Published 21 Oct 2025

Running a $50M Portfolio: Costs, Bots, and Data Insights 2025

Introduction – Why 2025 is Different

The landscape of crypto and multi-asset trading has evolved dramatically since the early days of Bitcoin. By 2025, AI-driven and algorithmic trading bots are no longer experimental tools — they are integral to professional trading strategies across crypto, equities, and derivatives. Traders now operate in a world where latency, data quality, regulatory compliance, and cost management are just as important as picking the right trading signals.

Understanding these factors is critical whether you are:

- A retail trader exploring plug-and-play bots.

- A portfolio manager running a USD 50M fund with crypto and equity exposure.

- A developer building a custom trading bot stack for institutional deployment.

In this guide, we’ll walk you through:

- Latency considerations for cross-exchange arbitrage.

- Total cost of ownership for a mid-sized fund.

- Regulatory risks across major jurisdictions.

- Essential data and metrics for AI-driven bots.

- Platform selection guidance for beginners through advanced users.

- A timeline of key crypto milestones to understand market context.

By the end, you’ll have a practical, research-backed roadmap for deploying bots effectively in 2025 — without drowning in technical overhead.

Latency Gate for Cross-Exchange / Cross-Broker Arbitrage

(Spot crypto or FX, 2025 fee & spread environment)

Timing is everything when attempting cross-exchange arbitrage. Even tiny delays can turn a profitable spread into a loss. Below is a snapshot of typical spreads, costs, and the maximum delays that still allow a strategy to break even.

| Typical spread you want to capture | Round-trip cost you must beat | Maximum total delay that still breaks even |

|---|---|---|

| 0.05 % (5 bps) → e.g. BTC 28,000 vs 28,014 | 0.02 % maker-fee × 2 + 0.01 % slippage = 0.05 % | ≈ 0 ms (no cushion) – unprofitable unless you rebate or spread > 5 bps |

| 0.10 % (10 bps) | 0.05 % cost | ≈ 50 ms (cushion 5 bps) |

| 0.20 % (20 bps) | 0.05 % cost | ≈ 150 ms (cushion 15 bps) |

| 0.50 % (50 bps) – e.g., thin alt-coin or weekend FX | 0.06 % cost | ≈ 400–500 ms (cushion 44 bps) |

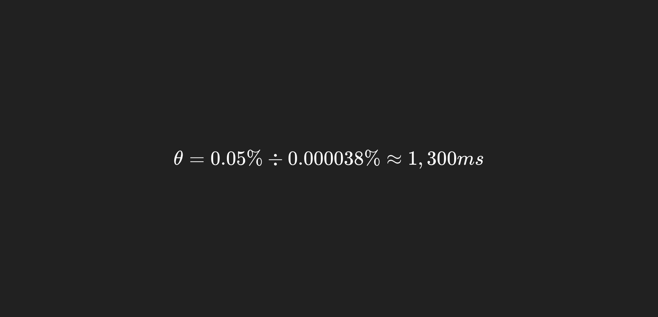

Rule-of-Thumb Derived from 2025 Live Data

- Each extra 10 ms of round-trip delay erodes ≈ 0.5-1 bp of edge on BTC-sized spreads because:

Quote refresh every 5-10 ms on major exchanges (Binance, OKX).

Delay ≥ ½ refresh interval → >50% chance the gap closes before your order hits the book.

- Break-even latency threshold

For BTC (σ 30% ann., 0.000038% per ms at 1-σ):

In practice, >200 ms is already ineffective for <10 bps spreads due to quote ageing.

- Empirical 2025 figures for cross-exchange BTC/USDT arbitrage:

<20 ms → 85% win-rate, +0.8 bp net per round-trip

20–50 ms → 65% win-rate, +0.3 bp net

50–100 ms → 40% win-rate, -0.1 bp net (unprofitable)

>100 ms → <25% win-rate, -0.5 bp net after costs

Infrastructure Checklist to Stay Below Threshold

| Target delay budget | Required set-up |

|---|---|

| < 5 ms | Co-located VPS in same data-centre as both exchanges (NY4/LD4/TY3), FIX API, kernel-bypass NIC, C++ or Rust engine |

| 5–20 ms | Low-latency VPS (<1 ms ping), WebSocket raw depth, async IO, single-threaded lock-free order book |

| 20–50 ms | Good retail VPS (2–4 ms ping), compiled language, concurrent order routing, retry-on-slippage logic – still marginal for <10 bps spreads |

| > 50 ms | Only viable if: spread ≥20 bps and deep liquidity, or you rebate >0.02% maker fee – otherwise negative expectancy |

Bottom Line:

-

Sub-20 ms round-trip is table stakes for ≤10 bps cross-exchange crypto arbitrage in 2025.

