Published: 21 Nov 2025

The Wallet Wars 2025 — Market Structure, Revenue Models, and User Behavior

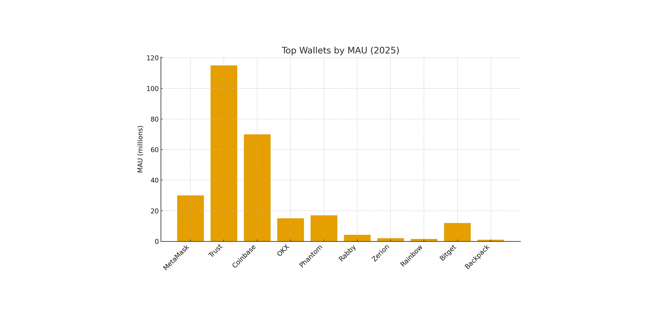

The wallet landscape changed fast in 2025. User numbers grew, revenue models shifted, and competition moved from simple storage to full trading, bridging, and app discovery. The data shows clear patterns. Trust Wallet now leads by reach with more than 115 million monthly users. MetaMask keeps its position as the top execution hub, earning an estimated 325 million dollars a year from swaps. Coinbase Wallet holds the strongest retention, especially inside the Base ecosystem, where its smart-wallet model makes onboarding easier.

Multichain coverage also became a key factor. Bitget Wallet and Trust Wallet support more than seventy networks. MetaMask stays focused on Ethereum and L2s, while Phantom and Backpack remain tied to Solana even as they expand to EVM. This fragmentation shapes how users move liquidity. Most swaps in major wallets now pass through a handful of aggregators like 0x, 1inch, Jupiter, and the internal routers of OKX or Bitget.

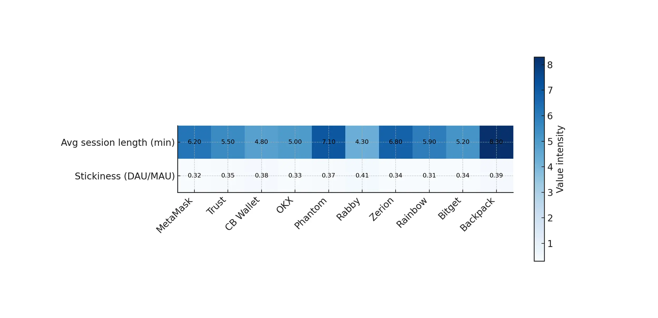

User behavior gives another angle. Phantom and Backpack show the longest session times. Rabby has the highest share of users who swap and bridge regularly. Safe and Coinbase Wallet lead in stickiness, helped by account-abstraction features that remove seed phrases and add social recovery. MPC wallets from Binance, Bitget, and OKX also gain traction as they reduce onboarding friction and feel closer to Web2 security.

As wallets grow into small platforms, they compete not just on networks and fees but on discovery, routing quality, and built-in financial tools. The data from 2024-2025 makes it clear: the next stage of competition is shaped by execution logic, liquidity routing, and the ability to keep users active inside a single interface.

Key Metrics: MAU, DAU, Retention, ARPU

The wallet market shows clear separation between scale, daily activity, and revenue efficiency. Trust Wallet leads by reach with more than 115 million monthly active users. MetaMask holds second place with 30 million, while Coinbase Wallet maintains a strong position driven by its Base ecosystem. When activity becomes the focus, smaller wallets like Phantom, Rabby, and Zerion rise in importance. They show longer sessions, more swaps per user, and higher stickiness than many larger wallets.

Retention paints a different picture. Safe and Coinbase Wallet reach nearly 70% monthly retention, showing that account-abstraction and strong recovery options help users stay active. MetaMask and Trust Wallet remain stable at around 60-65 %. Rabby and Phantom benefit from active DeFi users but carry slightly higher churn because their audiences trade more aggressively.

