Published: 12 Nov 2025

Regulatory Momentum: The Catalyst for Global Adoption

By late 2025, stablecoins have moved from the edge of finance to its core.

For the first time, governments around the world are not just reacting to them — they’re defining how they should exist.

After years of uncertainty, three landmark frameworks — Europe’s MiCA, the U.S. GENIUS Act, and Hong Kong’s Stablecoin Ordinance — have set the global standard for what a compliant stablecoin looks like.

These laws define reserves, audits, redemption rights, and licensing, bringing stablecoins in line with traditional payment instruments.

The result is a clear shift in perception.

Stablecoins are no longer viewed as high-risk crypto assets but as regulated digital dollars trusted by banks, fintechs, and institutional investors.

They now move billions across continents, integrated into payroll systems, remittance corridors, and e-commerce platforms — all under legal protection.

This article explores how regulation became the catalyst for global adoption, transforming stablecoins from experimental tokens into pillars of digital finance.

Key Takeaways — Regulation Turns Trust Into Growth

The 2025 wave of regulation didn’t slow the stablecoin industry — it accelerated it.

For the first time, issuers, investors, and regulators aligned around a shared framework for transparency, reserve quality, and consumer protection.

-

Europe’s MiCA, the U.S. GENIUS Act, and Hong Kong’s Stablecoin Ordinance now serve as global reference points for compliance.

-

Clear legal definitions transformed stablecoins into legitimate financial instruments rather than speculative crypto assets.

-

The total market cap grew from $190B to over $250B in less than a year following the new laws.

-

Institutional adoption surged as payment companies, fintechs, and even traditional banks entered the ecosystem.

-

The focus shifted from yield-bearing products to fully backed, payment-grade stablecoins with verifiable reserves.

These regulatory breakthroughs replaced uncertainty with trust — the foundation of every modern financial system.

Stablecoins, once driven by arbitrage and DeFi speculation, are now shaped by policy, compliance, and real-world utility.

Regional Frameworks — Three Models of Regulation

Europe: MiCA (Markets in Crypto Assets)

Europe became the first major region to implement a comprehensive legal framework for stablecoins.

MiCA requires issuers to hold full 1:1 reserves, publish regular audit reports, and guarantee redemption at face value.

It also introduces licensing for e-money tokens, effectively classifying regulated stablecoins as payment assets rather than securities.

This framework has positioned the EU as a leader in consumer protection and compliance transparency, drawing interest from global issuers seeking passported access to the European market.

By Q4 2025, Circle and PayPal had both expanded MiCA-compliant offerings across the bloc.

United States: The GENIUS Act (2025)

The Guiding and Establishing National Issuance for U.S. Stablecoins Act, passed in mid-2025 with bipartisan support, gave the U.S. its first unified stablecoin law.

The act formally recognizes fiat-backed tokens as legitimate payment instruments, sets audit and disclosure standards, and allows non-bank issuers to operate under regulatory supervision.

It prohibits algorithmic or yield-bearing stablecoins while enabling partnerships with banks and fintechs for custody and reserve management.

This combination of flexibility and oversight has already turned the U.S. into the world’s largest regulated stablecoin market by volume.

Hong Kong: The Stablecoin Ordinance (2025)

In Asia, Hong Kong’s Stablecoin Ordinance became the region’s defining piece of legislation.

Effective August 2025, it requires all fiat-referenced tokens to maintain segregated reserves, independent audits, and capital adequacy ratios similar to banks.

The first wave of license applications came from both regional exchanges and global issuers like Tether and Circle.

With its strict but clear approach, Hong Kong has become a regulatory hub for Asia’s digital payment systems, bridging Western and Eastern frameworks.

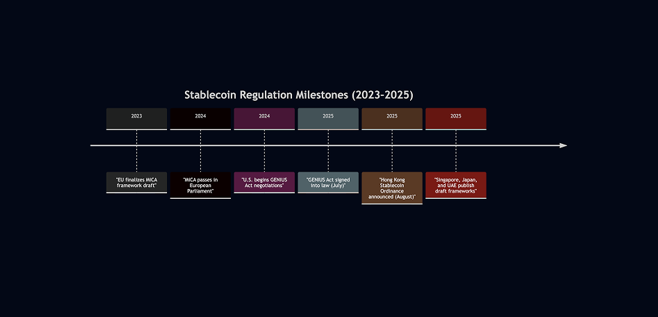

Global Timeline — 2023–2025

Between 2023 and 2025, stablecoin regulation evolved from fragmented drafts to full legal frameworks across major economies.

