Published 31 Dec 2024

RateX Report: Trends in Crypto Startups

The Landscape of Crypto Projects

The cryptocurrency market continues to amaze with its dynamism: despite volatility and periodic downturns, the industry is witnessing a significant resurgence of interest from both developers and investors. Technological trends, such as the integration of artificial intelligence and the growing activity around alternative blockchains, are creating new opportunities for crypto startups.

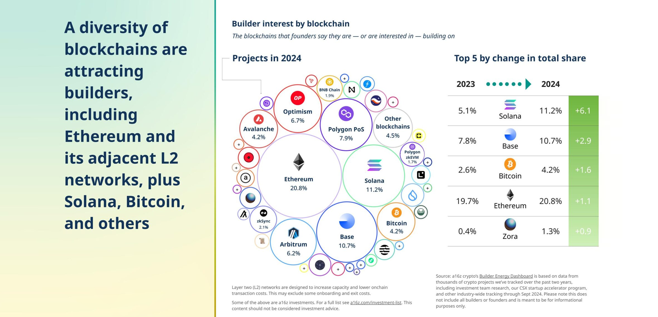

According to a16z, the blockchain that showed the most significant increase in interest from builders is Solana. The share of those who stated they are building or interested in building on Solana has grown from 5.1% last year to 11.2% this year.

Base demonstrated the second-largest growth, with its share rising from 7.8% to 10.7%, while Bitcoin also showed notable improvement, increasing its share from 2.6% to 4.2%.

Ethereum continues to be the most attractive blockchain for developers, capturing 20.8% of total interest. Solana and Base follow as the next most popular choices. Other notable platforms include Polygon (7.9%), Optimism (6.7%), Arbitrum (6.2%), Avalanche (4.2%), and Bitcoin (4.2%).

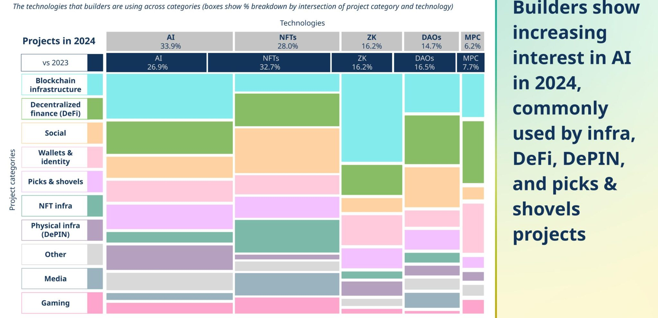

The use of artificial intelligence (AI) is becoming increasingly widespread among crypto projects. According to a16z, approximately 34% of projects report integrating AI into their development processes, a 7% increase compared to last year, as indicated by data from the Builder Energy dashboard. The most significant application of AI is observed in the infrastructure sector.

AI is used by 33.9% of projects

- Blockchain Infrastructure: 20.1%

- DeFi: 14.2%

- Social: 10.3%

- Wallets and Identity: 9.4%

- Picks and Shovels: 11.5%

NFTs (28.0%)

- Blockchain Infrastructure: 6.4%

- DeFi: 15.0%

- Social: 19.3%

- Wallets and Identity: 8.2%

- Picks and Shovels: 9.3%

- NFT Infrastructure: 13.9%

ZK (16.2%) - Blockchain Infrastructure: 35.2% - DeFi: 16.0% - Social: 13.6% - Wallets and Identity: 13.6% - Picks and Shovels: 8.8%

