Published 16 Jun 2025

Rethinking Crypto Quality: A New Framework for Trust

The Issue

The crypto world is chaotic. Projects rise and vanish . Hype overshadows reality. Influencers push meaningless tokens. Popular metrics like follower counts and trading volumes can be manipulated.

Big investors understand this problem. This is why many avoid the space. Without reliable and data-based tools, figuring out lasting value amid temporary hype becomes difficult.

The Answer: RateX Scoring

RateX Peer Quality Index, or RQI, aims to tackle the trust issues in Web3. It acts as a high-level scoring system to assess crypto assets, teams, and ecosystems. Instead of focusing on just hype or market trends, RQI prioritizes core fundamentals, technical stability, and readiness for institutional use.

How It Works

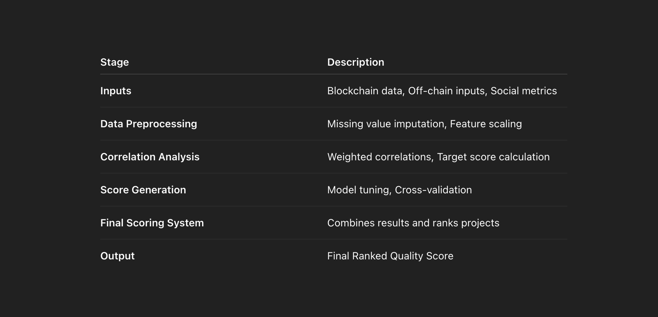

RateX evaluates using three main inputs:

- Data from blockchains, like activity, liquidity, and wallet stats

- Team performance, product updates, and transparency from off-chain data

- Social factors, like engagement patterns and credibility signals

All this data goes through a machine learning process that includes:

- Identifying correlations and tracking key variables

- Scoring with weights assigned based on what predicts success

- Validating results with checks and producing rankings that make sense

Scoring Pipeline Breakdown

How RateX transforms raw data into a ranked quality score.

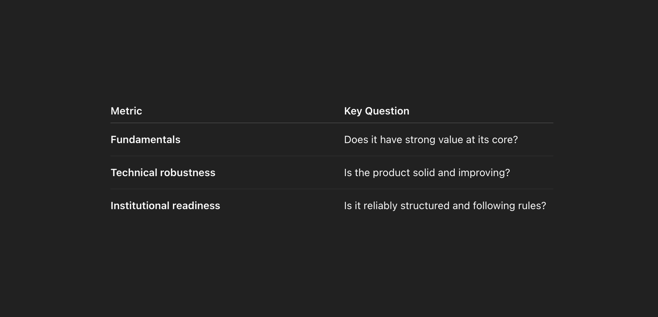

What We Measure

- Fundamentals — Does it have strong value at its core?

- Technical robustness — Is the product solid and improving ?

- Institutional readiness — Is it reliable, structured , and following rules?

Three Core Evaluation Metrics

The pillars of RateX scoring logic.

Who Benefits

- Institutional investors — To assess risks and evaluate portfolios

- Crypto funds — To perform large-scale due diligence

- Exchanges & platforms — To evaluate projects before listing them

- Teams & founders — To demonstrate quality to users, partners, and supporters

Why It Matters Now

- Regulations are becoming stricter

- Investors want clearer information

- Trends driven by hype are fading; real value is essential

- A huge pool of capital is waiting for dependable solutions

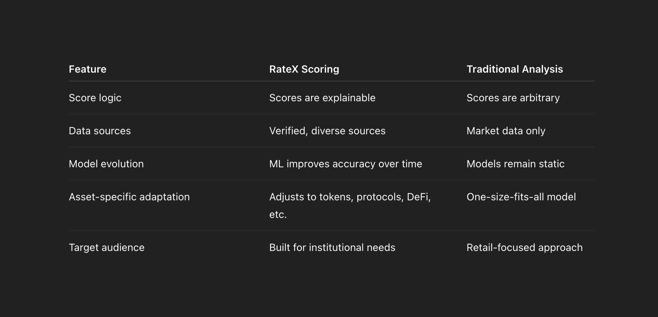

What Sets RateX Apart

- The scores can be explained instead of being mysterious.

- It relies on a mix of verified and diverse sources for data.

- Machine learning grows smarter as time goes on.

- Models adapt based on asset types like tokens, protocols, or DeFi.

- It focuses on institutional needs at its core.

How RateX Compares to Traditional Analysis

Why RateX offers deeper, smarter, and more relevant evaluations.

True Impact

RateX is already featured in dashboards, investment tools, and due diligence systems. It cuts through hype. It spots risks. It shines a light on what matters.

Future Plans

- Releasing a public dashboard.

- Broadening coverage to include more chains and L2s.

- Adding API connections and access for enterprises.

- Offering scoring reports and insights on a regular schedule.

Final Note

Web3 runs on trust — and that trust begins with clarity. Our data-driven scoring system helps investors, teams, and platforms focus on what truly matters: real, measurable quality.

Want to explore it further or get involved? Learn more and join here. Let facts speak louder than hype.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024