Published 24 Apr 2025

Stablecoin Yields vs. Bank Deposits in 2025

Introduction: Passive Income That Outpaces the Banks

In 2025, traditional bank deposits continue to offer near-zero returns in many parts of the world. As inflation quietly eats away savings, more investors are turning to crypto — not for speculation, but for yield. And not just any crypto — stablecoins.

USDT, USDC, and DAI aren’t designed to grow in value. Their power lies in something else: generating stable, passive income when deployed on the right platforms.

This research breaks down the best ways to earn from stablecoins right now — whether you're risk-averse, yield-hungry, or somewhere in between. We compare centralized and decentralized options, track real APYs, and highlight where the opportunities are real — and where they’re not worth it.

1. Why Stablecoins Compete With Bank Deposits

For decades, bank deposits were the go-to choice for passive income. Simple, secure, insured. But in 2025, the math no longer adds up.

Average savings account rates still hover around 1–2% annually — and that’s before inflation. In contrast, even conservative stablecoin strategies can deliver 5–9% APY, sometimes more, depending on the platform and level of risk.

The Shift in Strategy

Stablecoins like USDT and USDC are pegged to the U.S. dollar, so they don’t fluctuate like BTC or ETH. That makes them attractive to yield-seeking investors who want steady returns without the volatility of crypto markets.

In regions where inflation quietly erodes savings — and where local banks offer minimal returns — stablecoins present a viable alternative. This shift is especially visible among retail investors, digital nomads, and crypto-native users who want better returns without sacrificing stability.

Market Snapshot (Q2 2025)

- Tether (USDT) remains the most used stablecoin for yield farming and lending.

- USDC is preferred on U.S.-regulated platforms due to stricter compliance.

- DAI offers decentralized exposure and often slightly higher DeFi rates.

These stablecoins are now integrated into both CeFi platforms like Binance Earn and OKX, and DeFi protocols such as Aave, Curve, and Compound — each with different approaches to risk and return.

2. How You Can Earn With Stablecoins

Stablecoins don’t grow in value — but they work for you when placed in the right system. There are two main ways to earn with stablecoins in 2025: centralized finance (CeFi) and decentralized finance (DeFi).

CeFi: Simple and Accessible

Platforms like Binance Earn, OKX, and Bybit let users deposit USDT or USDC and earn fixed or flexible interest. These platforms handle the backend — lending your funds to vetted borrowers or using internal liquidity tools. You just choose a product and wait.

Rates vary by platform, duration, and type of product. As of Q2 2025: - Flexible products often offer 2–5% APY - Locked terms (30–90 days) can reach 6–8% APY

The appeal? You don’t need technical knowledge. It’s plug-and-earn. But you do rely on the platform’s custody and risk management.

DeFi: Higher Yields, Higher Responsibility

In DeFi, you interact directly with protocols like Aave, Curve, or Compound. You lend your stablecoins into liquidity pools or vaults and earn interest from borrowers or trading activity.

Here, the rewards can be higher — 5–12% APY depending on protocol demand — but so are the risks:

- Smart contract bugs

- Volatility in liquidity pools

- Impermanent loss (especially in mixed pools)

You also need a Web3 wallet (like MetaMask), pay gas fees, and monitor the protocol yourself.

What’s Better?

If you want ease and convenience — CeFi is for you.

If you want full control and can handle some complexity — DeFi might give you better returns.

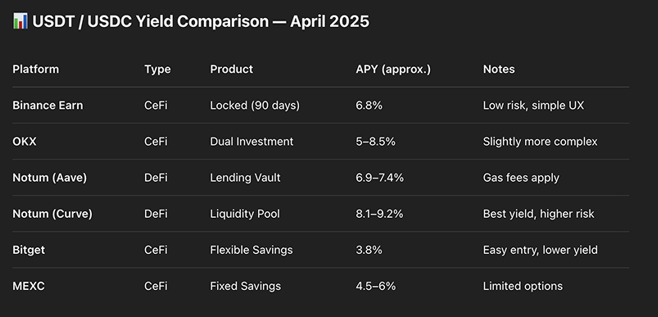

3. Top Platforms for Earning on USDT and USDC

Not all platforms offer the same returns — and the difference between 3% and 9% APY can add up fast. Here’s a breakdown of where you can earn the most on stablecoins right now, and what you should know before choosing where to park your funds.

