Published 08 Sep 2025

Top 7 AI Tools for Crypto, Stock, and Forex Traders

AI-powered trading systems now handle over 70% of global trading volume and are revolutionizing financial markets. These sophisticated tools boost analysis, spot patterns, and help traders discover insights that lead to smarter strategies and quicker decisions.

Trading opportunities and risks fill the 24/7 foreign exchange market, which makes price movement predictions and profitable trades challenging. AI crypto trading platforms have become crucial for spotting trading opportunities. AI stock trading systems excel at analyzing financial charts that human traders find difficult. The impact of AI forex trading tools shows in automated trades and removal of emotional decision-making.

But today's crowded marketplace makes choosing the right AI trading solution overwhelming. A trader's style, goals, and technical comfort level determine the best choice. This piece compares AI trading solutions that deliver results by examining their features, security measures, and performance in different trading scenarios.

ChatGPT Plus

ChatGPT Plus stands out from other AI trading tools. Its features go beyond simple analysis. This OpenAI subscription service gives traders advanced features to improve their decisions in cryptocurrency, stock, and forex markets.

ChatGPT Plus Capabilities for AI Crypto Trading

ChatGPT Plus offers major benefits to cryptocurrency traders through its web browsing feature. Plus subscribers can see up-to-the-minute market data, which helps them track fast-changing crypto conditions. They can request current price analysis, market sentiment assessment, and trend identification.

The platform excels at detailed cryptocurrency research. Plus subscribers can use this feature to analyze token fundamentals, track market movements, and assess potential investments. ChatGPT Agent's launch in July 2025 brought a big step forward for crypto traders. This feature combines up-to-the-minute web browsing with deep analytical tools and conversational intelligence. Users get a unified assistant that handles multiple tasks at once.

ChatGPT Agent enables crypto traders to:

- Automate research processes on platforms of all types

- Generate AI crypto trading strategies based on current market conditions

- Monitor token liquidity and portfolio performance

- Create customized dashboards for tracking investments

- Identify arbitrage opportunities across multiple trading pairs

ChatGPT Agent scans social media platforms, news feeds, and blockchain explorers to spot early market signals. Traders receive alerts about major whale movements, token listings, or regulatory updates before these factors affect the market fully.

ChatGPT Plus Performance in Chart Pattern Recognition

Chart pattern recognition stands as one of ChatGPT Plus's best features for traders. The platform shows remarkable accuracy when it interprets trading charts and spots technical patterns human eyes might miss.

The system analyzes cryptocurrency charts with precision. It identifies price movements, support and resistance levels, and common patterns like head and shoulders, double tops, and flag formations. The platform calculates live technical indicators including Simple Moving Averages (SMA), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD).

To name just one example, a properly configured ChatGPT Plus monitors Bitcoin and Ethereum price charts hourly. It flags SMA crossovers and generates potential buy or sell signals automatically. This round-the-clock monitoring helps traders catch important moves in the 24/7 cryptocurrency market.

The system's Optical Character Recognition (OCR) technology reads and understands text from chart images. When looking at a Bitcoin chart, ChatGPT spots the current price, market capitalization, trading volume, and supply information. It also tracks the chart's direction, noting price changes over different timeframes.

ChatGPT Plus Pricing and Accessibility

Users can get ChatGPT Plus for $20.00 monthly. This makes it cheaper than many specialized trading platforms. The subscription includes several key benefits:

- General access to ChatGPT, even during peak usage times

- Quick responses for time-sensitive trading queries

- First access to new features and improvements

- Extended access to GPT-5, OpenAI's flagship model

- Higher limits on messaging, file uploads, data analysis, and image generation

- Standard and advanced voice mode with video and screensharing

Traders worldwide can use the platform. OpenAI offers higher-tier subscriptions for users who need more advanced features. These include Pro ($200.00/month) and Business ($25.00 per user/month billed annually).

