing their current count, value, and percentage change, offering insights into ongoing market participation. Additionally, it highlights the number of newly created pools, along with their growth rate and value, helping users stay informed about emerging opportunities in the DeFi space.

TVL (Total Value Locked) - the amount of assets in the pool ($), TVL = number of token 1 * token 1 price + number of token 2 * token 2 price, etc.

We have also made a dedicated separate dashboard for each support chain on RateX as the Fundamental Explorer, providing a granular view of the network’s activity.

An exclusive feature is the Circulation Distribution, offering a breakdown of token holders, smart money wallets, smart contracts, and other important wallet categories.

Conclusion

By consolidating essential on-chain data into a single, easy-to-navigate platform, RateX.AI simplifies crypto analysis for both newcomers and seasoned investors. As the market evolves, we remain committed to refining our methodologies and expanding our insights to keep you ahead of the curve.

Read More

Get RateX Pro

Get RateX Pro

14 May 2024

14 May 2024