01 Feb 2026

01 Feb 2026RateXAI: Remove The Noise. Take Back Control. Turn On-Chain Trading Into An Engineering Discipline

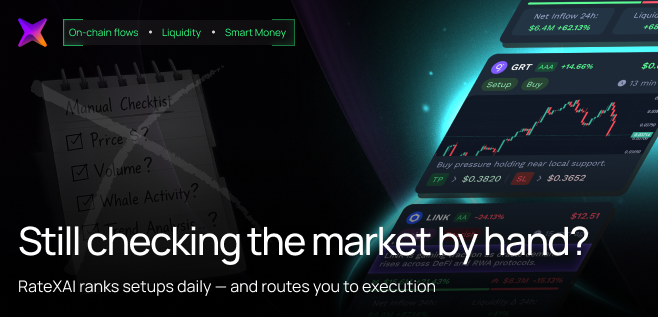

Web3 has grown faster than the tools available to the people making decisions in it. The market has gone on-chain, the speed has become extreme, and the main resource of any trader or analyst — attention — constantly burns out in the noise. You can be smart, experienced, and disciplined, and still lose money — because entries and exits are often determined not by logic, but by information overload, liquidity manipulation, and delayed reactions. There is no single standard of risk here. “Signals” are sold as belief. There are too many tabs — and too little certainty that you’re seeing reality.

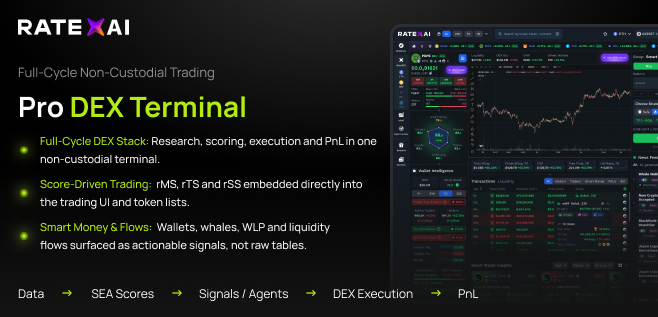

We built RateXAI as an answer to this. Not as another chart. Not as just another “terminal with features.” But as a DEX trading browser — a single space where the market is broken down into clear entities and actions:

What’s happening → What’s the risk → What to do → How to execute → What resulted.

Inside is a full-cycle system: on-chain terminal, non-custodial wallet, institutional APIs, InfoFi Intelligence, AgenticAI, and most importantly — the Risk Algorithmic Scoring (RAS) Engine, which turns chaos into a system.

We built a stack that usually takes years and millions

Over 3 years, we didn’t “build a concept.” We invested about $1.5M (including $1M of our own funds) and built an independent infrastructure: our own indexers, full-history/real-time pipelines, a proprietary Data Lake of indexed on-chain and off-chain data, and engines for scoring and agentic processes. This is not “integrations for the sake of integrations.” It’s the foundation for a product that doesn’t fall apart under load and doesn’t depend on external limitations.

Living on this foundation is the Risk Algorithmic Scoring (RAS) Engine — a risk-control layer inspired by institutional systems that turn investing into a repeatable process. RAS uses 65+ metrics to score the market “like grown-ups”:

- Token health — token integrity and market structure

- Liquidity quality — liquidity quality and pool risk patterns

- Wallet behavior — wallet cohorts and smart money activity

- KOL/news impact — influence of calls and headlines on crowd behavior

- Mindshare momentum — attention dynamics and narrative velocity

What matters is not that “there are many metrics.” What matters is that they work as a unified risk-control system across levels — from quick trade filters to institutional due diligence. That is the difference between “signals” and a standard.

InfoFi Intelligence and AgenticAI: the market as a flow of decisions, not a flow of news

Most of Web3 is an information war for your decision. That’s why RateXAI doesn’t just “pull news and posts.” InfoFi Intelligence connects the information field with on-chain behavior: attention → actions → flows → liquidity → results. We can see where a narrative is backed by real money, and where it’s empty.

On top of that runs AgenticAI: personal agents that take your task (ticker, sector, strategy), watch the market, gather facts, assess risk through RAS, and deliver short daily digests and briefs — not endless walls of text. This is not “AI for the sake of AI.” It’s a way to give you back control over your time and the quality of your decisions.

Why this scales

DEX has already become a significant share of the crypto market and keeps growing. But the real opportunity isn’t just the trend. The opportunity is that on DEX, you can build a business that scales along three lines:

- DEX trading fees — commission on volume and execution

- Subscriptions — paid access to scoring, agents, interfaces, and filters

- B2B / Institutional — terminal, API, and datasets for funds, market makers, trading desks, and Web3 developers

We already have organic demand and a distribution network: 20,000+ users, 40,000+ monthly visitors — all without paid ads — plus an affiliate and KOL pipeline that turns the terminal itself into a growth channel.

What we’re really doing

We’re doing something simple but rare: turning the on-chain market from noise into an engineered decision-making system. With data, a risk standard, repeatable processes, and controlled execution. This kind of stack is usually locked inside top institutions. We’re making it available to the market — as a product you can open and use.

RateXAI is not a promise of a “revolution tomorrow.” It’s already a built foundation — one we’re ready to accelerate from. And we plan to accelerate fast.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024