CeFi Platforms

Binance Earn and OKX Earn remain two of the most popular options for passive income in stablecoins. They’re trusted, offer both flexible and locked terms, and are beginner-friendly.

- Binance Earn (USDT):

- Flexible: ~3.5% APY

-

Locked (90 days): up to 6.8% APY

-

OKX (USDT / USDC):

- Dual investment and fixed income products available

- Rates vary from 2.5% to 8.5% depending on duration and product type

Why users like it: No DeFi setup, fast onboarding, lower technical barrier.

What to watch for: Your funds are in custody of the exchange. That means your yield depends on their solvency and lending policies.

DeFi Aggregators

Notum has grown as a go-to tool for finding the best DeFi yields without deep diving into every protocol manually.

- How it works: Notum aggregates APYs from various DeFi platforms and lets users switch between them easily.

- Example yield (USDC): 7–9% APY depending on pool choice and platform (e.g. Aave, Curve, Stargate)

Why it stands out:

- Aggregation simplifies access to high-yield DeFi strategies

- UI is beginner-friendly compared to raw DeFi dApps

- Great for users who want higher rates with some autonomy

Other Mentioned Projects

- Bybit, Bitget, MEXC — offer similar CeFi-style savings products with stable APYs

- Curve Finance and Aave — still major DeFi players, though yields vary more dynamically

RateX Insight:

While DeFi can outperform CeFi in yield, the real advantage depends on how much effort you're willing to put in. CeFi is easier. DeFi is more flexible — but less forgiving if you don’t monitor your assets.

4. Case Studies and APY Snapshots (Q2 2025)

To choose the best way to earn on stablecoins, it’s not enough to know the advertised rates — you need to see how they actually perform. Below is a snapshot of real-world APYs from major platforms in Q2 2025, with brief insights from the RateX Network team.

Key Takeaways

- CeFi offers predictable, accessible yields — great for passive investors.

- DeFi provides higher potential returns — but you manage your own risk.

- Notum bridges both worlds, offering better rates without full DeFi complexity. RateX Note:

A 5% difference in APY may seem small — but on $1,000 in stablecoins, that’s over $50 a year. Multiply that by time, and it’s a real opportunity cost.

5. Understanding the Risks

Stablecoin yields can look like easy money — but higher returns almost always come with trade-offs. Whether you’re using CeFi or DeFi, it’s essential to know where the risks are hiding.

CeFi Risks: Platform Dependence

Centralized platforms like Binance or OKX manage your funds. That means:

- You don’t hold the private keys

- Your return depends on how the platform manages lending, security, and liquidity

- If the platform is hacked or mismanages assets, your funds could be frozen or lost

While large CeFi platforms have solid reputations, past collapses like Celsius and BlockFi remind us that even big names carry risk.

DeFi Risks: Smart Contracts and Liquidity Volatility

DeFi gives you full control — but also full responsibility.

- Smart contract bugs: Code vulnerabilities can be exploited, draining entire pools.

- Protocol risk: If a DeFi protocol fails economically (e.g. bad tokenomics, poor liquidity incentives), APYs vanish.

- Impermanent loss: In liquidity pools with volatile assets, your final balance might be lower even if yields look high.

- Gas fees and slippage: Small mistakes during transactions can eat into profits.

Even advanced users double-check contracts and use aggregators like Notum for safer routing.

Stablecoin Risk Itself

Not all stablecoins are created equal.

- USDT (Tether) has faced repeated transparency questions.

- USDC is generally viewed as more compliant, but still relies on centralized reserves.

- DAI is decentralized — but can become undercollateralized in extreme market events.

Before you choose where to earn, think about which stablecoin you actually trust to hold its value.

RateX View:

There’s no “risk-free yield”. But with basic diligence — like diversifying across platforms and limiting exposure to high-risk DeFi pools — you can earn passively without gambling.

Conclusion

Stablecoins offer a real alternative to traditional savings — especially when bank rates stay low and inflation keeps rising. In 2025, earning 5–9% APY on USDT or USDC isn’t just possible — it’s common if you know where to look.

- CeFi platforms like Binance and OKX are simple and reliable for most users.

- DeFi tools, especially when used through aggregators like Notum, unlock better returns for those willing to manage risk.

- No platform or protocol is fully safe — but the right balance of yield, trust, and liquidity makes stablecoin strategies a strong passive income option.

If you want your savings to actually grow — not just sit still — stablecoins are worth a serious look.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024