ChatGPT Plus gives users the best mix of cryptocurrency research features at its price point. Web browsing lets traders see current market data without switching platforms. The data analysis tools help process complex market information quickly to get useful insights from large datasets.

Security features protect user data with encryption in transit (TLS 1.2) and at rest (AES-256). Strict access controls determine who sees user data. This security setup keeps sensitive trading information and strategy details safe.

TrendSpider

TrendSpider is changing how we trade with its automated platform that uses advanced algorithms to simplify technical analysis. This state-of-the-art AI-powered trading solution stands out in the market. It works with many asset classes, making it an excellent choice for traders who want to automate their work.

TrendSpider’s Automated Technical Analysis

The platform's main strength comes from its automated technical analysis that saves hours of manual charting. Smart algorithms automatically detect and draw trendlines with mathematical precision. This helps remove personal bias in technical analysis and spots patterns human eyes might miss.

The pattern recognition technology can spot over 300 candlestick patterns and chart formations automatically. These patterns include wedge patterns, channels, triangles, double tops and bottoms, head and shoulders formations, and broadening formations. Traders don't need to find these patterns manually – the platform highlights them with labels for faster decisions.

TrendSpider's multi-timeframe analysis lets traders see patterns on different timeframes at once. This helps them find stronger setups where patterns match up on multiple timeframes. The platform also creates automated Fibonacci measurements and support/resistance heatmaps that show where prices tend to cluster.

The system watches trendlines and tells traders when prices break important levels. This feature helps traders who can't watch charts all day but need to act fast on breakouts.

TrendSpider for AI Stock Trading

TrendSpider's AI tools make it different from other platforms. The AI Strategy Lab helps traders build custom machine learning models for any market, timeframe, or strategy without coding. Traders can pick their training data, model type, goals, and inputs to create prediction models that match their trading style.

The platform has a no-code Strategy Tester where traders can build, test, and improve trading systems using 50 years of market data. They can test strategies in different market conditions to see what works best. This helps traders know which approaches work in specific market situations.

Stock traders can use advanced screening tools to mix and match technical indicators for ideal setups. The easy-to-use interface lets them combine factors like bullish chart patterns on high-volume stocks with upcoming earnings releases to create targeted scans.

The platform has unique data sources that other systems don't offer, such as unusual options order flow data, retail trading activity percentages, and dark pool volume information. Stock traders can use these insights with traditional technical indicators.

Sidekick, the platform's AI trading assistant, was added recently. It answers questions, looks at charts, and finds insights right away. Traders can quickly understand complex market data and spot opportunities without doing extensive analysis.

TrendSpider Pricing and Plans

TrendSpider has four subscription levels that offer more features as you go up:

Standard Plan – $107.00 monthly or $642.00 yearly (with discount). The plan has 5 open workspaces, 5 trading bots, 10 alerts (30-day duration), 1-minute charting, 2-hour backtest with 2K depth, 2-hour scanning, and standard support.

Premium Plan – Most traders choose this one at $137.00 monthly or $1,092.00 yearly. You get 10 open workspaces, 10 trading bots, 50 alerts (90-day duration), 1-minute charting, 1-minute backtest with 10K depth, 5-minute scanning, and standard support.

Enhanced Plan – $183.00 monthly or $1,464.00 yearly. This plan comes with 15 open workspaces, 50 trading bots, 100 alerts (180-day duration), 1-minute charting, 1-minute backtest with 20K depth, 1-minute scanning, and priority support.

Advanced Plan – The top tier costs $447.00 monthly or $2,682.00 yearly. It includes 20 open workspaces, 100 trading bots, 400 alerts (365-day duration), 1-minute charting, 1-minute backtest with 30K depth, 1-minute scanning, priority support, and weekly training sessions. New users can save up to 32% on their first bill. While there's no free version, you can try it for 14 days at a special rate.