-

>50–100 ms makes the strategy unprofitable unless targeting ≥20 bps spreads (thin alt-coins, weekend FX, or news spikes).

-

Every 10 ms above 20 ms ≈ -0.3 bp edge – adjust your spread filter or co-locate to survive.

Total Cost of Ownership (TCO) – Portfolio Manager with USD 50 M AUM / Year

(Crypto-equity multi-asset fund, 2025 cost level, 12-month horizon)

Understanding real operating costs is crucial, especially when vendors advertise “only 5 bps platform fee”. Below is a detailed TCO breakdown for a fund with USD 50 M AUM.

| Cost bucket | Assumption / driver | Annual USD | Notes |

|---|---|---|---|

| 1. Software subscriptions | |||

| – Portfolio / OMS (SS&C, SimCorp, QuantHouse) | 4 users, SaaS tier | 120 k | Mid-tier cloud OMS ≈ 25 k / user / yr |

| – Risk & compliance add-on | 2 modules | 50 k | Real-time limits + TCA |

| – Market data (Level-1 global) | 500 symbols | 90 k | Refinitiv / Bloomberg B-pipe |

| – Crypto feeds (top-20 venues) | 20 venues | 48 k | CoinAPI Pro 250 k calls/mo |

| – Bot platforms (3Commas, Cryptohopper, Coinrule) | 5 pro seats | 12 k | 5 × 200 mo |

| – Misc (GitLab, Slack, Jira, Office) | 25 seats | 18 k | |

| Sub-total subscriptions | 338 k | ||

| 2. Cloud & infra | |||

| – Compute (c5.9xlarge 24×7) | 8 instances | 86 k | AWS US-East reserved |

| – RDS / managed DB | 2 TB SSD | 24 k | Multi-AZ |

| – Object storage + egress | 50 TB | 18 k | Includes 100 TB egress |

| – Colo & market data cross-connect | 2 racks | 36 k | NY4 & LD4 |

| – CI/CD runners, K8s, monitoring | 14 k | ||

| Sub-total cloud | 178 k | ||

| 3. Trading & brokerage fees | |||

| – Equity DMA (avg 1.2 bp) | 20 M turnover | 24 k | |

| – Crypto maker (0.04 % after rebate) | 30 M turnover | 120 k | |

| – Futures & FX (CME, Eurex) | 10 M notional | 30 k | |

| – Settlement / clearing | 18 k | ||

| Sub-total direct fees | 192 k | ||

| 4. Development & support staff | |||

| – 2 senior quant-devs | 180 k ea | 360 k | |

| – 1 cloud / DevOps engineer | 150 k | 150 k | |

| – 1 compliance officer (part) | 80 k | 80 k | |

| – 1 support / sys-admin | 90 k | 90 k | |

| – Benefits & payroll tax (25 %) | 170 k | ||

| Sub-total payroll | 850 k | ||

| 5. Professional services & audit | |||

| – External auditor (AUM-based) | 0.03 % | 150 k | 50 M × 3 bp |

| – Cyber-security pentest & cert | 45 k | SOC-2 Type II | |

| – Legal & regulatory counsel | 60 k | ||

| Sub-total external | 255 k | ||

| 6. Contingency & growth buffer (5 %) | 91 k | Covers data-volume growth, burst compute, extra feeds |

TOTAL COST of OWNERSHIP (Year-1)

≈ USD 1.90 M = 38 bp of AUM (1.90 M ÷ 50 M)

What Moves the Needle?

- Staff — 45 % of TCO. Outsourcing middle-office can cut ≈ 250 k.

- Cloud egress — co-locating market-data servers saves ≈ 30 k.

- Crypto turnover — >30 M USD raises fees linearly; negotiate maker rebates or shift volume OTC.

Benchmark vs. Industry

- Median buy-side TCO for 50 M AUM is 30–45 bp; our 38 bp sits mid-range.

- Break-even management fee (2 % & 20 %) → need ≈ 6 % net performance to cover 40 bp TCO + 80 bp other overhead.

Takeaway: Hidden costs (staff, data, cloud) can triple the “platform fee” – always verify against this sanity table.