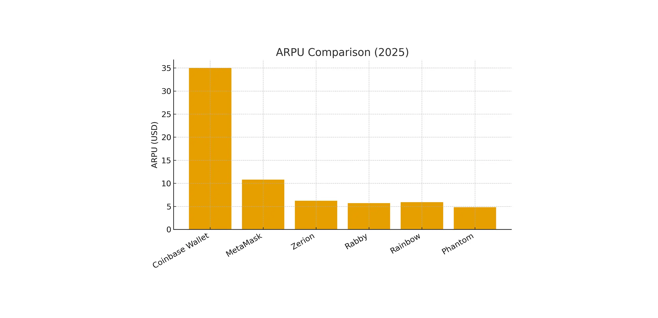

Revenue per user changes the rankings again. Coinbase Wallet leads with an estimated 35 USD per user annually, supported by its integration with Coinbase Pay and smart-wallet transactions. MetaMask follows with 10.8 USD, driven almost entirely by swap fees. Most other wallets stay between 1-6 USD per user, showing how important routing control is for monetization.

These metrics set the baseline for understanding the competition in 2025. Trust Wallet dominates by size. MetaMask dominates by monetization. Coinbase Wallet dominates by retention. Phantom and Rabby dominate in engagement depth. And Safe leads the shift toward AA-based smart accounts.

Top Wallet Performance Metrics — MAU, DAU, Retention, ARPU (2025)

| Wallet | MAU | DAU | Retention (30d) | Stickiness (DAU/MAU) | ARPU (USD) |

|---|---|---|---|---|---|

| Trust Wallet | 115,000,000 | 3,800,000 | 60% | 0.35 | 0.9 |

| MetaMask | 30,000,000 | 1,000,000 | 65% | 0.32 | 10.8 |

| Coinbase Wallet | 70,000,000 | 2,300,000 | 68% | 0.38 | 35 |

| OKX Wallet | 15,000,000 | 500,000 | 62% | 0.33 | 4.5 |

| Phantom | 17,000,000 | 570,000 | 64% | 0.37 | 4.8 |

| Rabby | 4,200,000 | 140,000 | 58% | 0.41 | 5.7 |

| Zerion | 2,000,000 | 70,000 | 55% | 0.34 | 6.2 |

| Rainbow | 1,500,000 | 50,000 | 53% | 0.31 | 5.9 |

| Bitget Wallet | 12,000,000 | 400,000 | 60% | 0.34 | 3.3 |

| Backpack | 1,000,000 | 35,000 | 50% | 0.39 | 3.0 |

| Safe | 1,000,000 | 30,000 | 70% | 0.30 | 2.1 |

| Exodus | 1,000,000 | 30,000 | 57% | 0.30 | 2.2 |

Trust Wallet dominates in raw scale. Coinbase Wallet captures the most revenue per user. MetaMask stays the main execution hub. Phantom, Rabby, and Zerion show deeper engagement despite smaller size. Safe stands out with the best retention thanks to account-abstraction.