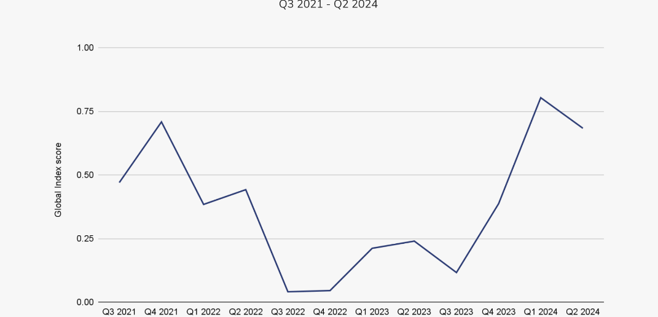

Global Cryptocurrency Activity is Growing

Between the fourth quarter of 2023 and the first quarter of 2024, the total value of global cryptocurrency activity has significantly increased, reaching higher levels than during the 2021 cryptocurrency bull market. This trend can be observed in the chart below:

Despite the current caution in venture capital, the cryptocurrency ecosystem remains one of the most promising industries. The increased adoption of blockchains such as Solana and Base, along with the active integration of artificial intelligence, indicates sustained interest in technological development. Periods of decreased investment activity can be seen as opportunities for strategic work, allowing the most promising startups to secure support and position themselves as future market leaders.

Venture Market

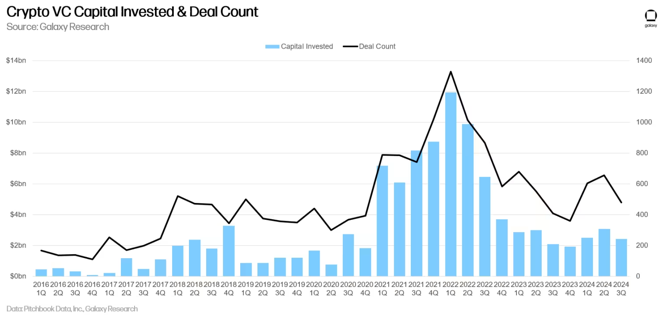

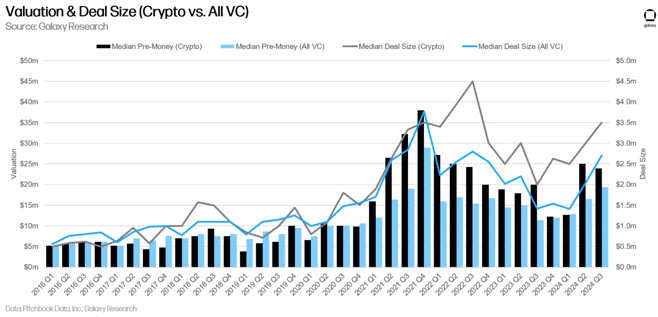

The cryptocurrency and blockchain industry continues to attract the attention of venture capital despite economic instability and shifting market conditions. Investors are focusing on strategic deals aimed at supporting new technologies and approaches that could shape the future of the crypto ecosystem. However, statistics show that the level of activity in venture capital investments in crypto startups remains far from the peak levels seen during previous bull cycles.

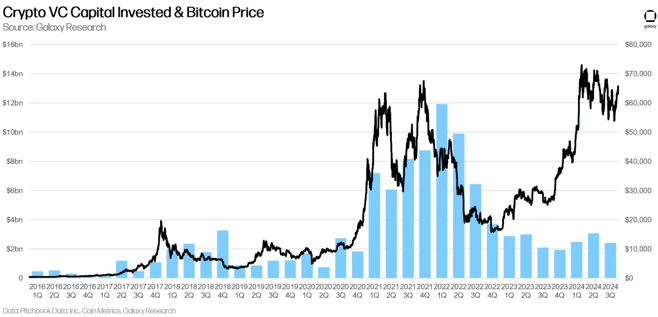

In the third quarter of 2024, venture capitalists invested $2.4 billion (-20% compared to the previous quarter) in startups related to cryptocurrency and blockchain, completing 478 deals (-17% compared to the previous quarter).

The long-term relationship between the bitcoin price and the amount of investment in crypto startups has been broken: bitcoin has risen significantly since January 2023, while venture capital activity has not kept pace with that growth.

