Published 28 Apr 2025

Trading Slippage Explained: How to Minimize Hidden Costs

When you place a trade, you expect to get a certain price — but fast-moving markets don’t always cooperate. Slippage happens when your order fills at a different price than expected, quietly eating into your profits.

In crypto trading, where volatility and liquidity shifts are constant, minimizing slippage is critical for protecting your bottom line.

This guide covers why slippage happens, when the risks are highest, and what smart strategies you can use to keep hidden costs under control.

Trading Slippage Basics

Slippage happens when there’s a difference between the price you expect for a trade and the price you actually get. It’s a normal part of trading — especially in fast or illiquid markets — but it can quietly erode your profits if you don’t manage it carefully.

Here’s a simple example:

You place a market order to buy Bitcoin at $30,000. But by the time your order is filled, the best available price is $30,050. That $50 difference is slippage — and if you’re trading often or at large sizes, these small differences add up quickly.

Why Slippage Happens

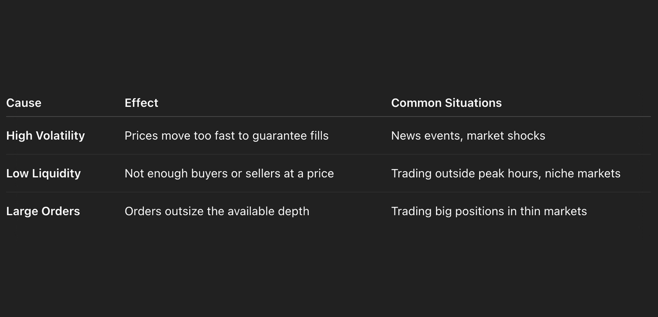

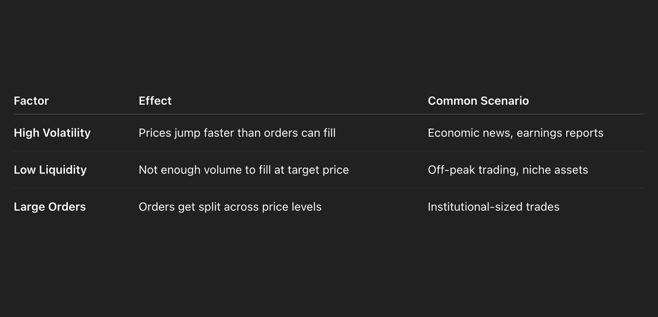

Several factors increase the risk of slippage:

Most slippage occurs during times of market stress — when news breaks, liquidity dries up, or prices swing sharply.

Managing slippage isn’t about eliminating it completely. It’s about understanding when it’s likely to happen — and using smart trading strategies to keep it under control.

What Causes Slippage

Slippage isn’t random — it usually happens for a reason.

Understanding what drives slippage is key to avoiding unexpected losses and improving your trade execution.

Here are the main causes:

1. Market Volatility

When markets move fast, prices can jump between the moment you place an order and the moment it’s filled.

Major news releases, economic reports, or sudden market shocks can cause huge price swings in seconds — making slippage almost unavoidable if you’re using market orders.

2. Low Liquidity

In markets with fewer active buyers and sellers, even small orders can push prices around.

Low liquidity is common outside regular trading hours, during holiday periods, or in smaller altcoins and assets with less volume.

3. Large Order Sizes

The bigger your order, the more liquidity you need at your chosen price.

If the available liquidity isn’t enough, your order will fill across multiple price levels — leading to bigger slippage.

Knowing why slippage happens allows you to prepare for it — and to design smarter trading strategies that work even in unpredictable conditions.