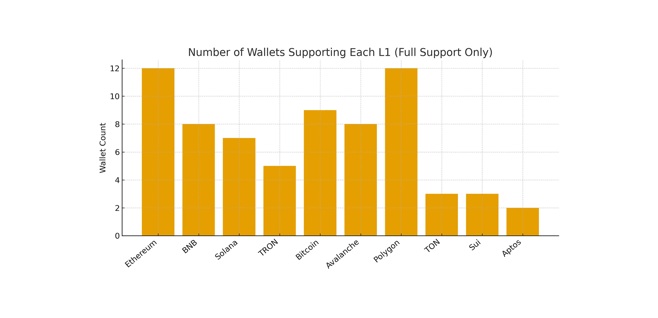

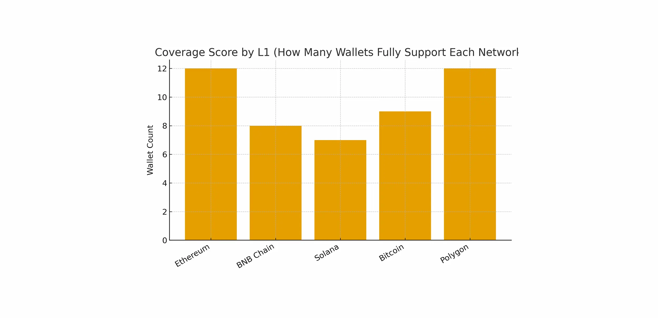

L1 Distribution per Wallet

Wallets expanded across more networks in 2025, but the coverage is uneven. Trust Wallet and Bitget Wallet offer the broadest reach, supporting more than seventy chains and handling almost every major L1 and L2. MetaMask stays focused on Ethereum and its layer-2 ecosystem, adding new networks only through Snaps. Phantom and Backpack remain Solana-first, even after adding limited multi-chain support.

This fragmentation matters. Routing quality, fees, and user behavior depend on which networks a wallet handles by default. Multi-chain wallets like Trust Wallet and Bitget reduce friction for users who move between ecosystems. Ethereum-centric wallets like MetaMask, Coinbase Wallet, Safe, Rainbow, and Zerion stay optimized for DeFi activity, L2 scaling, and EVM liquidity.

Solana-native wallets keep the fastest execution for SPL tokens but still rely on bridges like Wormhole for EVM access. As a result, network support becomes part of the competition: wallets with broader coverage capture casual users, while focused wallets compete through deeper integrations and better execution on a smaller set of chains.

L1 Support Matrix (Top 15 Wallets)

| Wallet | ETH | BNB | SOL | TRON | BTC | AVAX | Polygon | TON | Sui | Aptos | Primary L1 by traffic |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MetaMask | ✓ | partial | — | — | — | ✓ | ✓ | — | — | — | Ethereum |

| Trust Wallet | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | partial | partial | BNB Chain |

| Phantom | ✓ | — | ✓ | — | ✓ | — | ✓ | — | ✓ | — | Solana |

| OKX Wallet | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Ethereum |

| Coinbase Wallet | ✓ | — | — | — | ✓ | — | ✓ | — | — | — | Ethereum / Base |

| Zerion | ✓ | ✓ | ✓ | — | — | ✓ | ✓ | — | — | — | Ethereum |

| Rainbow | ✓ | — | — | — | — | — | ✓ | — | — | — | Ethereum |

| OneKey | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | — | — | — | BTC / ETH |

| Safe | ✓ | partial | — | — | — | ✓ | ✓ | — | — | — | Ethereum |

| Rabby | ✓ | ✓ | partial | — | — | ✓ | ✓ | — | — | — | Ethereum |

| Backpack | partial | — | ✓ | — | — | — | — | — | — | — | Solana |

| Bitget Wallet | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | BNB / ETH |

| TokenPocket | ✓ | ✓ | — | ✓ | ✓ | ✓ | ✓ | — | — | — | TRON / BNB |

| Exodus | ✓ | — | ✓ | — | ✓ | ✓ | ✓ | — | — | — | BTC / ETH |

| XDEFI | ✓ | ✓ | ✓ | — | ✓ | ✓ | ✓ | — | — | — | ETH / THORChain |

Trust Wallet and Bitget offer the widest network coverage. MetaMask stays focused on Ethereum and L2 ecosystems. Phantom and Backpack remain Solana-first. This uneven coverage shapes routing, swap prices, and user movement across chains in 2025.

Wallet → DEX Routing Flows

Routing became one of the biggest differentiators between wallets in 2025. Most users no longer care which DEX they interact with directly. Instead, they depend on the routing engine inside the wallet. This means the wallet, not the DEX, decides where liquidity comes from, which aggregator is used, and how much the user pays in fees.

MetaMask, Coinbase Wallet, Rabby, Zerion, Rainbow, and Bitget rely heavily on 0x, 1inch, and Paraswap to route execution. Phantom stays tied to Jupiter on Solana, giving it the most consistent execution for SPL tokens. OKX Wallet and Bitget Wallet use internal routers, capturing more value inside their own ecosystem and reducing dependency on third-party aggregators.

