23 Jan 2026

23 Jan 2026Stablecoins Give Traders Alpha. Here’s Exactly Where to Find It

Our team conducted research and realized that the price almost always becomes “obvious” too late. Alpha appears earlier, when available liquidity changes, and in the crypto market it is most often expressed in stablecoins. In 2025, stablecoins scaled to volumes comparable with large payment infrastructure, and their transaction turnover was estimated in the tens of trillions of dollars.

A stablecoin is a digital dollar on the blockchain. It is used to pay for trades on DEXs, to move capital between exchanges and networks, to lock in profits after a pump, and to rotate into when market participants reduce risk. That is why stablecoins are not a “secondary tool” but the settlement layer of the market that affects execution, volatility, and the stability of price moves.

If you learn to read stablecoins as a liquidity layer, you can choose entries more precisely, filter moves that lack support, and detect rising systemic risk earlier.

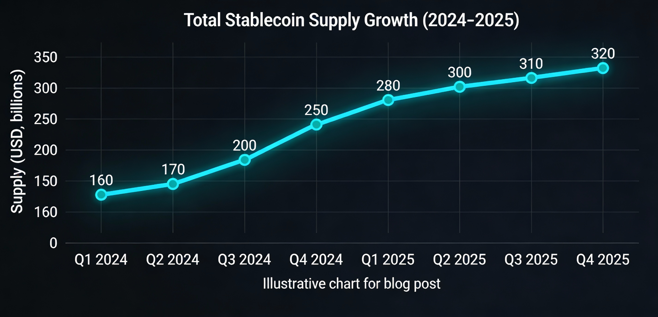

Total stablecoin supply reached record highs over $300B by mid-2025

Why this gives an edge in trades

Stablecoins have become the unit of account for a large share of trading activity. By regulators’ assessments, trading remains a dominant use case for stablecoins, and a significant portion of CEX turnover is routed through them.

Liquidity is distributed unevenly. Ethereum holds the largest share of supply, but growth on fast chains and L2s matters not as a “trend,” but as a sign of migration in trading activity and changing execution costs.

Table. How to interpret network liquidity shifts

| Observation | What it often means for a trader | Practical action |

|---|---|---|

| Stablecoin share and activity increase on a network | Liquidity becomes “working” there | Watch pairs/DEXs on that network, look for setups with better execution |

| Stablecoins rotate from risk venues into more “conservative” venues | Risk appetite drops, the cost of mistakes rises | Reduce leverage, cut size, wait for confirmation |

| Flows accelerate around news | Higher probability of volatility | Tighter entry discipline and profit-taking, fewer “chase” trades |

The logic is based on stablecoins being the primary settlement asset of crypto markets and a proxy for tradable demand/supply inside the system

How to profit from this: scenarios that actually work

This is not about “investing in stablecoins.” The logic is to understand where liquidity appears, where it disappears, and where conditions deteriorate for aggressive entries. This approach filters trades and improves outcomes without making the strategy complicated.

Three scenarios that most often convert into profit or profit protection:

- Early entry where liquidity accumulates. If stablecoins flow into a specific network or venue, trading conditions often improve there. Capital becomes available to execute trades, which directly affects move quality (less “empty” candles and fewer random spikes).

- Filtering “growth out of thin air.” Price movement without signs of liquidity inflow more often ends in a sharp pullback because buying power does not anchor the impulse. Practically, this means a simple advantage: fewer late entries where expected value is worse.

- Profit protection when systemic stress rises. When stablecoins behave unstably, spreads, liquidations, and overall volatility can change quickly. In those periods, the right objective is not “maximize,” but avoid giving profit back to the market.

What to track (three signals that deliver 80% of the value)

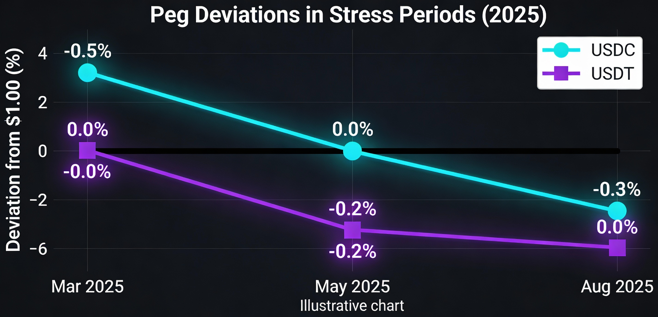

Peg breaks signal early stress, as seen in USDC deviations

Signal 1. Stablecoin supply

Supply growth more often signals rising potential liquidity inside the crypto system. Supply contraction more often signals capital moving to more conservative forms or reduced risk appetite.

Signal 2. Flows across networks and venues

Flows show where liquidity becomes “working.” This helps pick an environment where execution is easier and opportunities show up more often, rather than just discussions.

Signal 3. Price stability around 1.00

This linkage is often called the “peg.” If the “peg breaks,” it means the system starts operating less stably because the market is pricing in issues with redemptions, reserves, or overall liquidity. BIS research shows that public shocks and information about reserves can amplify deviations from 1.00 and change holder behavior.

Risk block. Why “more transparency” does not always save you

It feels intuitive that more transparency and reserve reporting should always make the system more stable. But BIS models and evidence suggest the effect of public information can be ambiguous. With weak prior beliefs about reserve quality, more disclosure can increase run risk; with strong beliefs, it can reduce run risk.

This matters for one reason. Market reaction to reserve news may be non-linear. Sometimes “good” news reduces stress, and sometimes any news increases coordination among participants and accelerates moves.

Where it’s more efficient and convenient to read alpha

The problem is not the absence of data. The problem is that manually it is hard to keep issuance, flows, on-chain activity, and market context in your head at the same time. That is exactly why those who shorten the time from signal to decision win.

When the site has a unified feed under the Stablecoins tag and token cards, it becomes easier to quickly see which stablecoins and related themes are “active” right now and which are falling out of market attention. This saves time and helps avoid giving profits back due to delayed reaction.

And when an AI analysis and noise-filtering layer is added, it becomes easier to turn a stream of signals into a clear trade hypothesis. This approach is especially useful in a 24/7 market, where manual control most often breaks during sharp moves.

Conclusion

Alpha is more often found not in guessing the next impulse, but in understanding when the market is even capable of sustaining that impulse. Stablecoins provide a measurable framework: liquidity expands—conditions improve; liquidity contracts or the “peg” breaks—the system operates less stably and the cost of mistakes rises.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024