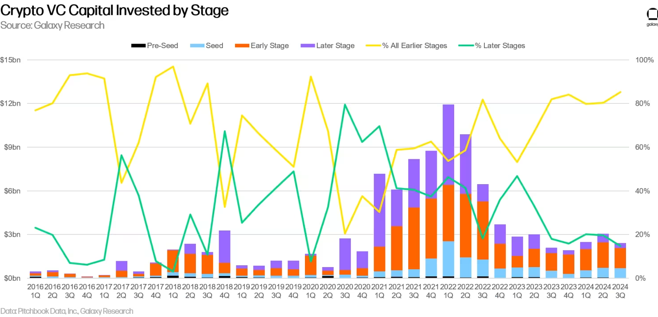

In the third quarter of 2024, 85% of venture investments were directed towards early-stage startups, while 15% went into later-stage companies. Cryptocurrency funds still have access to capital raised several years ago, enabling them to pursue new opportunities emerging amidst the renewed interest in cryptocurrencies.

Estimates and sizes of investments:

Although crypto asset markets have significantly recovered since late 2022 and early 2023, venture activity remains substantially below the levels seen in previous bull markets.The venture market for cryptocurrencies is showing signs of recovery, although its pace lags behind the growth in the value of key assets like Bitcoin. This indicates a more measured approach by investors, who prefer to focus on early-stage opportunities where the potential for growth and innovation is at its highest.

Startups in 2024

The conclusions are based on a report by Alliance, one of the largest accelerators in Web3. Many of the conclusions confirm the aforementioned points but are derived from a smaller sample of projects.

Key Findings

The number and quality of startups shaping the ecosystem remain key quantitative indicators of how the ecosystem will develop over the next 1–2 years. Startups are the ones creating products that drive adoption, influence on-chain metrics, attract attention, and lead to changes in value.

Let's look at these metrics (Metrics are based on startups that participated in Alliance's accelerator programme)

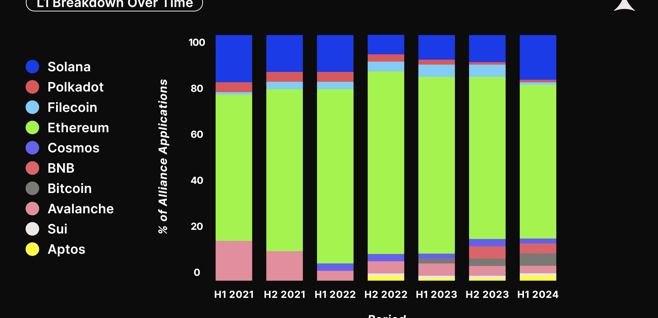

L1

Ethereum remains the most active ecosystem, attracting almost ⅔ of the attention of all startups. Ethereum holds the leading position among ecosystems, attracting 62% of crypto startups applying to Alliance. However, Solana grew again, reaching 18% of all applications after dropping to 8% in the second half of 2022. Notably, Bitcoin also attracted a significant number of developers, accounting for around 5% of all applications.

Solana is now showing the highest growth dynamics among ecosystems. After a decline in the number of startups developing on this platform in the second half of 2022, it has started to recover strongly. This decline coincided with the collapse of FTX, which provided significant early support for Solana. However, SOL has since strengthened and the chain's performance has returned to previous levels.

Bitcoin is attracting more startups, especially after the launch of Ordinals in 2023. This token standard has sparked interest and led to experimentation with others such as BRC-20 and Runes. Projects that extend the capabilities of the BTC network have also emerged, such as BitVM and L2 solutions, as well as decentralised exchanges, lending platforms and stablecoins adapted from Ethereum. Definitely noticeable is the large growth of startups in this network. Bitcoin holds over $1 trillion, which for startups could be a potential $1 trillion of liquidity in their protocols. However, Ethereum and Solana are still far superior to bitcoin in the features they offer to developers and users.