This routing logic affects everything: price quality, speed, MEV exposure, and the hidden spreads that become revenue for the wallet. It also shapes how liquidity moves across chains. Wallets that use Li-Fi, Synapse, Wormhole, Hop, and Orbiter direct users through specific bridges, creating patterned flows between Ethereum, L2s, Solana, and BNB Chain.

The result is simple. Routing engines now define the user’s trading experience. Wallets that pick the best routes earn trust. Wallets that use internal routers capture more fees. And wallets connected to a single aggregator inherit its strengths and weaknesses.

Main Table — Wallet → DEX Routing Flows

| Wallet | Default Swap Provider | Secondary Routing Providers | Preferred chains for swaps | % swaps via aggregator | Notable integrations |

|---|---|---|---|---|---|

| MetaMask | 0x API | 1inch, Paraswap, Odos, CoW | ETH, BNB, Polygon, Arbitrum | 100% | MetaMask Bridges (Li-Fi), 0.875 % service fee |

| Trust Wallet | 1inch + Jupiter | Paraswap, 0x, Mayan | BNB, ETH, Polygon, Solana | ~95% | 1inch for EVM, Jupiter for SOL |

| Phantom | Jupiter | Raydium, Orca, Lifinity | Solana, Ethereum, Polygon | 100% | Jupiter limit orders, perps |

| OKX Wallet | OKX DEX | 1inch, 0x, Paraswap | ETH, BNB, Polygon, Solana | ~90% | OKX Bridge, Smart Route |

| Coinbase Wallet | 0x API | 1inch, Uniswap | ETH, Base, Polygon, Arbitrum | 100% | AA smart-wallet routing |

| Rabby | 1inch | Paraswap, 0x, CowSwap | EVM (240+) | ~95% | “Best Route” scoring engine |

| Zerion | Zerion Router (1inch+0x) | Paraswap, Li-Fi | ETH, BNB, Polygon, Arbitrum | 100% | Portfolio swaps + bridge |

| Rainbow | Rainbow Router | — | ETH, Base, Polygon | 100% | 0.85 % spread |

| Bitget Wallet | Bitget Swap | 1inch, 0x, Jupiter | 130+ chains | ~92% | Cross-chain gas tank |

| Backpack | Jupiter | — | Solana, Ethereum | 100% | xNFT swap widget |

Routing Flow Diagram

MetaMask ──► 0x ──► Ethereum MetaMask ──► 0x ──► Arbitrum MetaMask ──► 0x ──► Polygon

Trust Wallet ──► 1inch ──► BNB Trust Wallet ──► 1inch ──► Ethereum Trust Wallet ──► Jupiter ──► Solana

Phantom ──► Jupiter ──► Solana Phantom ──► Jupiter ──► Polygon

OKX Wallet ──► OKX DEX ──► Ethereum OKX Wallet ──► OKX DEX ──► Solana

Coinbase Wallet ──► 0x ──► Base Coinbase Wallet ──► 0x ──► Arbitrum

Rabby ──► 1inch ──► Ethereum Rabby ──► 1inch ──► BNB

Zerion ──► Zerion Router ──► Ethereum Zerion ──► Zerion Router ──► Polygon

Rainbow ──► Rainbow Router ──► Base

Bitget Wallet ──► Bitget Swap ──► BNB Bitget Wallet ──► Bitget Swap ──► Solana

Backpack ──► Jupiter ──► Solana

Most major wallets route swaps through 0x, 1inch, and Jupiter. Internal routers from OKX and Bitget capture more value but reduce flexibility. Routing engines now define execution quality, bridge selection, and cross-chain flows — making them one of the strongest competitive factors in 2025.