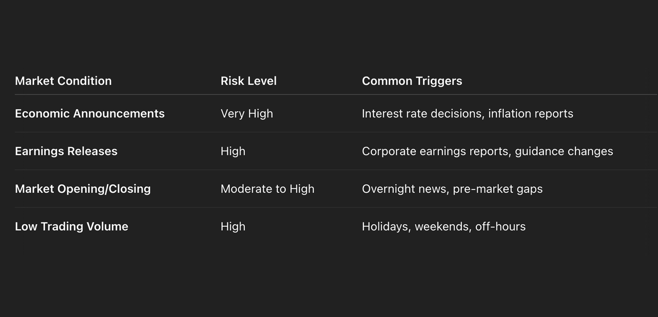

When Slippage Risk Spikes

Slippage isn’t always the same. Certain market conditions make it far more likely — and much more costly.

Knowing when slippage risk is highest helps you time your trades better and protect your profits.

High-Risk Market Conditions

Some situations create perfect storms for slippage:

Prices can jump dramatically during these events — and market orders often fill at unexpected levels.

Order Types Most at Risk

Not all orders react the same under pressure:

- Market Orders: These execute at the best available price, which can change dramatically in volatile conditions.

- Stop Orders: Once triggered, they become market orders — exposing you to the same slippage risks.

- Limit Orders: Offer more control but may not fill at all during extreme market moves.

In highly volatile moments, it’s safer to control your execution price — even if it means missing a few trades — rather than absorbing costly slippage.

Timing Matters

Timing can be just as critical as order type.

Even milliseconds matter: studies show that a 300-millisecond delay can cause noticeable losses for active traders.

The longer the delay — the higher the risk that prices move against you.

Key timing risks:

- Trading during major announcements

- Holding positions through overnight sessions

- Operating in thinly traded markets

- Placing large orders without assessing liquidity

Trading during stable, high-liquidity periods — and choosing smarter order types — are two of the best ways to manage slippage before it happens.

Methods to Minimize Slippage

While you can't eliminate slippage completely, you can take smart steps to control it — and protect your trading results over time.

Here are the most effective ways to minimize slippage:

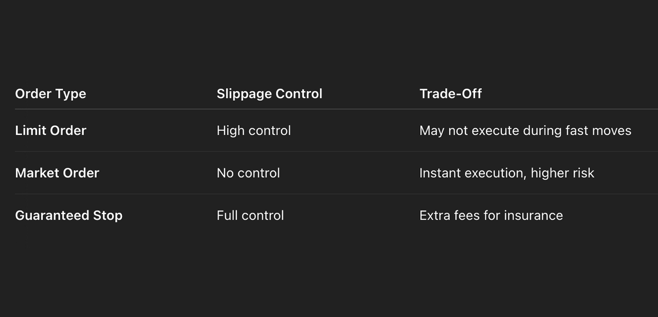

1. Choose the Right Order Type

- Limit Orders: Set a maximum or minimum price you're willing to accept. If the market can't match it, the order won't fill — protecting you from unexpected price swings.

- Market Orders: Prioritize speed but at the cost of price control. Only use them in highly liquid conditions when precision isn’t critical.

- Guaranteed Stops: Some platforms offer guaranteed stop-losses that trigger at your exact price, even during volatility — but they often come with extra fees.

2. Trade During High-Liquidity Hours

Markets behave differently depending on the time of day.

Trading during peak hours increases your chances of smooth, low-slippage execution.

Best times: - Stock markets: during regular U.S. market hours (9:30 AM–4:00 PM EST) - Forex: when London and New York sessions overlap - Crypto: around major global activity peaks (e.g., late morning UTC)

Avoid trading during holidays, weekends, or right after major news events unless necessary.

3. Manage Large Orders Strategically

Big trades can move the market against you if you're not careful.

Smart strategies for large orders: - Break the order into smaller chunks. - Use time-weighted execution (spreading orders over a time window). - Execute during peak liquidity to reduce impact.

Taking the time to scale into or out of positions helps avoid large visible trades that could shift prices.

4. Set Slippage Tolerance (When Possible)

Some trading platforms allow you to define acceptable slippage limits.

Setting a slippage tolerance (like 0.3–0.5% under normal conditions) ensures your trades won't fill at wildly unexpected prices — or will cancel if conditions aren’t favorable.

Reducing slippage isn’t about being perfect — it’s about stacking small advantages that add up over hundreds of trades.