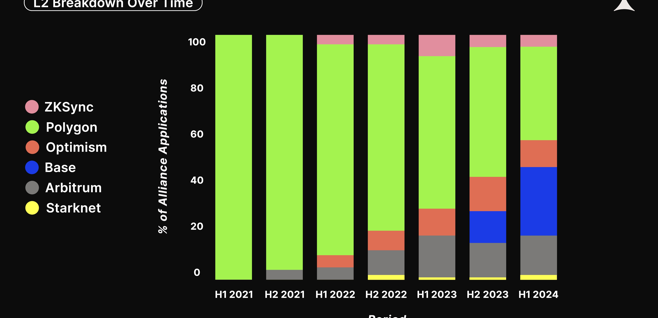

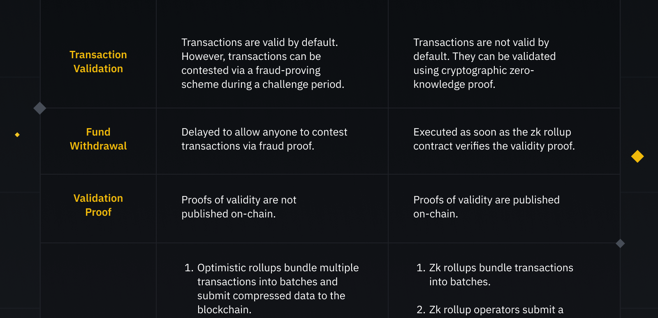

L2

Earlier, startups were mostly created on Polygon. However, Rollups based on optimistic models, such as Optimism, Base and Arbitrum, have started to gain popularity over the past three years. Together, they account for 59 per cent of Ethereum L2-based startups. Notably, Base, which launched as recently as 2023, is now home to 28% of Ethereum L2-based startups.

Optimistic Rollups have proven to be a more successful solution compared to ZK Rollups. On average, they offer lower fees and a more user-friendly development environment, fuelling user and startup growth.

Polygon aggregates much of the activity of startups centred on Polygon POS, Ethereum's sidechain. The loss of some market share emphasises that Polygon POS was one of the few Ethereum scaling solutions available. And the newly formed Base, has been so successful that it is second only to the veteran in the form of Polygon.

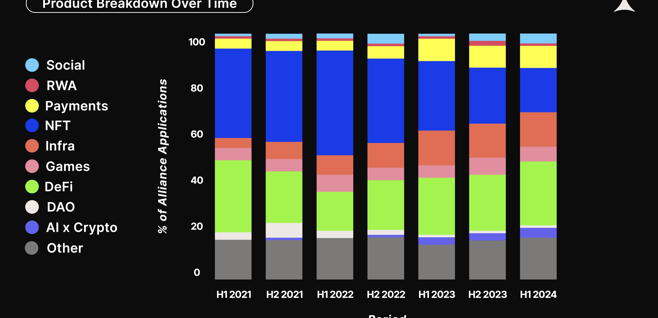

Product

Any attempt to categorise product verticals is inevitably subjective and therefore cannot be absolutely accurate.

The percentage of infrastructure-focused startups has increased over the past three years. This growth is largely due to historically high valuations of infrastructure tokens, which attracts more startups and accelerates the development of infrastructure projects. As a result, there is an increased flow of capital into the field, creating a cycle that further fuels the growth of infrastructure startups.

Ai x Crypto still holds a small share among all startups, its growth since the advent of GPT has been steady. As shown, the signal to noise ratio of startups has decreased significantly compared to last year.

DeFi has shown steady growth among startups — this is clearly a departure from the correlation with public opinion that believes the DeFi sector is regressing.