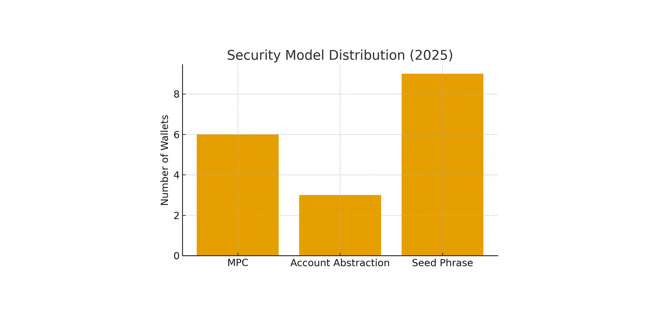

Security Race: MPC vs AA vs Seed

Security determines how people onboard, recover their wallets, and protect funds during attacks. In 2025, wallets split into three security models: MPC, Account Abstraction, and seed-phrase wallets. Each model solves a different problem, and each one shapes how users behave.

MPC wallets — led by Binance Web3 Wallet, OKX Wallet, Bitget Wallet, and Zengo — remove seed phrases entirely. They replace them with biometric authentication, cloud recovery, and split-key cryptography. This makes them the easiest wallets for beginners and the safest against phishing. Exchanges push MPC because it keeps users inside their identity ecosystem while staying technically non-custodial.

Account Abstraction (AA) is the second wave. Coinbase Smart Wallet and Safe use ERC-4337 to remove seeds, enable social recovery, add passkeys, and support automated transactions. This is the first model where security and UX align: users sign with Face ID, developers use paymasters, and institutions configure guardians. Safe now holds the strongest retention rate in the entire dataset — a direct result of AA reducing both friction and anxiety around key management.

Seed-phrase wallets remain the largest group. MetaMask, Trust Wallet, Phantom, Rabby, Rainbow, Exodus, and others still depend on 12 or 24 words. These wallets give users full control but expose them to human error. More funds have been lost through compromised seed phrases than through all smart-contract hacks combined. The model is simple and battle-tested, but its weakest point is always the user.

The market is now split: MPC leads onboarding. AA defines the next UX standard. Seed wallets stay dominant by inertia — but not by safety.

Core Table — Security Models Across Top Wallets

| Wallet | Security model | Backup / recovery | Risk level | UX complexity | Supported chains | Owner |

|---|---|---|---|---|---|---|

| Zengo | MPC | Face scan + cloud | Low | 3 | BTC, ETH, SOL | Zengo |

| Coinbase Smart Wallet | AA | Social recovery, passkeys | Low | 3 | ETH, Base, L2s | Coinbase |

| Safe | AA | Social guardians | Low | 5 | ETH, L2s | SafeDAO |

| Bitget Wallet | MPC | Device + server split | Low | 4 | 130+ | Bitget |

| OKX Wallet | MPC | Account + biometrics | Low | 4 | 60+ | OKX |

| Binance Web3 Wallet | MPC | Exchange account | Low | 3 | 35+ | Binance |

| MetaMask | Seed | 12-word mnemonic | Medium | 6 | 11+ | ConsenSys |

| Trust Wallet | Seed | 12-word mnemonic | Medium | 5 | 70+ | Binance |

| Phantom | Seed | 12-word mnemonic | Medium | 4 | SOL, ETH | Phantom |

| Rabby | Seed | 12-word mnemonic | Medium | 5 | 240+ | DeBank |

| Rainbow | Seed | 12-word mnemonic | Medium | 4 | ETH, L2s | Rainbow |

| OneKey | Seed + optional MPC | 12-word + device | Medium | 7 | 60+ | OneKey |

| Backpack | Seed | 12-word mnemonic | Medium | 4 | SOL, ETH | Coral |

| Exodus | Seed | 12-word mnemonic | Medium | 5 | 50+ | Exodus |

| TokenPocket | Seed | 12-word mnemonic | Medium | 6 | 20+ | TP Foundation |

Mini-Analysis: Where each model wins

MPC wins onboarding Seedless login + biometrics + account-linked recovery = fewer mistakes and fewer attack vectors. Large exchanges push MPC because it keeps users inside the ecosystem.

