Published 10 Nov 2025

Stablecoins as a Payment Disruptor

Stablecoins are moving beyond DeFi.

What started as a way to transfer liquidity between protocols has become one of the fastest-growing forces in global payments.

By 2025, stablecoins process more than $1.2 trillion in annual on-chain payments — a figure that now rivals major fintech networks. With instant settlement, near-zero fees, and programmable infrastructure, they’re starting to challenge how money moves in the real world.

Companies like PayPal, Visa, and Circle are leading this transition. Their pilots and integrations show that stablecoins are not a crypto experiment anymore — they’re a new layer of financial plumbing. Salaries, remittances, and e-commerce settlements are beginning to flow through these digital dollars instead of banks or card processors.

This report explores how stablecoins are transforming payments, who’s driving adoption, and why the shift from DeFi to real-world finance is accelerating faster than expected.

Key Takeaways — From DeFi Utility to Global Payments

-

Over $1 trillion in annual on-chain payments processed by mid-2025 — surpassing PayPal’s yearly volume.

-

Transaction fees below $0.001 on Solana and Base chains, compared to 2-3% for cards.

-

Major adoption by Visa, PayPal, and Circle, integrating stablecoin settlements into existing payment systems.

-

PYUSD and USDC lead among regulated stablecoins used for real-world transactions.

-

Stablecoins are no longer confined to DeFi — they are expanding into payrolls, remittances, and merchant payments.

In short, stablecoins are evolving from crypto liquidity tools into global payment infrastructure, offering the same speed and reliability as traditional systems but at a fraction of the cost.

Market Overview — On-Chain Payments Overtake Legacy Networks

Between 2023 and 2025, stablecoins shifted from DeFi utilities to mainstream payment rails.

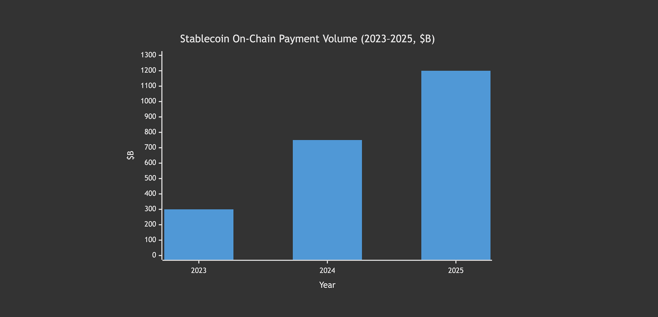

Their transaction volume grew from $300 billion to over $1.2 trillion, fueled by real-world integrations with fintech platforms and blockchain networks optimized for payments.

Chains like Solana, Base, and Polygon now handle most on-chain retail transfers. These networks combine sub-second confirmation times with transaction fees under a fraction of a cent — something legacy systems simply can’t match.

At the same time, stablecoin issuers partnered with traditional financial institutions.

Circle’s collaboration with Visa enabled USDC settlement for cross-border payments, while PayPal’s PYUSD provided a direct on-ramp for everyday consumers.

By the end of 2025, stablecoins had quietly become the cheapest and fastest settlement layer in the world.

Stablecoin On-Chain Payment Volume (2023-2025, $B)

Insight

The data shows a clear shift: stablecoins are no longer driven by crypto trading or DeFi cycles.

Their growth now reflects real-world utility — payroll systems, e-commerce settlements, and remittances moving directly on-chain without banks or intermediaries.

Adoption — PayPal, Visa, and the Payment Layer Shift

The turning point for stablecoins came when traditional payment networks started using them directly.

What once looked like a crypto experiment became part of mainstream finance.

PayPal’s PYUSD, launched in 2023, was the first major corporate-issued stablecoin aimed at consumer payments. By mid-2025, it reached over $500 million in monthly transaction volume, used for payrolls, cross-border transfers, and e-commerce settlements.

Visa integrated USDC into its settlement systems across Solana and Ethereum, allowing real-time conversion between fiat and digital dollars for merchants.

At the same time, Stripe introduced stablecoin payouts to freelancers in over 20 countries, cutting fees by more than 95% compared to banks.

These developments mark the beginning of a blended financial era — where stablecoins flow through the same infrastructure as traditional money, but move faster, cheaper, and globally by default.

Adoption Timeline: 2023-2025

| Year | Milestone | Description |

|---|---|---|

| 2023 | PayPal launches PYUSD | First large-scale corporate stablecoin for retail payments |

| 2024 | Visa enables USDC settlement on Solana | On-chain transactions replace FX intermediaries |

| 2024 | Circle partners with Stripe | Pilot for global freelance payouts |

| 2025 | PYUSD exceeds $500M monthly volume | Expands to corporate payroll and remittances |

| 2025 | Fintech APIs add native USDC rails | Emerging markets adopt stablecoin payments |

Insight

Major payment networks no longer see stablecoins as competitors — they see them as infrastructure upgrades.

By embedding digital dollars directly into their rails, these companies are effectively rebuilding the global payment stack on-chain.