You can add extras like more backtest depth for Standard and Premium plans ($39.00/month) and different Sidekick AI assistant packages. These range from free (10 messages/month) to $349.00/month (1,000 messages/month) with access to various AI models.

Trade Ideas (Holly AI)

Trade Ideas stands out with its Holly AI system in the AI trading world. This smart trading assistant looks at millions of data points each day to give practical trade suggestions right when needed.

Holly AI’s Predictive Trade Signals

Holly AI runs millions of tests every night on more than 8,000 US stocks using over 60 unique algorithm strategies. The system only picks strategies with a win rate above 60% and an estimated risk-reward ratio of 2:1 for the next day's signals. This careful screening helps traders get the best possible trades.

Holly works as a complete trading system, not just a suggestion tool. The system typically starts 5 to 25 trades each day and shows exact entry points, stop-loss levels, and profit targets. Traders don't have to guess what to do next.

The system comes in three different versions:

- Holly Grail: The first AI system that uses 70 different strategies on all US stock exchanges

- Holly 2.0: A bolder version showing higher-risk trades

- Holly Neo: The latest version that focuses on immediate chart patterns and technical setups

Numbers show how well Holly works as an AI trading solution. The system has beat the market in the last three years without using leverage, giving back about 20% each year. Yes, it is impressive that Holly 2.0 has outperformed the S&P 500 by 31% since 2019.

Trade Ideas for Intraday Stock Setups

Holly AI spots intraday opportunities in markets of all types. The system uses special strategies like breakout detection, pullback entries, and momentum plays. Holly's algorithm watches stock trades non-stop and finds statistical patterns that have made money before.

Holly's biggest strength lies in finding promising trades before others notice them. This gives traders a vital timing advantage in quick-moving markets. Real trading examples show how Holly spotted Canadian Solar Inc. (CSIQ) right as volume went up and price broke from a tight base. This helped traders position themselves before earnings came out.

The platform's scanning features optimize trading results. Holly alerts users through the 'Holly A.I.' channel when it sees familiar patterns forming. The system's value goes beyond day trading. Many signals turn into multi-day or even multi-week opportunities that traders can follow in the Holly Longterm Window.

Traders can follow Holly's suggestions by hand or use automatic features. The platform merges with several brokers including Interactive Brokers. Users can trade directly from the Holly Strategy Trades Window with one click.

Trade Ideas Pricing and Value

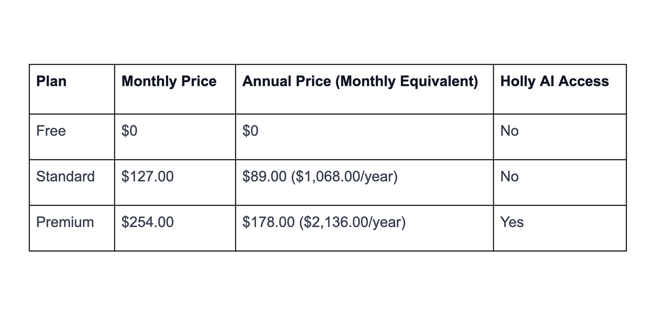

Trade Ideas has three subscription levels:

The Standard plan has immediate data, paper trading, and customizable layouts. You need the Premium subscription to use Holly AI. This plan also gives you backtesting tools, smart risk levels, and advanced trading templates.

Active traders often find the premium price worth it. The system gives them an edge by finding quality trades and managing risk clearly. Holly AI helps new traders learn and experienced traders do better.

Holly AI brings value through automation, statistical accuracy, and openness. The system helps traders cut through market noise by showing mathematically tested opportunities based on past results. Many traders find that Holly pays for itself by finding profitable trades and reducing emotional decisions.

QuantConnect

QuantConnect stands out as a formidable player in the algorithmic trading world. The platform gives traders a sophisticated infrastructure to develop and deploy automated trading strategies. This cloud-based system handles over USD 45.00B in notional volume monthly. Professional traders find it a complete solution for their needs.