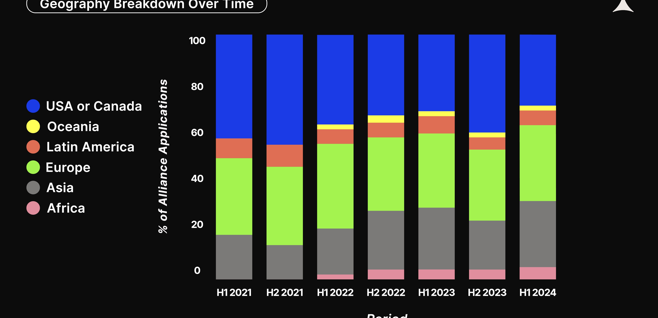

Geography

In the first half of 2024, the share of founders from the US and Canada was only 29%, which is significantly lower than in the second half of 2021, when this figure exceeded 45%. At the same time, we recorded the highest share of startups from Asia and Africa, at 26% and 5% respectively. Overall, North America, Europe and Asia continue to be the leading regions, with startup shares ranging from 25% to 33%. The growth of startups in emerging markets is largely driven by this trend, as cryptocurrencies become an important tool for hedging the risks associated with local fiat currencies and facilitating cross-border transactions.

Buzzwords

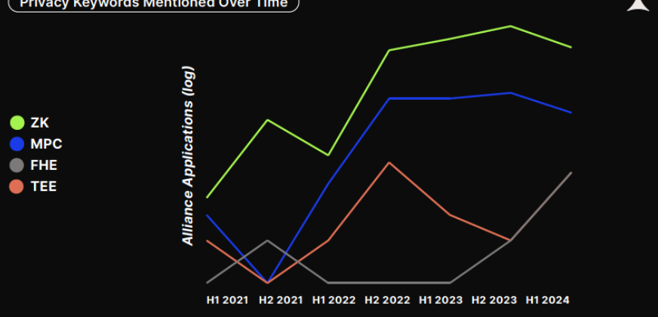

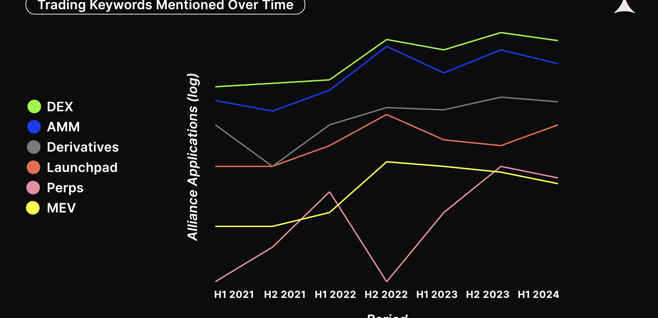

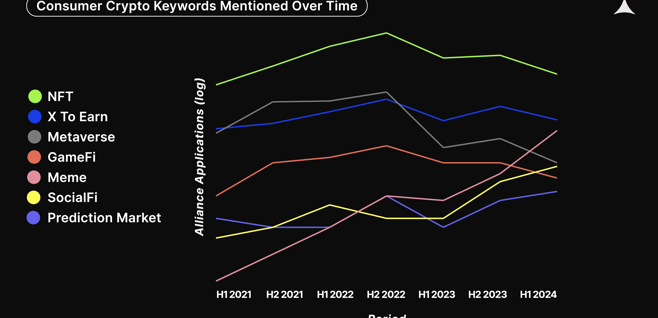

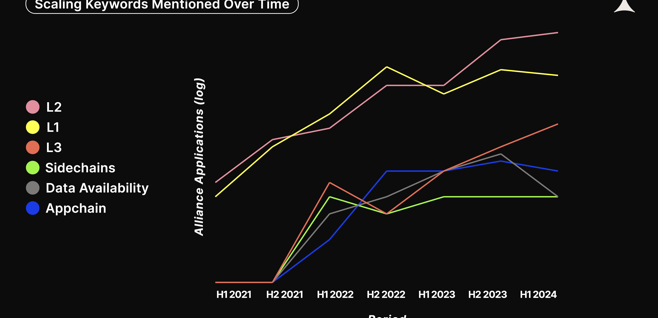

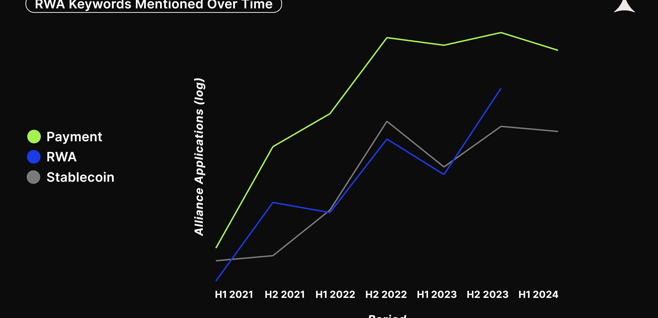

Analysing the keywords mentioned in Alliance Acceleration applications revealed what was popular at different periods of time. These were divided into several categories to capture their trends in more detail.

Terms that have increased in popularity over the last 12 months include fully homomorphic encryption (FHE), chain abstraction, meme, SocialFi, prediction market, liquid-stacking, re-stacking, RWA, stablecoin, L1, L2 and L3.

Founder Background

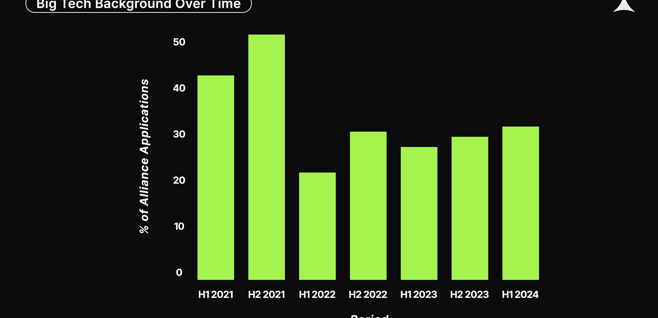

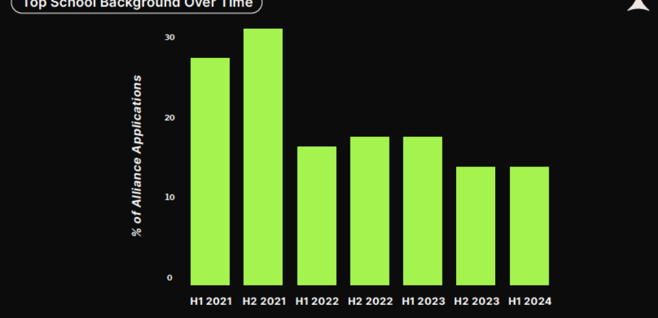

Today, 30 per cent of founders apply to an accelerator with experience in large technology companies (S&P500), and 12 per cent of founders have studied at leading institutions (QS top 100 universities).