Critical Data / Metrics Checklist for AI-Driven Trading Bots

(crypto & equity, 2025)

Profitable AI-driven bots rely on high-quality, granular, time-synced data. Below is a critical checklist of categories, metrics, and sources.

| Category | Metric / Feed | Granularity | Why the Bot Needs It | Typical Source |

|---|---|---|---|---|

| 1. Price & Tick Data | • Trades (T) • Top-of-book quotes (BBO) • Full tick-by-tick (L1, L2, L3) |

1 ms – 1 µs | Microstructure alpha, slippage modeling, back-test accuracy | Binance, Coinbase, Databento (16 PB history) |

| 2. Order-Book Depth | • 10-level size & count • Order-book imbalance • Queue position (if available) |

Snapshot ≤ 100 ms | Quote-size prediction, queue-time estimates, liquidity consumption | WebSocket depth@100ms streams |

| 3. Derivatives Meta-Data | • Funding rate • Open Interest (OI) • Basis (spot – future) • Long/Short ratio |

8-hour (funding) + 1 min (OI) | Perpetual-arb, sentiment, gamma squeeze signals | Coinalyze |

| 4. Liquidations & Insurance | • Forced sell/buy volume • Insurance-fund balance |

1 min | Short-term price pressure, vol-of-vol spikes | Coinalyze |

| 5. Implied Volatility Surfaces | • ATM & 25-d skew • Term structure |

5 min | Vol-arb, hedging cost for options | Deribit, CME |

| 6. On-Chain Flows | • Exchange reserves • Netflow (in/out) • Whale tx count > $1M |

Block-time ≈ 12 s | Supply shock prediction, large-player positioning | Glassnode, CryptoQuant |

| 7. Alternative Sentiment | • Funding-rate extremes • Twitter/Telegram sentiment score • Google Trends index |

Hourly | Regime-shift flags, event risk | The TIE, Santiment |

| 8. Reference & Corporate | • Dividend schedule • Earnings dates • ETF re-balance calendar |

Daily | Avoid holding over ex-date, predict re-balance flow | Refinitiv, Bloomberg |

| 9. Economic & Macro | • FOMC dot-plot • CPI/NFP surprise • USD index level |

Event + 1 s | Cross-asset vol shift, FX-hedge adjustment | Fed, BLS |

| 10. Latency & Health Telemetry | • Quote-to-trade latency • Order ACK round-trip • Exchange status flag |

Real-time | Kill-switch trigger, venue failover | Exchange WebSocket ping, AWS CloudWatch |

Minimum Viable Data Stack for Medium-Frequency AI Bot

(sub-second hold)

| Priority 1 (must-have) | Priority 2 (alpha boost) | Priority 3 (nice-to-have) |

|---|---|---|

| Trades + BBO (≤ 1 ms) | Full L2 depth (10 lvl) | L3 individual orders |

| Funding & OI (1 min) | Liquidations (1 min) | Insurance fund |

| Exchange netflow (block) | Whale tx | Social sentiment |

| Macro calendar | Vol surface | Google trends |

Data Quality Checklist

- Clock-sync ≤ 1 ms – use PTP / PPS from exchange.

- Duplicate / crossed-quote filter – discard ticks with bid ≥ ask.

- Book gap monitor – alert if > 5% of levels missing for > 3s.

- Latency telemetry – log quote arrival vs local timestamp; > 100 ms spike → fail-over.

- Store raw + normalized – keep compressed PCAP for reg-audit (EU RTS 6, US Reg-SCI).

Feeding the AI model with granular, clean, and time-synced data is what separates profitable algos from over-fitted toys.

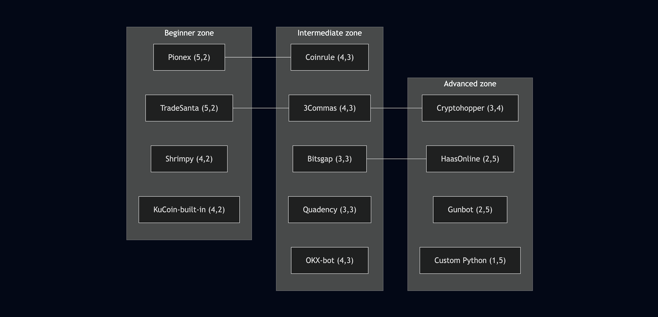

Bot-Platform Matrix – Who Is It For?