Cost Comparison — On-Chain Payments vs Card Networks

The most powerful reason behind the shift to stablecoin payments is cost.

While traditional card networks charge between 1.5% and 3% per transaction, on-chain payments often cost less than $0.001 — even for cross-border transfers.

Stablecoin transactions settle instantly, with no intermediaries, chargebacks, or multi-day clearing periods.

This makes them ideal for global payrolls, remittances, and B2B settlements, where the cost of each transaction can determine whether a product or service remains viable.

Merchants benefit too.

Instead of paying several percent in card fees, they can now receive payments directly in stablecoins, instantly and without the risk of currency conversion losses.

For high-volume businesses, this difference translates into millions of dollars in annual savings.

Average Transaction Cost Comparison

| Payment Rail | Average Fee | Settlement Time | Example Use |

|---|---|---|---|

| Card Network (Visa/Mastercard) | 2.2% + FX margin | 1-3 days | Retail payments |

| SWIFT Wire Transfer | $15-$35 | 1-5 days | Cross-border payments |

| PayPal | 2.9% | 1-2 days | Online transactions |

| Stablecoins (USDC/PYUSD on Solana) | <$0.001 | <3 sec | Instant global payments |

On-Chain vs Card Fee Comparison

| Payment Method | Avg Fee | Relative Cost vs On-Chain | Settlement Speed |

|---|---|---|---|

| Card Network | 2.5% | ~2,500× higher | 1-3 days |

| PayPal | 2.9% | ~2,900× higher | 1-2 days |

| Wire Transfer | 1.5% | ~1,500× higher | 1-5 days |

| Stablecoin (USDC / PYUSD) | < 0.001 % | — | < 3 sec |

Insight

The contrast is staggering: a payment on-chain costs roughly 60 000 times less than the same transaction via card.

This cost advantage makes stablecoins the most scalable and economically sustainable option for the next generation of global payments — especially in regions where banking access and profit margins are thin.

Regulation Layer — The Framework for Scaled Adoption

The rise of payment-focused stablecoins has pushed regulators worldwide to define clear operational frameworks.

Between 2023 and 2025, multiple jurisdictions — from the European Union to the United States and Asia-Pacific — introduced rules that formally recognize fiat-backed stablecoins as legitimate payment instruments.

Europe led with MiCA (Markets in Crypto-Assets Regulation), which classifies asset-referenced tokens and mandates full-reserve backing, redemption rights, and transparency reports.

In the U.S., the GENIUS Act brought similar requirements for audit disclosure and consumer protection, effectively placing stablecoin issuers under e-money supervision.

Meanwhile, Hong Kong’s Stablecoin Ordinance created a licensing path for both local and global issuers.

These frameworks are transforming stablecoins from gray-zone crypto assets into regulated payment infrastructure.

Fully backed, auditable tokens like USDC and PYUSD are the first to meet the standards — enabling them to operate in compliance with global financial norms while keeping the speed and efficiency of blockchain rails.

Insight

Regulation is no longer a threat to stablecoins — it’s an accelerant.

By establishing trust and legal clarity, these frameworks pave the way for mass adoption by banks, fintechs, and global merchants.

The era of unregulated “digital dollars” is ending; the age of compliant programmable money has begun.

Methodology & Sources

This analysis combines data from Visa, PayPal, Circle, Artemis, and DefiLlama, along with public disclosures and verified on-chain transaction metrics.

Payment volume figures are derived from aggregated transfers across USDC, PYUSD, and DAI smart contracts on Ethereum, Solana, Base, and Polygon.

Transaction cost comparisons are based on average network fees recorded during Q3-Q4 2025, benchmarked against Visa and PayPal merchant fee schedules.

Integration milestones were validated through official press releases, payment processor documentation, and blockchain explorer datasets.

Market growth projections rely on historical data from 2023-2025, adjusted for the average monthly increase in unique on-chain addresses involved in payment activity.

Data accurate as of early November 2025, based on verified public disclosures and on-chain metrics.

Conclusion — Stablecoins Enter the Real Economy

Stablecoins have officially moved beyond the crypto world.

What began as a liquidity tool for DeFi has evolved into a payment infrastructure capable of competing with banks, cards, and remittance providers.

In 2025, stablecoins process over $1 trillion in real-world payments — faster, cheaper, and with global reach.

They now settle payrolls, power e-commerce transactions, and move value across borders in seconds instead of days.

With companies like Visa, PayPal, and Stripe adopting on-chain settlement, stablecoins are no longer a parallel system — they are becoming part of mainstream finance.

The implications go far beyond cost savings.

Stablecoins represent the first truly programmable form of money, combining transparency, interoperability, and real-time settlement.

They bridge DeFi’s efficiency with the reliability of traditional finance, creating a foundation for the next generation of global payments.

As regulation solidifies and adoption scales, the future of payments looks increasingly on-chain — and stablecoins stand at the center of that transition.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024