QuantConnect for Algorithmic AI Forex Trading

The platform's strong support for ai forex trading comes from its wide range of currency pair options. Traders can access 71 foreign exchange pairs with data dating back to January 2007. This depth of historical information lets traders test their strategies through different market cycles.

Traders can access forex data at multiple frequencies from tick-level to daily bars. This gives them the freedom to build strategies for different timeframes. The granular data supports everything from high-frequency trading systems to long-term position strategies.

The platform merges with OANDA, a 28-year-old broker serving clients in over 240 countries. This connection lets algorithms execute trades through OANDA's liquidity providers without any manual steps.

The platform excels at supporting advanced forex strategies like:

- Carry trades that borrow from lower interest currency pairs to fund purchases of higher interest rate pairs

- News-based strategies that explore how global news cycles affect currency movements

- Technical pattern recognition across multiple currency pairs at once

The platform's accurate modeling of buying power and margin requirements helps algorithms stay within proper margin limits. Orders through connected brokers might face ground slippage, which mirrors actual market conditions.

QuantConnect Backtesting and Data Access

Backtesting capabilities are the platform's crown jewel. The engine runs a typical 10-year equity backtest in just 33 seconds. This speed lets traders quickly refine their strategies. The event-driven simulation architecture processes market data with remarkable efficiency.

The platform runs over 15,000 backtests daily. This number shows its popularity among serious algorithmic traders. Traders can test multiple assets in portfolios with thousands of securities while modeling realistic margins.

The platform connects to terabytes of financial, fundamental, and alternative data that comes ready to use. Alternative data sources link to underlying securities with proper identifiers (FIGI, CUSIP, ISIN). This makes building sophisticated strategies easier.

Historical data availability varies by resolution:

Parameter sensitivity testing is a great way to get insights. Traders can run thousands of full backtests on flexible cloud computing infrastructure. This turns weeks of work into minutes. Visual heatmaps show how sensitive a strategy is to different parameters. These help identify robust configurations for out-of-sample trading.

QuantConnect Technical Requirements

The platform needs specific system requirements to run locally. Windows users need a 64-bit processor, 4GB RAM minimum, Windows 10 (version 1903 or higher), hardware virtualization enabled, and at least 60GB of storage. Linux systems need the same RAM and storage requirements.

Docker is essential because algorithms run in containers. These containers include a minimal Linux-based operating system, the LEAN engine, and all packages from QuantConnect.com. This setup ensures development and production environments match perfectly.

Setting up takes about 10 minutes, plus an hour to download the latest LEAN image. The platform gets updated LEAN images automatically when the current version is over a week old. This keeps users up to date with the newest features.

Institutional users can opt for a Private Cloud add-on. This creates a cluster of centrally managed servers for distributed teams. The setup is nowhere near as resource-intensive as having each trader maintain their own data or GPU resources.

QuantConnect goes beyond simple AI trading tools. The platform offers institutional-grade algorithmic trading capabilities. This makes it an excellent choice for serious traders who want to develop advanced strategies across forex, equities, and other markets.

TradingView

TradingView stands out as a complete charting platform that uses sophisticated AI capabilities to recognize patterns in assets of all types. The platform has grown into a strong ecosystem where traders can access over 100,000 public indicators and get support from an active community.

TradingView’s AI Pattern Recognition

The platform shines through its automated chart pattern recognition technology that spots complex formations with mathematical precision. The Auto Chart Pattern indicator follows multiple steps to detect patterns. It derives multi-level recursive zigzag for various combinations and checks pivots for valid trendline pairs. The patterns then go through detailed classification based on geometrical shapes (wedges, triangles, channels), pattern direction (ascending, descending, bi-directional), and formation dynamics (converging, diverging, parallel).