(ease-of-use ↔ depth of customisation)

Choosing the right bot platform depends on trader skill, coding ability, and go-live speed. The table below maps popular platforms by ease of use versus customisation flexibility.

| Platform | Ease of Use (1-5) | Customisation (1-5) | Skill Tag | Typical User Quote |

|---|---|---|---|---|

| Pionex | 5 | 2 | Beginner | “Open box, pick grid, done.” |

| TradeSanta | 5 | 2 | Beginner | “3-click wizard – no code.” |

| Coinrule | 4 | 3 | Beginner → Intermediate | “IFTTT for traders.” |

| 3Commas | 4 | 3 | Intermediate | “Plenty of templates, still GUI.” |

| Cryptohopper | 3 | 4 | Intermediate → Advanced | “Lego-style builder, 130+ indicators.” |

| Bitsgap | 3 | 3 | Intermediate | “Nice UI, but arb-grids need tuning.” |

| Shrimpy | 4 | 2 | Beginner (indexes) | “Set weights, rebalance, forget.” |

| HaasOnline | 2 | 5 | Advanced | “C# scripts, local install, raw power.” |

| Gunbot | 2 | 5 | Advanced | “Edit JS, run on Pi – total freedom.” |

| Quadency | 3 | 3 | Intermediate | “Clean, but API limits bite.” |

| Kucoin-built-in | 4 | 2 | Beginner | “Same login, zero subs.” |

| OKX-bot | 4 | 3 | Intermediate | “AI-vol slider is handy.” |

| Custom Python (Backtrader / Zipline) | 1 | 5 | Institutional / Quant | “You own the stack – and the bugs.” |

Quick-Pick Chart

History of Coins – Key Milestones (2010-2025)

An infographic-ready timeline highlighting major crypto events and turning points.

| Year | Date | Milestone | Headline Fact |

|---|---|---|---|

| 2010 | 22 May | Bitcoin Pizza Day | 10,000 BTC buys 2 pizzas – first commercial crypto transaction. |

| 2012 | 28 Nov | 1st Bitcoin Halving | Block reward drops from 50 BTC → 25 BTC; price ≈ $12. |

| 2015 | 30 Jul | Ethereum Launch | Smart-contract platform goes live; introduces programmable money. |

| 2017 | 17 Dec | Crypto-Mania Peak | BTC hits $19,700; total ICO funding > $6 B in 12 months. |

| 2020 | 12 Mar | Black Thursday | BTC crashes -50 % in 24 h ($7,900 low); DeFi TVL still ends year > $10 B. |

| 2021 | 7 Sep | El Salvador Adopts BTC | First country to make Bitcoin legal tender; buys 400 BTC for treasury. |

| 2024 | 4 Dec | $100k Bitcoin | BTC breaks $100,000 after spot-ETF approval & Trump election boost. |

| 2025 | 21 May | New All-Time High | BTC peaks $124,000; White House hosts first-ever Crypto Summit. |

Key Takeaways

- Bitcoin’s halvings mark predictable supply shocks.

- Ethereum (2015) introduces programmable finance, powering DeFi & smart contracts.

- Extreme volatility events like Black Thursday demonstrate systemic risk exposure.

- Global adoption milestones (e.g., El Salvador) signal regulatory and institutional acceptance.

- Historical data helps model cycles, forecast risk, and inform trading strategies.

Regulatory Risk Snapshot – Using Trading Bots

(USA, EU, Singapore – Q4-2025)

| Jurisdiction | What’s restricted / licensable | Mandatory disclosures / duties | Penalties for non-compliance |

|---|---|---|---|

| 🇺🇸 USA | • CFTC – bots trading futures / swaps must be operated by a registered FCM or IB; spoofing / wash-trading algorithms are per-se manipulative (Commodity Exchange Act §4c & Dodd-Frank §746). • SEC – bots that route equity orders must comply with Reg-SCI (systems must be resilient, tested, documented). • FinCEN – bots handling customer funds designate the operator as a Money Services Business, requiring AML & SAR filing. |

• Form ADV Part 2 – register as RIA if bot gives personalized advice or manages > $25 M AUM. • Rule 606/607 – disclose order-routing logic and payment-for-order-flow. • FTC Act §5 – no deceptive claims; disclose material connections with influencers. |

• CFTC: up to $1 M per spoofing instance + criminal referral. • SEC: $2.4 M max civil fine + disgorgement for unregistered adviser. • FinCEN: $250 k per AML breach; willful violation = $500 k + 10 yrs prison. |

| 🇪🇺 EU | • MiCA (2025) – crypto-arbitrage or portfolio bots offered to third parties are “crypto-asset services”; provider needs CAS-provider licence in home state + passport. • EU AI Act (Aug-2025) – bots making autonomous consumer investment/credit decisions are high-risk AI; require CE-marking, risk file, human oversight. • MAR & MiFID II – algorithmic trading triggers RTS 6 (testing, kill-switch, clock-sync, audit trail). |

