Published 03 Nov 2025

Stablecoins and DeFi: The Liquidity Backbone

Stablecoins are no longer passive instruments — they’ve become the core operating capital of decentralized finance.

Every major DeFi protocol, from Curve to Aave, depends on their liquidity to function. By 2025, more than half of all Total Value Locked (TVL) in DeFi is denominated in stablecoins, making them the backbone of the on-chain economy.

What began as a convenience layer for traders has evolved into the circulatory system of DeFi.

Stablecoins now serve as collateral, settlement units, and trading pairs, powering lending markets, DEX pools, and derivatives platforms. Their stability allows protocols to compound liquidity across chains — effectively turning dollars into programmable capital.

This report explores how stablecoins sustain the DeFi ecosystem, how much liquidity they command, and how yield-bearing tokens like sDAI and USDe are reshaping the next phase of decentralized finance.

Key Takeaways — Stablecoins as DeFi Infrastructure

-

Stablecoins represent 50-60 % of all DeFi TVL across major protocols, consolidating their role as the base liquidity layer.

-

Curve and Aave hold the largest share of stablecoin-denominated pools, anchoring lending and swap markets.

-

DAO treasuries increasingly use USDC, DAI, and FRAX for payroll, grants, and liquidity management.

-

The rise of yield-bearing stablecoins (sDAI, USDe, USDY) introduces a new dimension — liquidity that earns.

-

Stablecoin liquidity now flows between Layer-1 and Layer-2 networks, improving composability and efficiency across DeFi.

Stablecoins have evolved from auxiliary tools into DeFi’s structural foundation — providing predictable liquidity, stable collateral, and scalable access to yield.

Market Overview — Stablecoin Share in DeFi TVL

The recovery of DeFi after the 2022 downturn was powered almost entirely by stablecoins.

While speculative assets retreated, demand for stable, composable liquidity surged — bringing a more sustainable structure to decentralized finance.

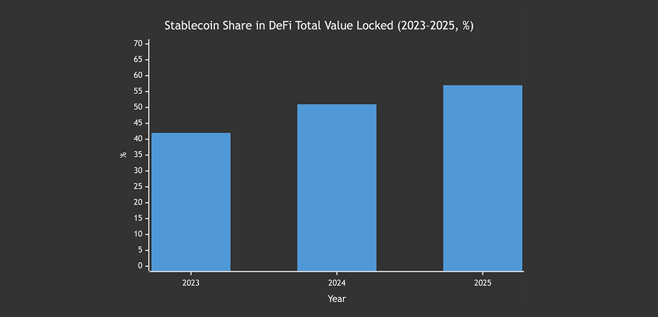

By mid-2025, stablecoins accounted for over 57% of the total $90 B DeFi TVL, compared to just 42% in early 2023. This growth shows how deeply stable assets are integrated into lending, staking, and derivatives protocols. Liquidity now moves less with price speculation and more with yield opportunities.

Protocols such as Curve, Aave, and Compound evolved into the main distribution channels for stablecoin liquidity, each optimizing around consistent, low-risk returns. The shift reflects DeFi’s maturation — from a trading-driven ecosystem to a capital market built on stability.

Stablecoin Share in DeFi TVL (2023-2025, %)

Summary Insight

The expanding share of stablecoins in DeFi highlights a structural realignment: protocols now favor liquidity that compounds safely instead of capital that speculates.

This transformation turns DeFi into a yield-optimized, dollar-denominated network — closer to a decentralized money-market system than to the volatile trading platforms of its past.

Stablecoins in Lending and DEX Protocols

Stablecoins sit at the heart of DeFi’s most active markets.

In lending, they are the dominant borrowed and collateralized assets; in decentralized exchanges, they serve as the base pair for almost every major trade.

This combination gives stablecoins unmatched velocity — they circulate continuously between lending pools and swap protocols, creating a self-sustaining loop of liquidity.

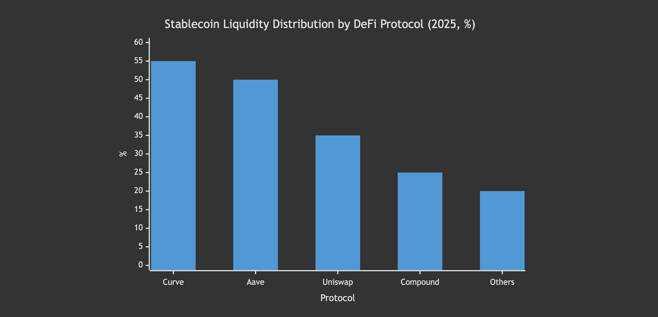

On Aave, stablecoins account for more than 70% of total borrow volume, reflecting their use as both leveraged capital and hedging tools.

Curve remains the largest stablecoin DEX, with pools like 3Pool, FRAXBP, and the newer USDe pairs representing over 55% of its total liquidity.

Even Uniswap, traditionally dominated by volatile pairs, now processes roughly one-third of its swaps through USDC or USDT pools.

These trends show that stablecoins are not just passive liquidity providers — they are DeFi’s universal settlement currency, the asset that underpins nearly every contract and transaction.

Stablecoin Liquidity Distribution by Protocol (2025, %)

Summary Insight

Every major DeFi protocol now depends on stablecoins as its core liquidity base.

