Published: 13 Nov 2025

The Next Wave: Yield-Bearing and Programmable Stablecoins

After a year defined by regulation and institutional adoption, the stablecoin sector is entering a new phase — one driven by yield and programmability.

In 2025, the conversation is no longer about whether stablecoins are legitimate. It’s about how they can work smarter.

A new class of tokens — yield-bearing and programmable stablecoins — is turning idle liquidity into active, income-generating capital.

Projects like USDe, eUSD, and agEUR Yield are leading this transformation, combining the price stability of fiat-backed coins with on-chain strategies that produce consistent returns.

These assets automatically reinvest yields from collateral such as tokenized treasuries or staking rewards, using smart contracts to distribute income transparently and efficiently.

They represent the next wave in stablecoin evolution — assets that don’t just hold value, but create it.

This report explores how yield-bearing stablecoins function, the role of programmability in their design, and why they could become the foundation for the next generation of digital finance.

Key Takeaways — From Stability to Productivity

Stablecoins are evolving from static reserves into dynamic financial instruments.

Instead of just preserving value, the new generation actively generates it — shifting the narrative from “store of stability” to “engine of yield”.

-

Yield-bearing stablecoins like USDe, eUSD, and agEUR Yield offer 5-8% annualized returns, transforming how on-chain liquidity is managed.

-

Smart contracts handle all yield operations automatically — collecting, compounding, and distributing income in real time.

-

These models attract DAOs, treasuries, and institutional investors, offering an alternative to traditional money-market funds.

-

Programmable layers make stablecoins adaptable — they can plug into DeFi protocols, lending systems, or automated portfolios.

-

As yield becomes native, liquidity becomes productive — turning stablecoins into self-sustaining capital systems.

The result is a market that doesn’t just grow by adoption, but by functionality.

Stablecoins are no longer passive liquidity — they are programmable, yield-generating assets redefining the structure of on-chain finance.

Yield Model — How Income is Generated

The defining feature of yield-bearing stablecoins is that their collateral works while it’s held.

Unlike traditional fiat-backed models that keep reserves idle in bank accounts, these tokens channel collateral into on-chain or tokenized yield sources — from short-term treasuries to staking derivatives.

Projects such as Ethena’s USDe and Lybra’s eUSD exemplify this shift.

USDe generates income by using delta-neutral strategies combining staked ETH and perpetual futures, while eUSD distributes yield from staked Ethereum directly to token holders.

Similarly, Angle Protocol’s agEUR Yield reinvests euro-denominated collateral into DeFi yield pools, turning a static currency peg into an interest-bearing asset.

This architecture creates a new model of dual utility:

-

Stability, backed by overcollateralized or fiat-pegged assets.

-

Profitability, through automated yield generation and distribution.

In practice, the token’s smart contract receives yield continuously, compounds it, and either adjusts the token’s exchange rate or sends yield directly to the holder’s balance — all without manual action.

Comparison: Classic vs Yield-Bearing Stablecoins

| Feature | Classic Stablecoins (USDC / USDT) | Yield-Bearing Stablecoins (USDe / eUSD / agEUR) |

|---|---|---|

| Backing | Fiat reserves, cash equivalents | On-chain treasuries, staked assets |

| Yield | 0% | 5-8% annualized |

| Distribution | None | Automated via smart contracts |

| Use Case | Payments, trading, collateral | Treasury yield, passive income |

| Risk Type | Custodial, regulatory | Protocol, collateral-based |

Insight

By embedding yield at the protocol level, these assets function like on-chain money-market funds — but without intermediaries.

Every dollar of collateral becomes part of an automated investment cycle, producing income while maintaining price stability.

Programmable Layer — Smart Contracts and Automation

Yield-bearing stablecoins don’t rely on fund managers or custodians.

Instead, smart contracts handle every stage of their operation — from investing reserves to redistributing earnings.

This programmability layer is what makes them both efficient and transparent.

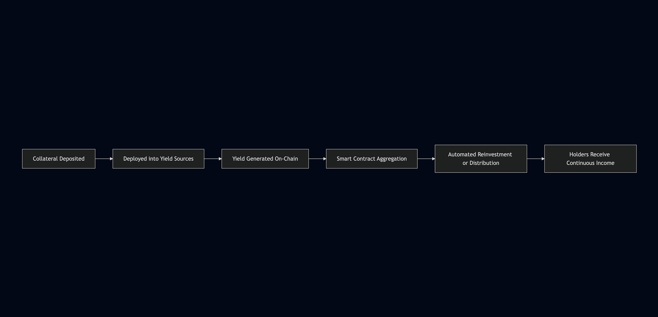

The process starts when collateral (such as staked ETH or tokenized T-bills) begins generating yield.