AA wins retention Safe and Coinbase Smart Wallet show the lowest churn because users don’t fear losing access. Passkeys, social recovery, session keys, and paymasters remove UX friction.

Seed wallets win compatibility They still support the widest set of chains, dApps, and hardware devices. They stay default because the crypto ecosystem was built around them.

MPC delivers the safest UX. AA sets the long-term direction for wallet design. Seed-phrase wallets keep the largest market share, but they now represent the weakest security model in mainstream use.

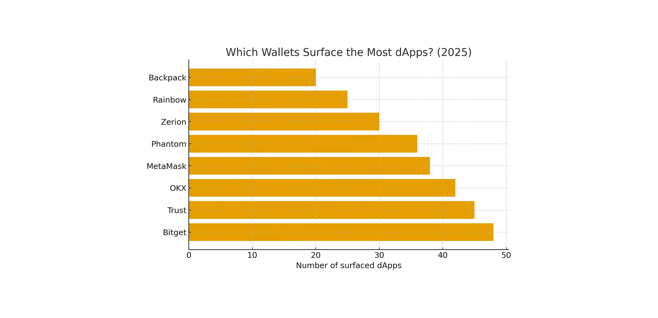

Wallet Ecosystems & Discoverability

Wallets are no longer simple key managers. In 2025, they function as mini-app stores for DeFi, NFTs, L2s, bridges, and cross-chain swaps. The ecosystem inside each wallet shapes what users discover, which protocols get traffic, and where liquidity moves.

The strongest ecosystems — MetaMask, Trust Wallet, Coinbase Wallet, OKX Wallet, Phantom, Zerion, Rainbow, Bitget Wallet, and Backpack — now serve as both execution layers and discovery platforms. Their home screens direct users toward trending tokens, curated dApps, NFT mints, staking pools, L2 ecosystem apps, and internal cross-chain tools. This gives wallets massive influence over protocol visibility.

Wallets tied to an exchange (Binance Web3, OKX Wallet, Bitget Wallet) push users toward in-house swaps, bridges, and staking pools. This tight integration boosts revenue but creates more closed ecosystems.

Self-custodial wallets (MetaMask, Rainbow, Phantom, Rabby, Zerion) emphasize discovery: DeFi dashboards, curated lists, risk scanners, trending charts, dApp browsing, and multi-chain explorers.

The competition now centers on discoverability: who surfaces the best opportunities, who gives actionable context, and who reduces the navigation friction across chains. Wallets that make exploration simple win engagement — and routing volume.

Main Ecosystem Table

| Wallet | Default DEX/aggregator | Default bridge | Top chains | Featured dApps | Discovery features |

|---|---|---|---|---|---|

| MetaMask | 0x API | Li-Fi | ETH, BNB, L2s | Uniswap, Aave, OpenSea | Explore tab, Snaps store |

| Trust Wallet | 1inch + Jupiter | Binance Bridge | ETH, BNB, SOL, BTC | PancakeSwap, Venus, Orca | DApp browser, trending |

| Coinbase Wallet | 0x | Coinbase Bridge | ETH, Base, L2s | Uniswap, Zora, BaseSwap | Discover feed |

| OKX Wallet | OKX DEX | OKX Bridge | 60+ chains | Solend, Raydium | DeFi/NFT/Game-Fi discover |

| Phantom | Jupiter | Wormhole | SOL, ETH, BTC | Magic Eden, MarginFi | Trending tokens, xNFTs |

| Rabby | 1inch | Synapse, Hop | 240+ EVM | Blur, Curve, EigenLayer | DeFi category sorting |

| Zerion | Zerion Router | Li-Fi, Socket | ETH, BNB, L2s | Lido, Convex | Portfolio-first discovery |

| Rainbow | Rainbow Router | Hop, Connext | ETH, Base, OP, Zora | Zora, OpenSea | NFT mints carousel |

| Bitget Wallet | Bitget Swap | Bitget Bridge | 130+ chains | PancakeSwap, Ston.fi | DApp Center, airdrop alerts |

| Backpack | Jupiter | Wormhole | SOL, ETH | Magic Eden, Solend | xNFT marketplace |