TradingView goes beyond simple pattern recognition with advanced neural network-based systems. The CNN Statistical Trading System applies convolutional neural network principles to price action through six specialized convolution kernels. These kernels detect momentum changes, reversal patterns, consolidation phases, and breakout setups simultaneously. This smart approach creates a composite score from -1 to +1, showing both directional bias and signal confidence.

Traders who focus on specific pattern types can use the Harmonic Pattern Detection tool. It identifies XABCD harmonic patterns that many consider the most accurate trading signals. Each pattern gets a score that helps traders tell strong formations from weak ones.

TradingView for Multi-Asset Analysis

TradingView's unique strength comes from its ability to analyze multiple assets at once across different timeframes. The Multi-Asset TF RSI indicator lets traders compare Relative Strength Index values between two assets, with custom timeframes for each instrument. This feature proves valuable when analyzing related markets, like cryptocurrency movements against dollar strength.

The platform's Multi-Asset Similarity Matrix offers a visual way to analyze relationships between assets. This tool calculates correlations using several mathematical measures, including Euclidean Distance, Correlation Coefficient, and Cosine Similarity. It creates color-coded visualization tables where red shows low similarity and blue indicates high correlation.

The Multi-Asset Histogram indicator shows how multiple assets perform against each other. This helps traders spot dominant assets and overall market trends. Users can input up to 10 different symbols for histogram analysis, with colors ranging from red (negative) to aqua (positive).

TradingView Community and Scripting Tools

TradingView's social features make it different from other trading platforms. It works like a social network where traders discuss market developments live and share their evolving opinions and ideas. This community-driven approach creates a valuable ecosystem where users learn from each other and get feedback on their market analysis.

Pine Script, TradingView's programming language, sits at the community's heart. This language is designed specifically to create custom indicators and strategies. Traders use this accessible coding language to develop tailored tools and share them with others. The platform contains a vast library of open-source scripts that community members study, modify, and build upon.

Developers who want to protect their intellectual property can publish scripts with protected source code. This feature lets creators share functionality while retaining control over their underlying code. It supports both knowledge sharing and commercial applications.

TradingView combines powerful AI pattern recognition, multi-asset analysis capabilities, and an active community. These features make it essential for traders who want to improve their market analysis in cryptocurrency, stock, and forex markets.

MetaTrader 4 with AI Plugins

MetaTrader 4 (MT4) stands out among AI trading platforms with its broad support for AI plugins and expert advisors. The platform started as a forex trading solution but grew into a versatile system that handles multiple asset classes through smooth integration.

MT4’s Integration with AI Expert Advisors

Expert Advisors (EAs) serve as the life-blood of MT4's AI implementation. These pre-programmed robots handle trades automatically based on set rules without human input.

Traders can develop EAs of any complexity using the platform's MQL4 integrated development environment. AI advancement has made EA creation simpler over the last several years. Traders now input trading parameters to AI platforms in plain English and get ready-made EA files for automated trading.

MT4's advanced capabilities shine through the AI Trading Connection Expert Advisor. This tool provides quick technical and fundamental analysis by combining with leading AI models like ChatGPT and Claude. WebRequest functions connect MT4 charts to external AI services, which enables support and resistance detection, pattern recognition, and sentiment analysis.

MT4 for Automated Forex Trading

MT4 excels at algorithmic trading and removes barriers in analytical and trading activities. The platform processes trading algorithms through several steps:

- Development in the MQL4 programming language

- Testing in the built-in Strategy Tester

- Optimization for market conditions

- Deployment for live trading

Traders can test their AI strategies using historical data before going live. This helps evaluate performance under different market conditions. This vital step verifies the robot's abilities and spots areas to improve. Traders can adjust EA settings to match their trading style after successful testing by fine-tuning risk levels and trade execution rules.

MT4 Plugin Ecosystem

MT4 supports AI-powered plugins of all types that improve its built-in features. Users get access to more indicators and expert advisors through premium upgrades, including mini charts, OCO orders, and keyboard trading functions. These tools let traders build algorithms, test strategies, and execute trades directly from charts.