Best Practices for Large Orders

Large orders can easily trigger slippage if they overwhelm available liquidity at your target price.

But with smart execution techniques, you can manage size without moving the market against yourself.

Here’s how:

1. Break Large Orders into Smaller Parts

Instead of sending one huge order all at once, split it into smaller, manageable chunks.

This reduces the impact on the order book and helps you blend into normal market activity.

Example:

Instead of buying 10,000 units in one order, execute 10 orders of 1,000 units spread over time.

2. Time Your Execution Carefully

Execute during periods of higher liquidity — like during major session overlaps or times of heavy trading volume.

Avoid trying to fill large orders during low-activity hours when spreads widen and depth is shallow.

3. Monitor Order Book Depth

Use real-time market data to check how much liquidity is available at each price level.

If there's not enough depth, adjust your strategy — either by reducing size per order or by waiting for better market conditions.

4. Use Advanced Execution Strategies (If Available)

Some professional platforms offer advanced tools like:

- Time-Weighted Average Price (TWAP) Orders: Spread execution over time to minimize impact.

- Volume-Weighted Average Price (VWAP) Orders: Follow average traded volumes to blend in with market activity.

If you have access to these tools, they can help optimize large trade execution without attracting attention.

Managing large orders isn’t just about speed — it’s about being invisible when you need to be.

Plan your execution like you plan your trades — and you'll avoid unnecessary hidden costs.

How to Set and Control Slippage Tolerance

Even with the best strategy, markets can still surprise you.

That’s why setting clear slippage tolerance levels is critical — it defines how much price movement you’re willing to accept when executing trades.

Here’s how to approach it smartly:

1. Define Acceptable Slippage Levels

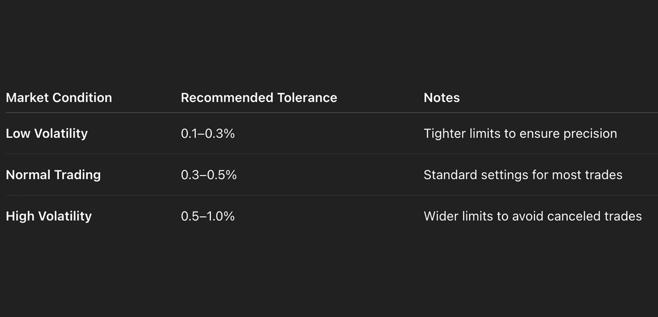

Your slippage tolerance should match both market conditions and your trading style.

Tip:

For aggressive scalping or high-frequency strategies, even smaller tolerances (0.1% or less) might be appropriate.

For longer-term swings, you can afford slightly broader margins.

2. Adjust Based on Asset and Strategy

Not all markets behave the same way:

- Crypto pairs with high liquidity (like BTC/USDT) often allow tighter slippage settings.

- Low-liquidity assets may require giving more room to avoid missed fills.

Adapt your slippage settings based on:

- Volatility levels

- Average trading volume

- Your urgency to enter or exit

3. Monitor Execution Quality Regularly

Setting slippage limits is only the first step.

You also need to review how your trades are performing over time.

Track:

- How often your trades fill within your target slippage range

- How often you get partial fills or cancellations

- Which market conditions tend to cause bigger deviations

By analyzing execution patterns, you can fine-tune your slippage strategy to stay efficient as conditions change.

Setting and controlling slippage tolerance isn’t just about protecting your trades — it’s about building discipline into every part of your execution plan.

Conclusion

Slippage is one of those hidden trading costs that can quietly eat away at your results — unless you actively manage it.

By understanding when slippage is most likely to happen, choosing smarter order types, trading during high-liquidity periods, and setting clear tolerance limits, you can protect your capital and improve your execution quality over time.

While you can’t eliminate slippage completely, you can control it.

And in trading, every small edge — every fraction of a percent saved — adds up across hundreds of trades.

The goal isn’t perfection.

The goal is consistency — and building systems that keep you in control, no matter how fast the market moves.

Read More

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024