Each step on this timeline marked a shift from speculation to structure — and from uncertainty to adoption.

Insight

By late 2025, more than 20 countries had adopted or drafted specific stablecoin laws.

For the first time, global regulators are converging on similar principles — full backing, transparency, and redemption assurance.

This convergence has created the conditions for interoperable, cross-border payment systems, where regulated stablecoins can operate safely across multiple jurisdictions.

Market Impact — Regulation as a Growth Catalyst

The arrival of formal regulation didn’t limit stablecoin activity — it unlocked a new phase of growth.

Once compliance standards were clear, institutional participation accelerated across all major regions.

Following the rollout of MiCA in Europe and the GENIUS Act in the U.S., the combined market capitalization of regulated stablecoins rose from $190 billion in early 2024 to over $250 billion by Q4 2025.

Liquidity deepened across centralized exchanges, while on-chain transaction volumes surged, particularly for USDC, PYUSD, and FDUSD, which fully comply with new disclosure rules.

The introduction of licensing also brought traditional finance closer to blockchain infrastructure.

Banks and fintech firms can now issue or hold stablecoins under the same legal protection as other payment assets — a development that bridges crypto-native liquidity with regulated financial rails.

In parallel, businesses have begun using regulated stablecoins for payroll, supplier payments, and cross-border settlements.

The regulatory green light turned stablecoins from speculative instruments into foundations of real-world payment infrastructure.

Regulatory Coverage Map (2025)

| Region | Framework | Legal Status | Implementation Year | Key Impact |

|---|---|---|---|---|

| Europe | MiCA | Fully enacted | 2024-2025 | Licensing, audit, and reserve compliance |

| United States | GENIUS Act | Passed | 2025 | National payment standard for fiat-backed tokens |

| Hong Kong | Stablecoin Ordinance | Enforced | 2025 | Issuer licensing and capital requirements |

| Singapore | Draft in progress | Pending | 2026 | Integrates with fintech regulatory sandbox |

| Japan | Draft in progress | Pending | 2026 | Aligns stablecoins with e-money and banking laws |

Insight

The data shows a clear trend: where regulation exists, liquidity concentrates.

Markets with legal clarity are seeing higher transaction growth, stronger institutional engagement, and lower redemption volatility.

Regulation has turned stability into the most valuable competitive advantage in the stablecoin sector.

Methodology & Sources

This report combines verified data from Circle, Tether, Paxos, and PayPal transparency statements with legislative documentation from the European Parliament, U.S. Congress, and Hong Kong Monetary Authority (HKMA).

Market figures are derived from aggregated on-chain metrics via Artemis, DefiLlama, and Nansen, segmented by jurisdictional compliance status.

The timeline of regulatory milestones was constructed using public databases from RegRadar, Deloitte, and Chainalysis Policy Tracker, cross-referenced with regional government announcements and law texts.

All adoption and market impact estimates were modeled using transaction data and total circulating supply growth between 2023 and 2025.

Data classification was based on three categories — regulated, semi-regulated, and unregulated stablecoins — to assess how new legal frameworks affected capital concentration and liquidity distribution.

Data accurate as of early November 2025, based on verified public disclosures and on-chain metrics.

Conclusion — Stability, Trust, and the Path to Global Adoption

By the end of 2025, regulation has reshaped the stablecoin industry into something far more durable.

What began as a search for compliance has evolved into a blueprint for global financial integration.

Europe’s MiCA provided the structure, the U.S. GENIUS Act added legitimacy, and Hong Kong’s Stablecoin Ordinance gave Asia a regulatory anchor.

Together, these frameworks transformed stablecoins from loosely governed digital assets into fully recognized payment infrastructure.

This alignment of policy and technology has created a foundation for global interoperability.

Stablecoins can now move across borders under consistent rules, backed by transparent reserves and legal redemption rights — the key ingredients for trust at scale.

Regulation didn’t restrict innovation; it refined it.

It introduced accountability, transparency, and oversight — turning volatility into reliability and speculation into adoption.

In 2025, stablecoins are no longer testing the limits of finance.

They are defining its next chapter, built on stability, trust, and the certainty that programmable money can now operate within the world’s financial system — not outside it.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024