They ensure pricing stability, reduce volatility in lending markets, and enable continuous composability across protocols.

Without them, DeFi’s credit, swap, and yield layers could not function at scale — making stablecoins the invisible infrastructure of decentralized finance.

DAO Treasuries — The New Liquidity Managers

Decentralized organizations are evolving into active liquidity managers, and stablecoins sit at the center of that transformation.

In 2025, over 60% of DAO treasuries hold significant stablecoin reserves — not just as idle assets, but as working capital for grants, payroll, liquidity provisioning, and risk hedging.

Stablecoins allow DAOs to operate predictably in an unpredictable market.

By keeping part of their treasury in assets like USDC, DAI, and FRAX, organizations maintain funding stability while staying fully on-chain. MakerDAO, Arbitrum DAO, and Optimism Foundation all rely on stablecoins to manage multi-million-dollar cash flows without exiting DeFi rails.

DAO Treasury Stablecoin Allocation (2025 Snapshot)

| DAO / Protocol | Stablecoin Share of Treasury | Primary Assets |

|---|---|---|

| Uniswap DAO | 58% | USDC, ETH, DAI |

| Arbitrum DAO | 63% | USDC, USDT |

| MakerDAO | 72% | DAI, USDe |

| Optimism Foundation | 65% | USDC, DAI |

| Curve DAO | 61% | USDT, crvUSD |

Stablecoins have turned DAOs into self-sufficient treasuries that mirror the function of traditional funds — holding stable reserves, deploying yield strategies, and maintaining liquidity buffers.

This integration of stable assets into governance and operations makes decentralized organizations more resilient and economically independent.

Insight

DAO treasuries illustrate a deeper point: stablecoins are not just for trading or lending — they are the balance sheets of DeFi itself.

The more decentralized organizations rely on stable reserves, the closer DeFi moves toward a sustainable, capital-efficient financial system.

Yield-Bearing Stablecoins — The Next Layer of Liquidity

The next stage of DeFi liquidity is no longer just stability — it’s productive stability.

Between 2024 and 2025, a new category of assets appeared: yield-bearing stablecoins. These tokens hold their peg while distributing passive yield directly to holders, effectively turning liquidity itself into an income-generating instrument.

Leading examples include sDAI, USDe, and USDY — each representing a different mechanism but serving the same goal: embedding yield into base liquidity.

For users, this eliminates the need to stake or lend manually. For protocols, it means liquidity pools automatically earn without additional smart contract layers.

This development also changes incentive structures across DeFi.

Protocols can now accept yield-bearing stablecoins as collateral, meaning that locked capital continues to accrue interest even when it’s used elsewhere.

The result is a more capital-efficient, self-compounding ecosystem — where every tokenized dollar works twice.

Leading Yield-Bearing Stablecoins (2025 Snapshot)

| Token | Issuer | Mechanism | Average Yield | Use Cases |

|---|---|---|---|---|

| sDAI | MakerDAO | Tokenized DSR | 5.2% | DeFi lending, DAO treasuries |

| USDe | Ethena | Delta-neutral synthetic | 7.0% | Exchange collateral, derivatives |

| USDY | Ondo Finance | Tokenized T-bills | 5.4% | Institutional yield, DeFi bridging |

Insight

Yield-bearing stablecoins mark the point where DeFi and traditional money markets converge.

They combine the liquidity of stable assets with the income potential of short-term debt — creating the foundation for programmable, yield-native liquidity.

In practice, they make DeFi more efficient, more attractive to institutions, and less reliant on speculative cycles.

Methodology & Sources

Data for this report was aggregated from DeFiLlama, Artemis, MakerDAO DSR statistics, and public DAO treasury dashboards.

TVL and liquidity metrics were normalized using quarterly averages to reduce volatility between on-chain snapshots. Protocol-level stablecoin shares were derived from combined data on lending, DEX, and derivatives platforms.

Estimates for yield-bearing stablecoins (sDAI, USDe, USDY) include real-time yield feeds from MakerDAO, Ethena, and Ondo Finance, adjusted to annualized rates.

DAO treasury allocations were compiled from DeepDAO and verified against multisig wallet data.

Comparative figures across 2023-2025 reflect the percentage of DeFi TVL denominated in stable assets and the total supply of yield-bearing stablecoins at each benchmark period.

Data accurate as of early November 2025, based on verified public disclosures and on-chain metrics.

Conclusion — The Circulatory System of DeFi

Stablecoins have become far more than a convenience layer — they are now the lifeblood of decentralized finance.

They stabilize lending markets, anchor liquidity pools, and fund the operations of DAOs and protocols across every major chain.

Between 2023 and 2025, their dominance reshaped DeFi’s entire architecture. Instead of volatile collateral driving short-term speculation, liquidity is now built on predictable, dollar-pegged assets.

This transformation made DeFi more resilient, capital-efficient, and institution-ready.

The emergence of yield-bearing stablecoins pushes this system even further.

For the first time, liquidity itself generates income, creating an on-chain equivalent of global money markets.

As these instruments scale, the distinction between “holding liquidity” and “earning yield” will disappear — every dollar in DeFi will work continuously.

Stablecoins are no longer just participants in the decentralized economy; they are its structural core — the settlement layer, the source of credit, and the medium of trust in Web3 finance.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024