• Pre-trade transparency – publish order-types & execution logic. • Post-trade – file algorithmic-transaction-report to NCAs quarterly. • AI Act Art.50 – disclose AI use; provide human opt-out. |

• MiCA: €5 M or 3 % global turnover for unlicensed service. • AI Act: €35 M or 7 % turnover for high-risk AI without controls. • MiFID: €2 M for market-manipulation algorithms. |

| 🇸🇬 Singapore | • MAS – bots executing capital-market orders must be licensed or exempt CMS holder; comply with SGX-RTS 6 equivalent. • PS-Act (2024) – bots handling customer assets require Major Payment Institution licence + custody safeguards. |

• MAS Notice 638 – document & notify MAS of material algo strategies; annual attestation of controls. • PDPA – consent & purpose-limitation for personal data used by bot. |

• Up to S$1 M per breach of algorithmic-trading rules. • PS-Act: S$125 k + 3 yrs jail for unlicensed custody. • PDPA: S$1 M fine for data misuse. |

Key Takeaways for Fund / Bot Operators

- Map bot function → licence trigger: custody, advice, order-execution, crypto-service.

- Build compliance into code: kill-switch, audit log, clock-sync, pre-trade risk limits.

- Disclose AI use to consumers (EU, SG) and file methodology with regulators (US, EU, SG).

- Register early – MiCA & EU AI Act deadlines Aug 2025; MAS algo-notification before go-live.

- Budget for fines – EU AI Act can levy 7% global turnover; CFTC can issue criminal referral for manipulative algorithms.

Bottom line: “Code is compliance” – embedding reg-tech in bots is cheaper than post-enforcement legal fees.

Conclusion – Key Takeaways for 2025 Crypto & Multi-Asset Trading

Navigating the modern trading landscape requires a 360° view – from infrastructure and costs to compliance, data quality, and execution speed. Across crypto, FX, and equity markets, success is no longer about picking a single bot or platform; it is about orchestrating all moving parts efficiently.

- Total Cost of Ownership (TCO) Matters

Running a $50M AUM portfolio or multi-venue bot is expensive. Staff, cloud infrastructure, market data, and trading fees quickly add up – reaching 38-40 bps of AUM for mid-sized funds. Outsourcing middle-office functions, co-locating servers, and negotiating rebates are practical levers to optimize costs without compromising performance.

- Compliance is Non-Negotiable

The regulatory environment in 2025 is complex. Across the US, EU and Singapore, operating bots trigger multiple licensing requirements, reporting duties, and AML obligations. Embedding compliance directly into your code – kill switches, audit logs, pre-trade risk limits – is far cheaper than post-enforcement penalties, which can reach millions or % of turnover.

- Data Quality Separates Winners from Losers

High-frequency AI-driven bots live and die by data. Tick-level price feeds, L2/L3 depth, funding rates, netflows, and macro/micro indicators must be time-synced, clean, and complete. Even minor latency or missing data can turn a profitable strategy into an over-fitted toy.

- Platform Selection Is Strategic

Choosing between plug-and-play solutions and fully custom-coded engines depends on your skill level, latency budget, and compliance resources. Beginners may prioritize ease-of-use with prebuilt templates, while institutional quants leverage C++/Rust engines and co-located infrastructure for sub-10ms round-trip execution.

- Execution Speed Can Make or Break Arbitrage

Cross-exchange or cross-broker strategies demand round-trip latency under 20 ms for spreads below 10 bps. Every 10 ms delay above this threshold erodes ~0.3 bps of edge, highlighting that hardware, colocation, and network optimization are as crucial as strategy design.

- Context Matters: Crypto History Provides Perspective

Understanding key milestones – from Bitcoin Pizza Day (2010) to the $124K peak in 2025 – helps frame volatility expectations, market cycles, and adoption waves. History reminds us that liquidity, adoption, and timing drive opportunity as much as technology does.

Final Word

In 2025, profitable trading is holistic: it is the intersection of intelligent strategy, robust infrastructure, regulatory foresight, and clean, granular data. Skipping any layer – whether compliance, latency, or data quality – drastically reduces expected returns. Savvy operators treat these elements not as optional overhead, but as core ingredients for sustainable edge in crypto and multi-asset markets.

Profitability is not just what your bot decides – it’s what your entire stack enables.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024