The definition of ‘best institution’ was compiled as a university ranked in the top 100 global universities. Among applicants, the percentage of founders who graduated from such universities peaked in 2021 and has remained relatively stable since then. This trend for top schools is not surprising, as it is similar to the trend in BigTech companies over the past few years, where the numbers have also remained fairly constant, and it is not a pronounced trend overall.

Conclusion

Overall, current trends in crypto startups show a mixed picture. The predominance of Ethereum as the main development platform continues to persist, while there has been a significant increase in interest in new ecosystems such as Solana, Base and Bitcoin. Despite the divergence between bitcoin's rising value and the slower pace of venture capital investment, the cryptocurrency market is showing positive momentum, as evidenced by an increase in the number of deals and a recovery in investor interest.

The integration of AI into crypto projects also continues to gain traction, especially in the area of blockchain infrastructure. Startups continue to increase activity despite a decline in interest in some areas, such as DeFi, which shows the resilience and diversity of current crypto products.

In addition, there is a notable shift in the geography of startups, with an increasing number of projects from developing regions, due to the growing interest in cryptocurrencies as a means to hedge risk and to facilitate cross-border payments. The statistics also show a steady interest in early-stage startups, indicating the possible growth of the ecosystem in the future.

Get RateX Pro

Get RateX Pro

06 Jun 2024

06 Jun 2024