The platform's plugin ecosystem appeals to traders because it removes emotional decision-making. These tools ensure consistent and disciplined trading by automating the process based on set criteria. Robots can watch markets non-stop and react to changes immediately, unlike human traders who need rest.

Traders looking for better AI capabilities can use third-party solutions like AutoGPT MetaTrader Plugin. This connects MT4 accounts to advanced AI systems to place trades, manage accounts, and get market data.

Tickeron

Tickeron, now 10 years old, delivers AI-powered trading solutions that focus on transparent confidence ratings for pattern recognition and trading signals. This fintech leader creates tools that bring algorithmic trading strategies to self-directed investors, strategies typically reserved for hedge funds.

Tickeron’s AI Pattern Recognition Engine

Tickeron's Pattern Search Engine (PSE) scans thousands of stocks, ETFs, Forex pairs, and cryptocurrencies daily to spot 39 distinct trading patterns. The system uses proprietary Financial Learning Models (FLMs) that analyze big amounts of financial data to find favorable market conditions. These models combine smoothly with technical indicators like MACD, RSI, and Stochastic to process data through neural networks. The engine provides specific details for each pattern:

- Entry and exit points

- Breakout prices

- Target predictions

- Historical success rates

Tickeron for AI Crypto Trading Signals

Tickeron creates Buy/Sell signals through a three-component system to help crypto traders. The Technical Analysis (TA) score assesses indicators through neural networks. The Fundamental Analysis (FA) score looks at quantitative metrics. These scores work together to produce practical trading signals. The platform's pattern recognition helps crypto traders spot opportunities with statistically verified success probabilities.

Tickeron Confidence Scores and Transparency

Tickeron's most distinctive feature lies in its confidence scoring system. Each pattern gets an AI confidence percentage that shows the prediction's likelihood of success. This "Odds of Success" metric showcases Tickeron's commitment to signal transparency. Traders can verify the AI's historical performance with specific patterns on particular assets. Tickeron's backtests show that patterns with confidence levels above 80% have achieved success rates up to 75% in bullish scenarios for high-liquidity stocks.

Conclusion

AI trading tools have changed how traders work with financial markets in crypto, stocks, and forex. This piece looks at seven powerful AI solutions that give unique advantages for different trading styles and goals.

ChatGPT Plus shines as a versatile tool with web browsing and chart pattern recognition features. It proves valuable for cryptocurrency research at a reasonable price. TrendSpider does well with automated technical analysis. It spots over 300 candlestick patterns with mathematical precision and removes subjective bias.

Trade Ideas' Holly AI runs millions of backtests every night. It delivers high-probability trade setups with specific entry points, stop-losses, and profit targets. QuantConnect gives traders institutional-grade algorithmic trading tools. It handles over $45 billion in monthly volume with fast backtesting speeds and multi-asset support.

TradingView blends AI pattern recognition with a lively community. Traders can share ideas and use over 100,000 public indicators. MetaTrader 4 platform stays relevant with its vast ecosystem of AI plugins and expert advisors that run trading strategies automatically. Tickeron completes our list by showing statistical probabilities for pattern-based predictions with clear confidence ratings.

Your specific needs determine the best AI trading tool for you. Holly AI's direct signals work best for active day traders. QuantConnect's reliable infrastructure suits algorithmic traders better. TradingView's social features help beginners while TrendSpider's automated pattern recognition appeals to technical analysts.

These AI solutions help traders by removing emotional decisions, finding patterns humans might miss, and watching markets 24/7. AI platforms keep getting smarter, but human judgment remains vital to interpret results and manage strategy.

These tools show how AI has grown from an experiment into a trader's essential companion. Traders who blend AI capabilities with good risk management practices will find it easier to direct their way through today's complex financial markets.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024