Ecosystem Flow Diagram

MetaMask ──► 0x ──► Ethereum ──► Uniswap MetaMask ──► Li-Fi ──► Arbitrum ──► Aave

Trust Wallet ──► 1inch ──► BNB ──► PancakeSwap Trust Wallet ──► Jupiter ──► Solana ──► Orca

Coinbase Wallet ──► 0x ──► Base ──► BaseSwap Coinbase Wallet ──► Coinbase Bridge ──► Ethereum ──► Zora

Phantom ──► Jupiter ──► Solana ──► Magic Eden Phantom ──► Wormhole ──► Ethereum ──► Uniswap

Zerion ──► Zerion Router ──► Ethereum ──► Lido Zerion ──► Li-Fi ──► Polygon ──► QuickSwap

Rainbow ──► Rainbow Router ──► Base ──► Friend.tech Rainbow ──► Hop ──► Optimism ──► Zora

Bitget Wallet ──► Bitget Swap ──► BNB ──► Biswap Bitget Wallet ──► Bitget Bridge ──► Solana ──► Raydium

Backpack ──► Jupiter ──► Solana ──► Solend

Mini-analysis

Trust Wallet and Bitget Wallet have the deepest app catalogs due to multi-chain coverage and built-in DApp centers.

MetaMask leads in modularity with Snaps, which extend compatibility into Solana, Starknet, and Bitcoin.

Phantom and Backpack dominate Solana-native discovery with NFTs and xNFTs integrated directly.

Coinbase Wallet focuses on curated feeds — a smaller catalog but better editorial control.

Zerion and Rainbow specialize in DeFi and NFT discovery with clean UX-first designs. The strategic difference: Some wallets maximize breadth. Others maximize context. The winners are the ones who reduce friction while surfacing credible opportunities.

Discoverability now defines how users find protocols. Multi-chain DApp browsers drive breadth, while curated feeds and xNFT modules drive depth. Wallet ecosystems have become one of the strongest competitive layers in the 2025 wallet market.

Conclusion – The Wallet Wars Enter Their Next Phase

The wallet market has shifted from simple key storage to a full-stack competition for liquidity, user flow, and discovery. In 2025, wallets define how people onboard, where they trade, which chains they adopt, and how much they trust crypto infrastructure. The data makes the landscape clear.

Trust Wallet dominates in scale, but size no longer guarantees control. MetaMask remains the execution hub because its routing sits at the center of EVM liquidity. Coinbase Wallet earns the most per user, using account abstraction to reduce friction and deepen retention. Phantom and Backpack continue pushing Solana-native UX, while OKX Wallet and Bitget Wallet use internal routing engines to keep value inside their own ecosystems.

Security models are splitting the market. MPC has become the easiest way to onboard beginners. Account abstraction now delivers the best retention. Seed-phrase wallets still hold the largest share, but they increasingly lag in safety and modern UX. The competition now revolves around who can minimize risk without limiting flexibility.

Routing engines have become the real battlefield. Wallets that use 0x, 1inch, Paraswap, and Jupiter shape the flow of liquidity across Ethereum, L2s, and Solana. Wallets with internal routers capture more revenue, but at the cost of reduced neutrality. As execution shifts toward aggregators and cross-chain bridges, routing efficiency becomes a long-term moat.

Ecosystem depth is the last piece. Wallets now serve as discovery platforms, pushing users toward specific dApps, staking modules, NFT markets, and L2 ecosystems. Some focus on breadth, others on curation, but all compete for one thing — controlling the user’s next click.

The Wallet Wars are no longer about features.

They are about influence: who captures the swap, who directs the bridge, who surfaces the opportunity, and who holds the user.

In 2025, wallets operate as the real consumer layer of web3.

And the ones that control routing, execution, and discovery now sit at the center of the entire crypto economy.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024