That yield is then captured by a smart contract, which automatically allocates returns — either compounding them into reserves or distributing them directly to holders.

Each cycle operates in real time, with no delays, manual approvals, or middlemen.

Programmable logic also introduces adaptive mechanisms.

For example:

-

Interest rates can adjust dynamically based on market performance.

-

Reserves can rebalance between protocols to optimize returns.

-

DAO treasuries can set automated payout schedules using the same contract logic.

This means the token becomes more than a payment instrument — it’s a self-managing micro-economy, capable of generating, tracking, and distributing yield independently.

Flow of Automated Yield Distribution

Insight

Programmable automation removes friction and trust dependencies from yield operations.

What used to require complex fund management now happens entirely through code-driven monetary logic — transparent, auditable, and unstoppable.

Market Impact — From DeFi Niche to Mainstream Use

What began as a small DeFi experiment has become a structural shift in the stablecoin market.

In just one year, the total supply of yield-bearing stablecoins expanded from $3.8 billion in 2024 to over $12 billion in 2025.

This surge reflects growing demand from institutions, DAOs, and corporate treasuries seeking transparent on-chain income rather than speculative returns.

For businesses, these tokens function as income-generating cash equivalents — digital assets that preserve value while earning yield automatically.

For DeFi protocols, they introduce a new source of organic liquidity, deepening lending and staking markets.

And for users, they provide a passive, fully on-chain alternative to savings accounts or money-market funds.

The shift is also attracting regulators and traditional financial players.

Jurisdictions that recently legalized fiat-backed stablecoins are now assessing how to classify yield-bearing ones — as securities, deposits, or a hybrid instrument.

Regardless of the classification, the trajectory is clear: stablecoins are no longer limited to stability — they’re becoming the core of programmable yield infrastructure.

Yield-Bearing Stablecoins Market Growth (2024-2025)

| Year | Total Supply ($B) | Avg Annual Yield | Primary Drivers |

|---|---|---|---|

| 2024 | 3.8 | 4.9% | DeFi adoption, ETH staking yield |

| 2025 | 12.1 | 6.7% | Tokenized treasuries, institutional use |

Insight

This growth shows how quickly programmable yield is redefining stablecoin utility.

The line between a stablecoin and an investment product is fading — replaced by a model where liquidity itself becomes productive.

Methodology & Sources

This analysis uses on-chain data from DefiLlama, Artemis, and TokenTerminal, combined with project transparency dashboards from Ethena (USDe), Lybra Finance (eUSD), and Angle Protocol (agEUR).

Yield figures represent annualized averages based on protocol-reported collateral returns between Q4 2024 and Q3 2025.

Market capitalization estimates include only fully collateralized yield-bearing stablecoins, excluding synthetic or leverage-based derivatives.

Growth metrics were modeled using supply data, yield fluctuations, and user adoption across Ethereum, Arbitrum, and Base networks.

All calculations assume continuous reinvestment through smart contracts without manual intervention — reflecting the automated nature of programmable yield systems.

Data accurate as of early November 2025, based on verified public disclosures and on-chain metrics.

Conclusion — The Future of Active Liquidity

Stablecoins have completed their evolution from static reserves to self-sustaining financial systems.

With yield-bearing and programmable models, liquidity no longer sits idle — it works continuously, autonomously, and transparently.

These tokens merge three financial layers into one: stability from reserve backing, profitability from automated yield, and efficiency from smart contract execution.

That combination positions them as the foundation of a new on-chain economy — one where every asset has purpose, and every dollar in circulation contributes to network productivity.

As institutions, DAOs, and fintech firms integrate these instruments, the line between money and investment begins to blur.

Yield-bearing stablecoins are becoming the digital equivalent of interest-bearing cash, providing programmable income streams that can move, earn, and settle globally in real time.

This is the logical next step for digital finance — money that not only holds value but creates it.

The future of liquidity is active, automated, and entirely on-chain.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024